What are surety bonds?

In an uncertain and fiercely competitive business environment, having a surety bond gives project owners the confidence to contract with suppliers, safe in the knowledge they will be compensated if contract terms are not met.

How do surety performance bonds work?

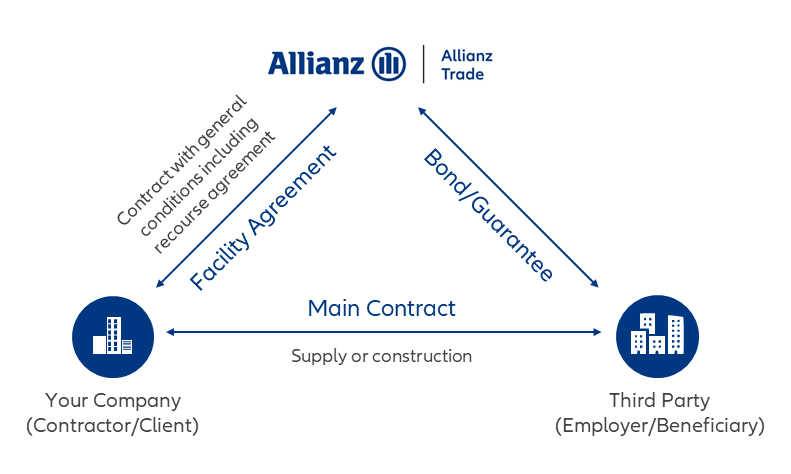

A surety bond creates a triangular relationship between you (the supplier or contractor), your employer (the project owner) and a surety bond company such as Allianz Trade.

Allianz Trade Surety Bond benefits

With Allianz Trade’s financial strength, our surety bond expertise and our alternative to bank bonds, contract surety is a given whilst freeing up bank lines of credit.

Reliability

Our AA rating means our bonds can be relied upon by clients globally, and are often a preferred product.

Liquidity

Our alternative to bank bonds doesn’t restrict your banking credit or reduce liquidity.

Growth

Our surety bonds give you and project owners the confidence to tackle ambitious projects.

The surety bonds we offer

Allianz Trade issues a variety of different types of surety bonds to meet the particular needs of different sectors and circumstances. These include:

How to obtain a surety bond

1. Apply online

New customers (including brokers) apply for a bond facility, sharing bond requirements and financial information online

2. Confirmation

Enquiries need to pass our initial checks during the online process, then we email to confirm whether we can help

3. Underwriting

Our underwriting team capture additional information from you as part of the underwriting process

4. Surety bond issued

Once the facility is in place and your bond application is complete, your bond is issued