Filing a Claim

If a company goes bankrupt and owes you money, you will receive a notice from the bankruptcy court detailing the action. That notice will include instructions for filing a proof of claim. A proof of claim is a written statement and supporting documentation that outlines why the client declaring bankruptcy owes you money. The proof of claim document and directions for how to complete it will be included with the bankruptcy notice. Filing is time-sensitive, so you should give this document full attention and file on or before the deadline. Submit the proof of claim document with the bankruptcy court where the bankruptcy was filed.

In addition, when a bankruptcy case is filed, you must stop all collection efforts, such as sending past-due notices or calling about past-due invoices.

To receive notice of bankruptcy and a proof of claim form, the business that is declaring bankruptcy must list you as a creditor. If that does not happen and you learn of the customer’s bankruptcy another way, contact the customer and ask for the bankruptcy case number and the court in which the bankruptcy was filed. Call the clerk of the appropriate court and confirm that a filing has actually taken place. Ask them about any relevant dates regarding your filing a proof of claim and request a copy of both the bankruptcy notice to creditors and a proof of claim form. Review the bankruptcy notice to see if you are or are not listed. Then, file a proof of claim.

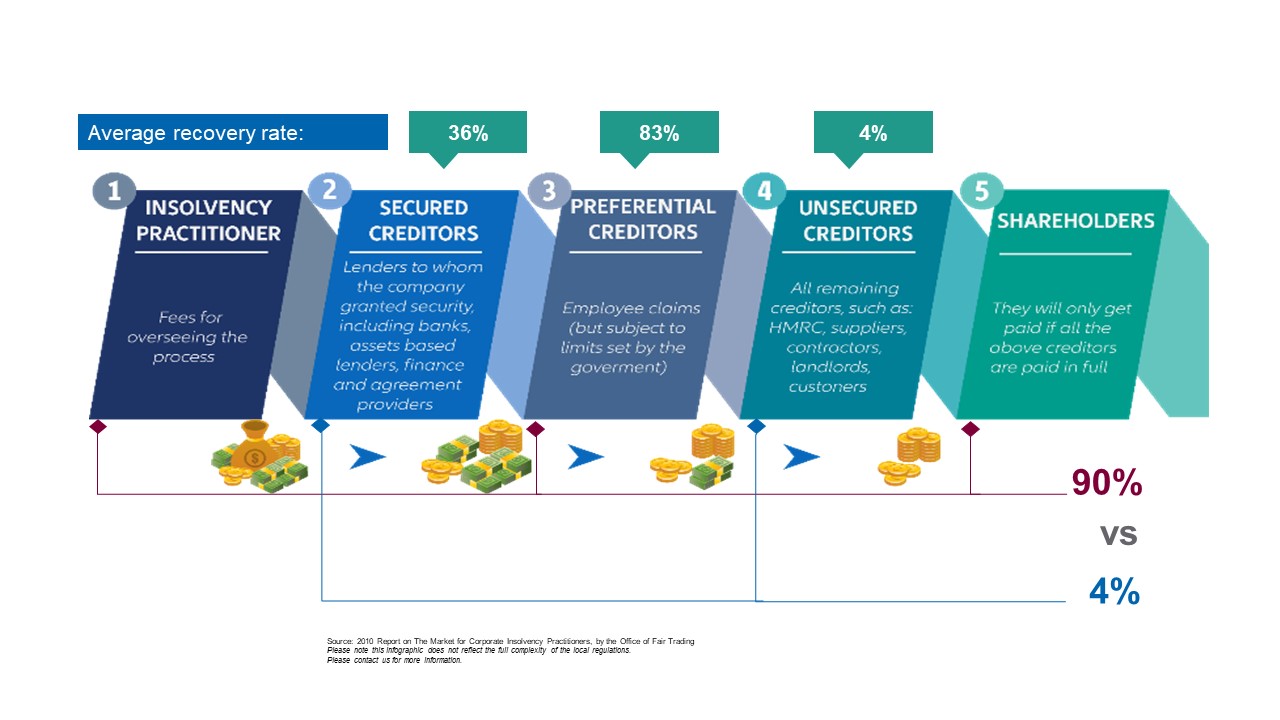

Filing a proof of claim only means you are listing your past-due amounts for consideration of payment by the bankruptcy trustee. There is no guarantee those debts will be paid. When you insure your accounts receivable with trade credit insurance from Euler Hermes, you can count on being paid, even if one of your accounts is unable to pay due to bankruptcy.

Protect Your Business From Customer Bankruptcy with Trade Credit Insurance

When a customer declares bankruptcy and later becomes insolvent, collecting on past-due invoices becomes next to impossible. Euler Hermes can help keep your cash flow positive with Trade Credit Insurance. Trade Credit Insurance protects your accounts receivables against loss and guarantees compensation even in the event of non-payment. Learn more about Euler Hermes and get a free trade credit insurance quote.