What is trade credit?

What is trade credit insurance?

What does trade credit insurance cover?

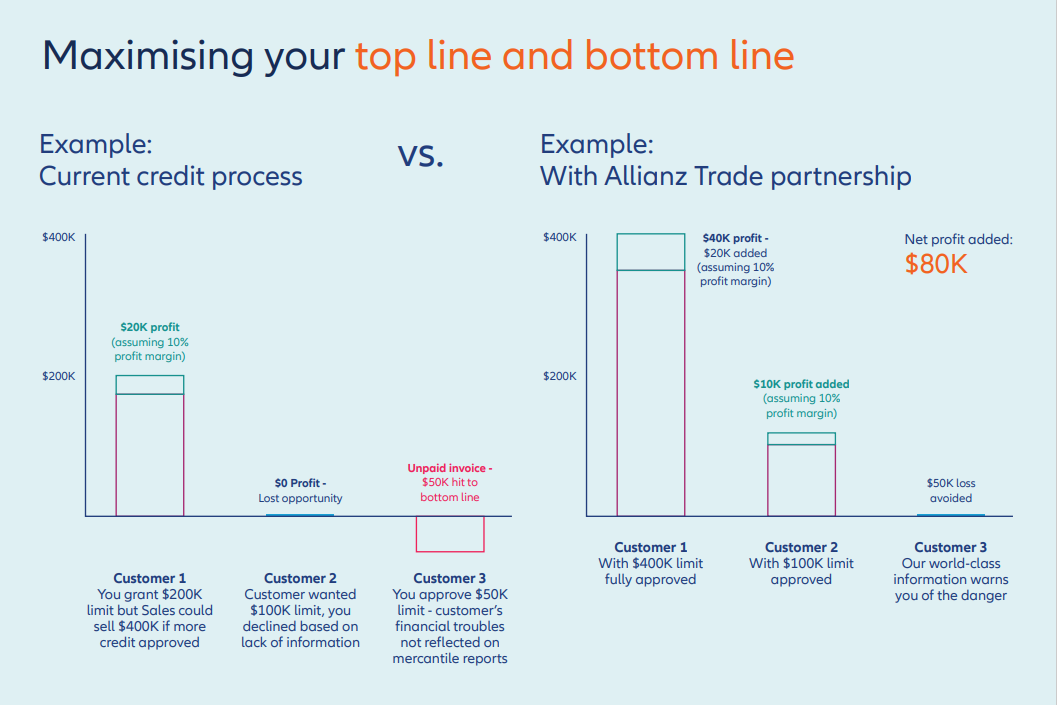

It protects businesses from non-payment of commercial debt. It covers your business-to-business accounts receivable. If you do not receive what you are owed due to a buyer’s bankruptcy, insolvency or other issue, or if payment is very late, the policy will reimburse you for a majority of the outstanding debt. This helps you protect your capital, maintain your cash flow and secure your earnings while extending your competitive credit terms and helping you access more attractive financing.

With trade credit insurance, you can reliably manage the commercial and political risks of trade that are beyond your control. It can help you feel secure in extending more credit to current customers or pursuing new, larger customers that would have otherwise seemed too risky.

How does it work?

We investigate and indemnify you for the insured amount if policy terms have been met.

Top reasons to buy

Why work with us?

DEDICATION

Corporate customers

INSIGHTS

Business transactions protected globally

ASSURANCE

by Standard & Poor's