New Dimensions of Social Risk

Social and political risk were already on the rise in a number of countries and regions well before the outbreak of the Covid-19 pandemic. In some cases, this was not surprising. In Venezuela, for example, long-lasting political and economic mismanagement had resulted in mass anti-government protests for several years. Iran had also seen anti-regime rallies before. And in Argentina, a textbook Emerging Markets (EMs) crisis led to a rapidly and painfully unravelling of macroeconomic imbalances, which aggravated already difficult social conditions. However, the wave of strong and durable anti-government demonstrations in Hong Kong, Lebanon and across Latin America (notably in Ecuador, Chile, Bolivia and Columbia) in the second half of 2019 was sudden and unexpected. In particular, the intensity of unrest in high-income EMs such as Chile and Hong Kong surprised markets. Moreover, anti-government protests also appeared to have increased in Advanced Economies (AEs). In particular, the Yellows Vests movement against fiscal austerity in France that began in late 2018 caught a lot of attention and sparked copycats in several other countries. Overall, this suggests that not only the overall level of economic wealth in a country but also the distribution of that wealth, changes in the level of welfare, as well as subjective perceptions of the country’s government and institutions, play a role with regard to social risk.

Most of the 2019 protest movements continued into early 2020 until the Covid-19 pandemic struck, resulting in especially strict lockdown measures that have largely starved them off for some time. But as stage two of the Covid-19 crisis – the gradual opening of national economies – has begun, there is a significant likelihood that protests in both EMs and AEs arise anew. Moreover, social discontent may be aggravated and could also spread to other countries that have been politically calm in recent years as a result of the impacts of the Covid-19 crisis. People who have given their governments the benefit of the doubt in phase one of the crisis (full or partial lockdowns to ‘flatten the curve’) may now become unsatisfied with the preparedness of authorities or the pace of de-confinement as the economic pain is growing. A generally poor health situation, increasing unemployment and poverty, rising prices (especially for food) as well as a weak government response to the crisis due to mismanagement or lack of fiscal resources may add to already existing social risks.

Already in the course of May, there have been protests and demonstrations around the world against government responses to the ongoing pandemic, and these protests have also drawn opposition from those who think the lockdowns have been justified. For the moment, while visible these protests do not appear to be supported by majorities in the populations. However, it cannot be ruled out that they develop into more serious and lasting protests in some places, or that they occur in countries that have been calm for now.

In this paper, we will identify those countries that are most vulnerable to systemic social risk in the wake of the Covid-19 pandemic, i.e. in the next 18 months or so. For this purpose we have developed a Social Risk Index (SRI) that identifies underlying strengths, weaknesses and perceptions of a country’s political, institutional and social frameworks, signaling the general susceptibility to ’systemic social risk‘ events that could become game-changers with regard to politics and policymaking, as well as business and investment decisions.

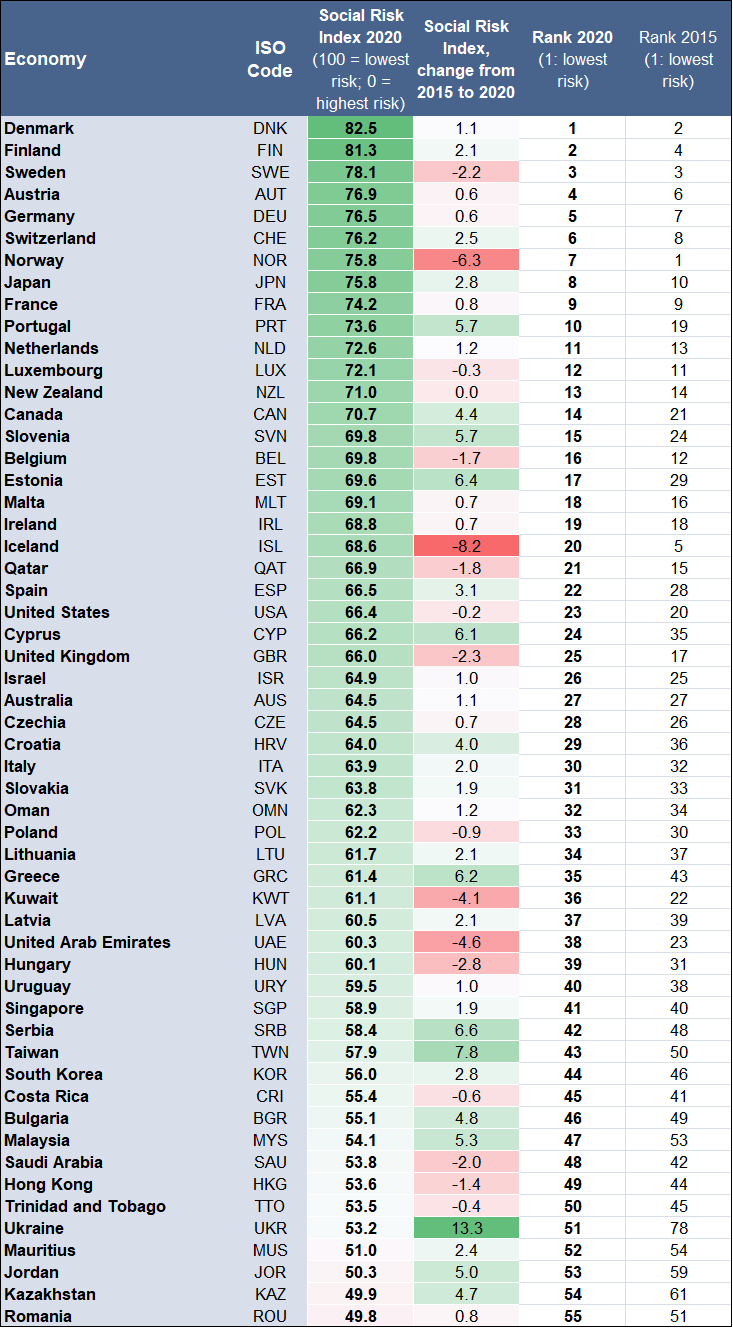

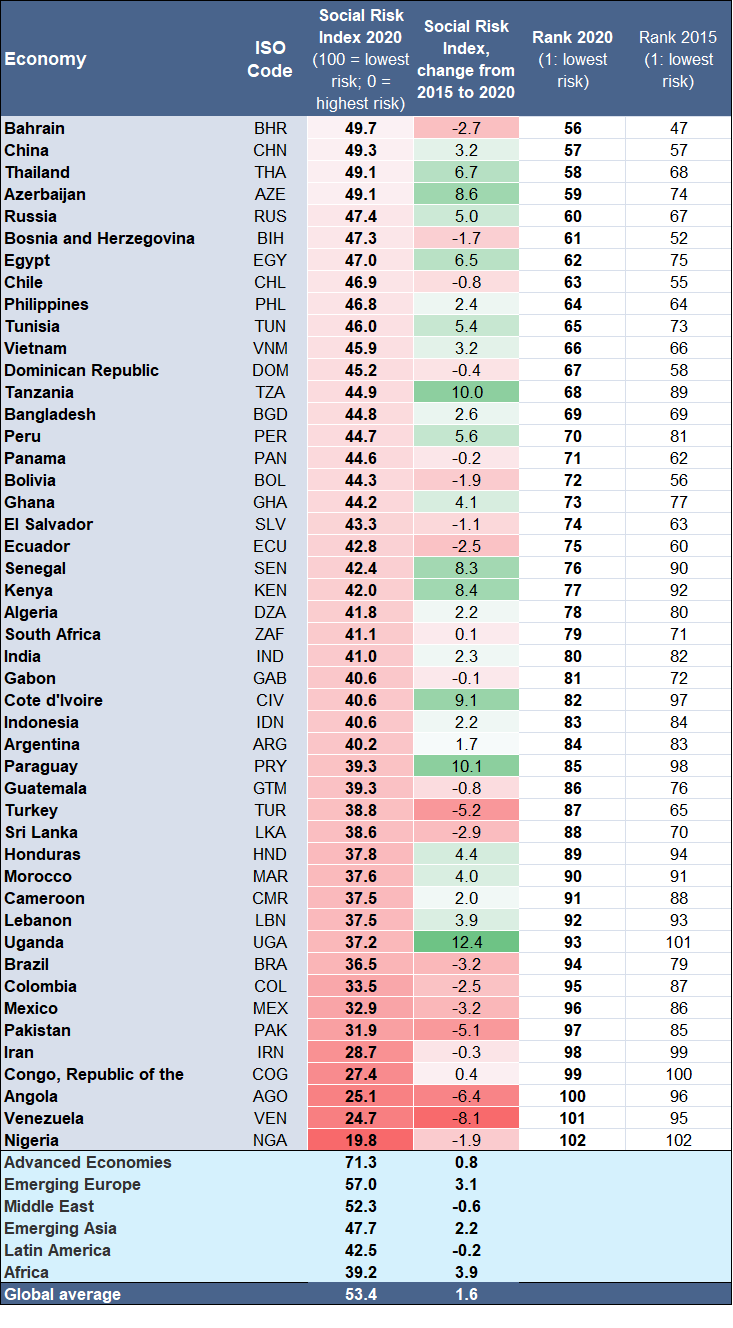

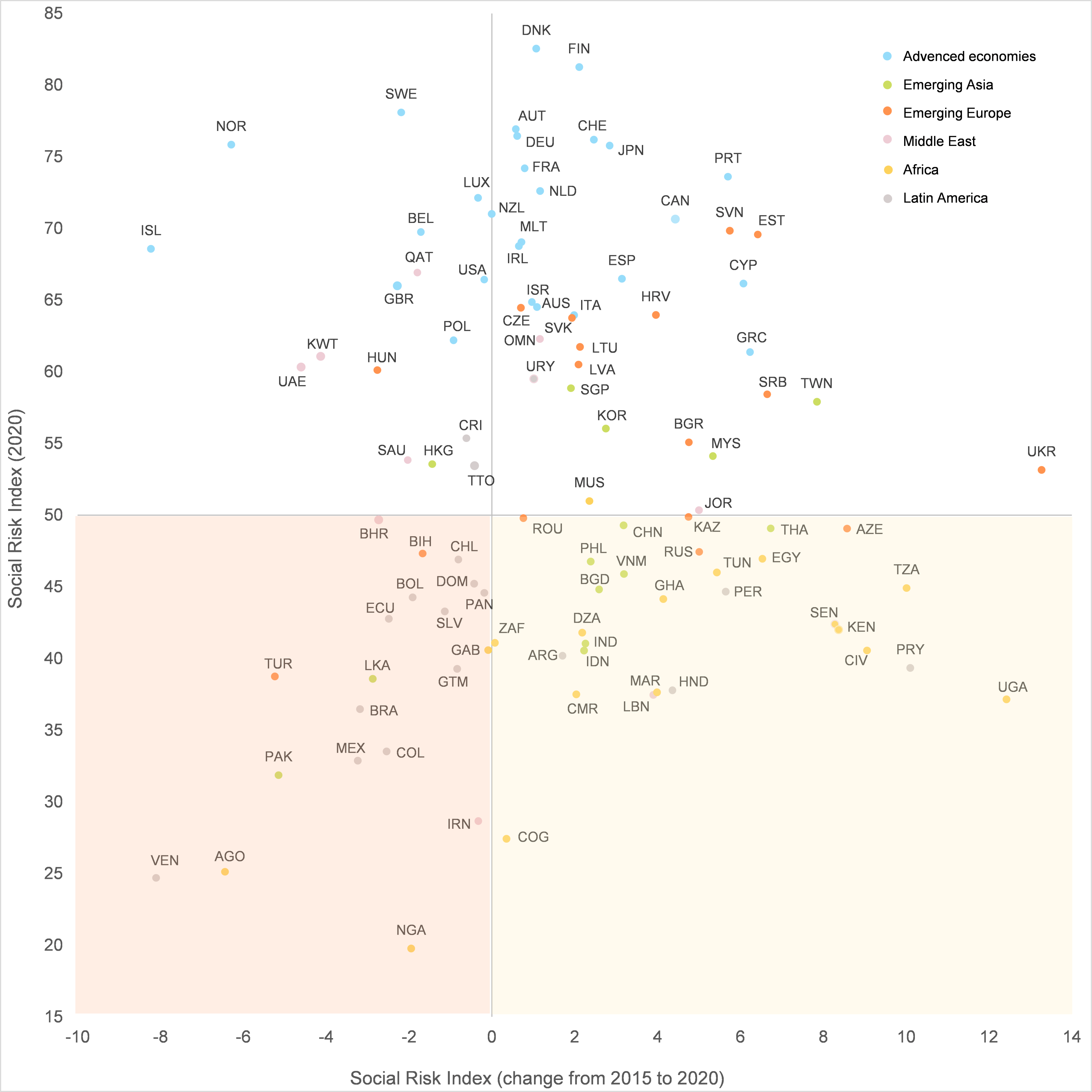

The focus of the analysis will be on 102 selected economies, including all AEs and the larger EMs. We have also calculated the Social Risk Index backwards for the year 2015 to analyze the change over the past five years per country and identify the potential for rising social discontent in wealthier countries.

For details on the methodology of the Social Risk Index, see Box 1.

Box 1: Indicators and methodology of the Social Risk Index (SRI)

We use twelve indicators for the SRI that are readily available for most countries:

1. Real GDP per capita growth trend: We compare the average annual growth in the last three years to the average growth prior to that since 2000. This approach reflects that the potential for social risk can also rise in high-income EMs (such as Chile or in the GCC) and AEs if the (relatively high) level of economic welfare is deteriorating or being perceived to deteriorate.

2. Labor force participation: The higher the share of the labor force in the working-age population, the lower the potential for discontent. This indicator is better than the unemployment rate, which is measured very inconsistently across countries.

3. Income inequality measured by the GINI index.

4. Public social spending on education, health and social protection, which reflects the importance of social policies and networks in a given country.

5. Political stability and absence/presence of violence, reflects together with

6. Government effectiveness and

7. Corruption perception how effective a government is perceived at doing its job.

8. Trust in government indicates the share of people that trust their national government.

9. Vulnerable employment is made up of own-account workers and contributing family workers who are less likely to have social security coverage and to benefit from other forms of social protection.

10. Imports of goods as % of GDP reflects together with

11. Currency depreciation the scope for imported inflation, notably for foodstuffs, which is a typical trigger for social discontent.

12. Fiscal revenue as % of GDP captures a government’s capability to respond with fiscal stimulus to crises.

Methodology

To make the data comparable across indicators, each of them was rescaled from 0 to 100 with 0 denoting the highest risk and 100 the lowest. Then the SRI was calculated as the average of the sub-indicators, thus also ranging between 0 and 100.

Advanced Economies: systemic social risk remains low

All AEs are ranked among the best 35 out of the 102 selected economies in our analysis (see Figure 1 for the overall scores and rankings). Denmark is leading the league with a SRI score of 82.5 out of a maximum of 100, followed by its Nordic neighbors Finland and Sweden. Germany is ranked fifth (with a SRI of 76.5) and France ninth (74.2). The latter may surprise some readers against the backdrop of the Yellow Vests movement in 2018-2019. But while these protests appear to be covered in our analysis by the sub-indicator 'Trust in Government', for which France scores only 45.9, they do not seem to have significantly changed the policy direction or business investment decisions in the country. Overall, systemic social risk continues to be low in France, according to our assessment, as most sub-indicators of the SRI have remained strong or even improved over the past five years.

At the opposite end in the group of AEs, Greece is placed 35th, thus exhibiting the highest vulnerability to social risk among AEs. However, its SRI score of 61.4 reflects an improvement of +6.2 points from five years ago when the country was still in the midst of its sovereign debt crisis which caused widespread social discontent at the time. Similarly, the SRI of Italy, where public discontent was also prevailing at the height of the Eurozone crisis, has improved by +2.0 points to 63.9 currently, placing the country 30th. In both countries, the improvement was in part due to stronger real GDP per capita growth in the last three years and better employment conditions. As these factors will deteriorate in the wake of Covid-19, the SRI for both is likely to decline somewhat in the next year but should not fall below the 2015 levels, also because local and EU fiscal stimulus should mitigate the adverse effects on the economies.

The U.S. is ranked 23rd with a SRI of 66.4. Our assessment reveals some weaknesses in labor force participation (62% of the working age population), income inequality, public social spending and trust in government. In contrast, the country scores well on political stability, government effectiveness, corruption perception, per capita growth and the low share of merchandise imports in GDP (15%), which together with the strong USD provides for a low risk of imported inflation.

Emerging Markets: Regional Disparity of Social Risk

As one would expect, Emerging Markets are in general more vulnerable to systemic social risk than Advanced Economies. However, there are some countries in Eastern Europe and the Gulf Cooperation Council (GCC) where the risk is comparably low as in the average AEs. Across EMs, there is a high regional disparity of systemic social risk, as outlined in detail below.

Emerging Europe

On a regional basis, overall social risk is relatively low in Emerging Europe. Twelve out of 18 countries in our sample have a SRI above 50 and nine of them are even above 60, placing them on par with many AEs. These nine countries are all EU member states (Slovenia, Estonia, Czechia, Croatia, Slovakia, Poland, Lithuania, Latvia, Hungary), reflecting that EU membership requires a substantial improvement in political and institutional frameworks. However, our assessment also indicates that Hungary and Poland have experienced a slight increase in social risk over the past five years. This is in line with the fact that democratic institutions have been somewhat weakened in these two countries over the past decade and there have also been public protests against these developments. Yet, while visible, these protests are not supported by majorities in the populations and are thus unlikely to have a significant impact in the medium term.

One EU country in the region, Romania, has a SRI of just below 50, along with Azerbaijan, Bosnia and Herzegovina, Kazakhstan and Russia. The country most vulnerable to social risk in the region is Turkey with a SRI of just 38.8 and rank 87 in 2020, exhibiting a marked deterioration by -5.2 points since 2015 and now showing a clear distance from the rest of the region. The weakest factors contributing to Turkey’s SRI are the continued currency depreciation, which raises the costs of imported consumer goods, a low labor force participation (53% of the working age population), political instability and income inequality.

Emerging Asia

In the Emerging Asia region, there are seven relatively populous countries out of 14 in our sample that have a SRI well below 50, suggesting significant vulnerability to systemic social risk in the future. These seven countries that have in common generally unfavorable employment and income conditions, as well as weak perceptions of public institutions, are (from least to most risky) the Philippines, Vietnam, Bangladesh, India, Indonesia, Sri Lanka and Pakistan. The latter two also experienced a marked deterioration in the SRI over the past five years. In Pakistan, the deepening economic crisis and emerging rifts in the government’s alliance with the military is increasing the risk of nationwide anti-government protests (the last large one occurred in October/November 2019). In Sri Lanka, tensions may also be simmering as government measures amid the pandemic spark concerns over religious differences. In Indonesia, localized protests are likely to occur as companies could struggle to pay annual holiday allowances. Policy ‘mistakes’ (favoring businesses over workers) would increase the risk of seeing nationwide strikes. Similarly, Bangladesh and Vietnam could also experience localized troubles in their economically significant manufacturing sectors. In India, measures to contain the Covid-19 pandemic have dissipated nationwide protests against the Citizenship Amendment Act, which had been ongoing since December 2019. However, as lockdowns are lifted in the coming months, and given growing discontent among migrant workers, anti-government protests could emerge again.

China and Thailand score somewhat better but their SRIs of just below the 50, combined with relatively low health expenditures and dependence on tourism in the case of Thailand, suggest some vulnerability to social discontent in the wake of Covid-19 as well.

The four Asian Tigers (Hong Kong, Singapore, South Korea, Taiwan), which are all high-income countries, score comparatively well on the SRI, benefiting from relatively strong institutional frameworks and favorable employment conditions. Hong Kong, however, has seen a deterioration of its SRI by -1.4 points to 53.6 in 2020 which almost entirely reflects a decline in the sub-indicator ‘Trust in government’ – only 27% of the people trusted their national government in 2019, down from 51% the year before – and thus the lasting anti-government demonstrations in Hong Kong last year. Social unrest is already resuming as hundreds of people marched to show discontent with mainland China’s plans to enforce national security provisions in Hong Kong without the need for approval of local authorities. A similar legislative change had been proposed in May 2003, and the context of the Sars epidemic then did not prevent 500,000 people from taking to the streets in a sign of protest.

Middle East

The Middle East itself exhibits a considerable disparity of systemic social risk. It is very high in Iran and Lebanon – with the very weak SRIs for both being in line with last year’s mass protests in the countries – and elevated in Jordan and Bahrain. In contrast, our SRI points to comparatively lower systemic social risk in the other GCC member states. This is mostly explained by the prevailing currency pegs, which eliminate the risk of imported inflation, large fiscal resources that can be utilized to mitigate the impact of crises as well as above average perceptions of government effectiveness. However, our analysis also shows that the SRI decreased (and thus the risk of social discontent increased) in all GCC states except Oman over the past five years. This trend mainly reflects declining real GDP per capita and shrinking fiscal revenues. The latter are a result of lower global oil prices and oil output cuts agreed by OPEC and other oil-exporting countries and mean reduced capacity for fiscal stimulus in times of crises in the future. If the uptrend in systemic social risk in the GCC is not halted, some of the member states could become future hot spots for public unrest, with the risk being higher in Bahrain and Oman, which have relatively low fiscal reserves to mitigate declining economic wealth levels.

Africa

In Africa, almost all of the selected 17 countries in our sample score badly on our SRI, with Mauritius (rank 52) being the only country with a SRI just above 50. Nigeria is at the bottom of our table with a SRI of 19.8 and South Africa is ranked 79th out of 102 countries with a SRI of 41.1, reflecting weaknesses across almost all sub-indicators of the index. Moreover, Covid-19 is likely to intensify the already high of systemic social risk in Africa in the near future, owing to very weak health care combined with currently low commodity prices, which reduce the capability of governments to respond with fiscal stimulus to the sanitary crisis. All in all, it cannot be ruled out that a number of public protests occur across the continent from the second half of 2020 to 2021.

Latin America

In Latin America, systemic social risk is also high across the whole region. Only Uruguay, Costa Rica and Trinidad & Tobago out of our regional 18-country sample have a score above 50. Moreover, social risk has increased over the past five years in most countries. Sharp currency depreciation raising the price of imports is a key weakness in crises for those countries in the region that have a flexible exchange rate regime. Venezuela has the worst SRI (24.7, -8.1 points over the past five years) in the region and is the second to last in our overall sample of 102 countries.

Mexico (SRI 32.9; rank 96) and Brazil (SRI 36.5; rank 94) also score particularly bad – the most striking weaknesses are high income inequality, currency depreciation, low or inefficient public social spending and a generally low trust in the government and its effectiveness at doing its job. The questionable policy responses of the central governments of these two countries to the coronavirus pandemic with still rising numbers of new infections will intensify social discontent and tensions in the near future. In Brazil, this combined with currently low commodity prices, a high fiscal deficit and elevated political fragmentation limit the possibility of a broad-based fiscal stimulus to quickly bring relief to economic agents. In Mexico, a pre-existing low level of business confidence hampering growth and monetary policy transmission due to the president’s overturning of pro-business reforms, in addition to the exposure to merchandise trade and to the U.S. industrial cycle, should trigger a severe recession leaving the most vulnerable by the wayside.

More generally, relatively low and deteriorating SRIs for Colombia (33.5), Ecuador (42.8), Bolivia (44.3) and Chile (46.9) confirm these countries’ vulnerability to social risk events as seen in the second half of 2019. The key factors in Chile, which is a high-income EM, are declining real GDP per capita growth (-2% on average in 2017-2019), high income inequality, currency depreciation and low public social spending due to ongoing fiscal austerity. Similarly low SRIs and downtrends put the Dominican Republic, El Salvador, Guatemala and Panama on the watch list for public unrest in the near future. Peru, Paraguay and Honduras also score badly but have seen an improvement in their SRIs over the past five years.

Overall, with regard to the Covid-19 crisis, many countries appear to have been badly prepared, This combined with the general high systemic social risk in Latin America suggests that we should not rule out more public protests in the region in the next 18 months or so

Figure 1: Social Risk Index for 102 selected economies