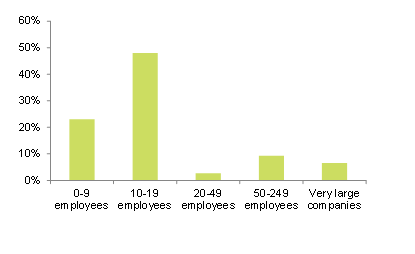

In the world post-Covid-19, SMEs could be left out of opportunities

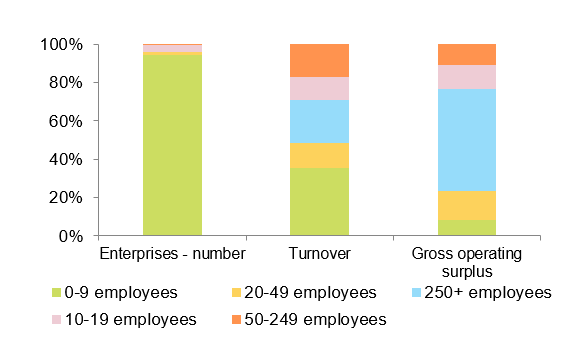

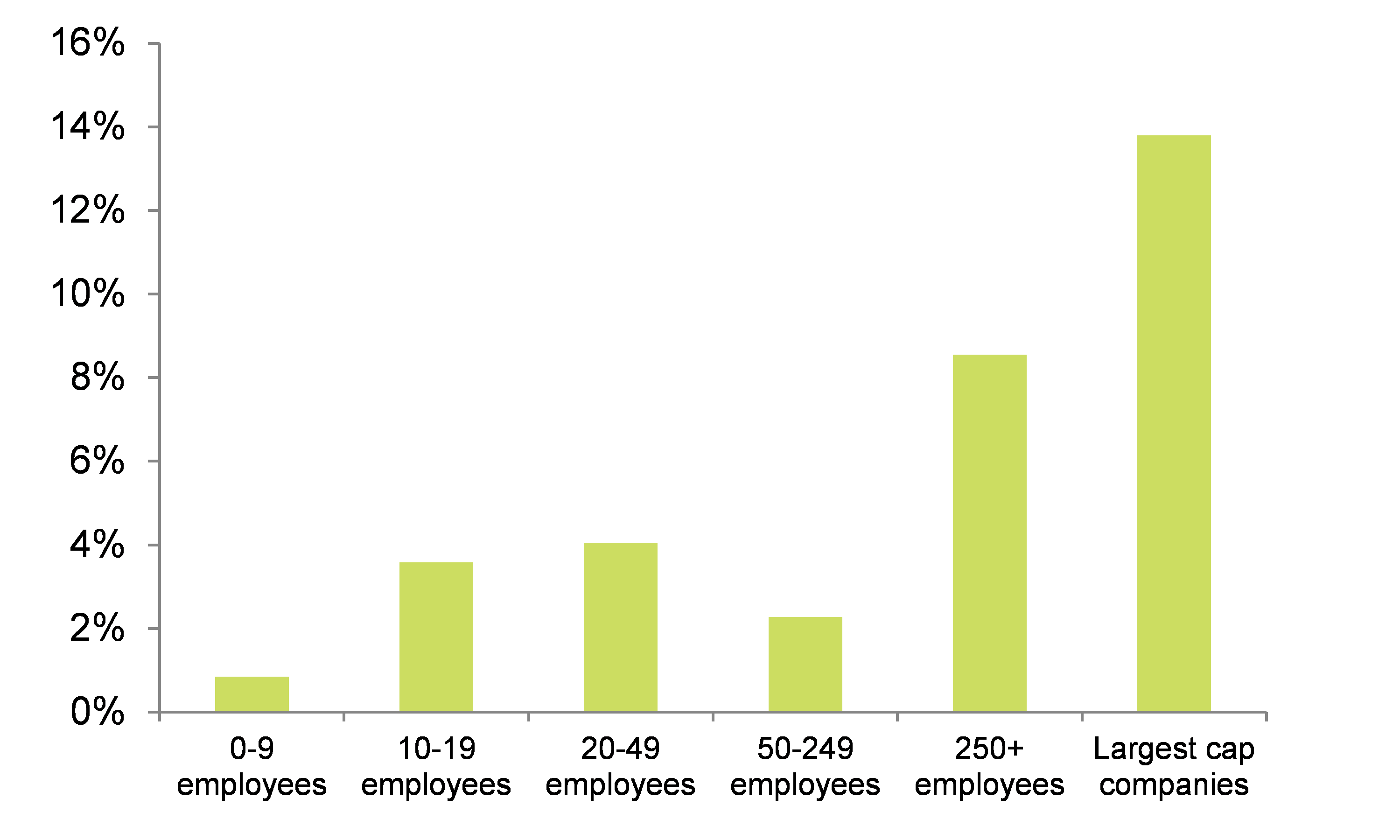

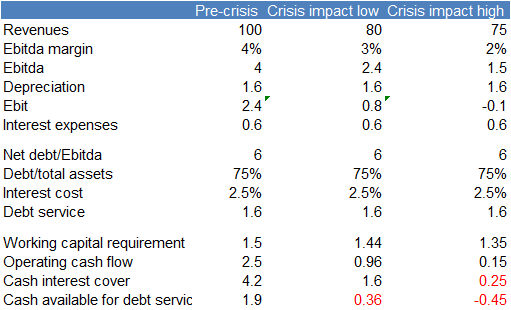

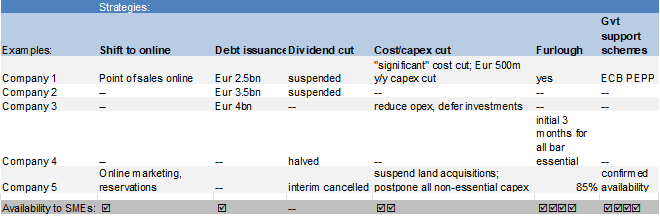

Despite the crisis, there will be opportunity and beyond that, the sector will likely see structural change. A current average P/E market multiple declining to just 10x 2021e from 26x 2020e (source: Factset, Euler Hermes) implies significant earnings recovery. Current consensus implying average Ebitda growth of 24% for our sample of large companies confirms this. We interpret this as large companies being able to benefit from solid book-to-bill ratios, which currently stand at around 1x, but more importantly, their ability to capture growth from infrastructure. While this means that that large companies may overshoot the economy, below we outline why we do not see the same ability to capture opportunity for SMEs.

- Residential – Besides enabling larger commuting distances, an increased uptake of remote working might lead to demand for houses with larger square footage. As peripheral and remote locations offer greater space and affordability, this could cause demand to shift away from city centres, leading to softening house prices in the latter. As city centres are typically characterised by renovation as opposed to new build activity, this segment could take a dent, though there may be a positive resulting outlook for new build activity outside of metropolitan centres. There may also be positive impact on infrastructure construction demand. SMEs might benefit from non-city centre peripheral activity, but they will also be hit by the dip in renovation. If such a trend became very pronounced, we could see large developers reaping most of the benefit of new build activity. Large companies would also be the prime beneficiaries of infrastructure build.

- Office – The increase in remote working could be reinforced by ESG considerations, notably reducing the usage of transport, as well as the real estate carbon footprint through less office space and wellbeing concerns. Of all structural trends, reduced office demand might turn out to be the strongest one. This would mostly affect large companies. In some cases, there could be reconversion to living space, but again, large developers would be best placed to benefit.

- Commercial/retail – The crisis has potential to further accelerate e-commerce penetration. This would affect small shop space but also shopping centres through likely rising vacancy rates. Shopping centres may see reduced foot fall as a result of regulation for some time. This could all lead to much reduced new build but also reduced retrofit activity. The scope for reconversion to living space is limited.

- Hospitality – While the hotel and hospitality sector is hit hard, it will ultimately see a rebound in activity. There may be a minor impact in terms of structural reduction in travel, also as a result of climate change concerns.

- Infrastructure and public works – Infrastructure is arguably a sector that will benefit, first and foremost through public stimulus programmes but also through longer term structural trends. This has been visible throughout the crisis, for example through companies seeing sustained demand in energy infrastructure. This segment will continue to see buoyant activity and the next level of climate policies will support that. Greening the economy will move to scale, favouring large projects. Furthermore, there is scope for increased public demand in the health sector as governments look to future proof against pandemics. Transport infrastructure demand could originate from the above mentioned office and housing trends. All of these are the domains of the largest operators in the sector. SMEs might receive subcontracted work but will not achieve the same profitability.

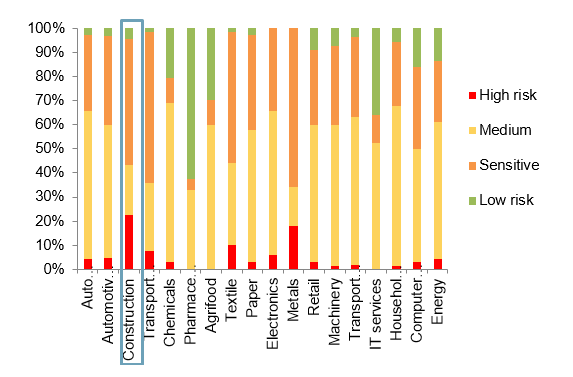

We have considered support policies for the major countries in Europe in order to see if this could materially alter the outlook. Our view is that while such policies may lend some help, they will not fully protect SMEs in the construction sector. Some countries are looking to speed up public tender processes in order to hand out public contracts. A number of countries have published green and energy policies that are helpful for the construction sector, and most have put lending support schemes in place. Germany stands out positively, while support is scarcest in France and the UK, as shown below. In the case of Germany, it is particularly because of the federal investment aid for states as the most important potential lever for spending.

- In Germany, measures are very broad-based, and targeted towards consumption as opposed to construction specific. We rationalize this with the sector showing strength going into the crisis. The VAT reductions are illustrative. Rates will revert to normal at the end of 2020, which according to some industry participants leads to additional cost of bureaucracy. the acceleration, easing and advancing of public tenders should be positive for the sector, albeit depending on execution. This concerns mainly federal tenders and should therefore mostly benefit larger companies. State and communal projects are more impactful for SMEs. Those could come forward through the broad EUR5.9bn federal support to states for investment spend, which we see at the core of the program. Capping social security contributions at 40% will also have a positive bearing for SMEs. There are also positive energy related measures: Over the near term these are principally made up of the removal of the solar build cap and support for energy efficiency related renovation measures through a EUR 1bn 2020/2021 increase in the CO2 building renovation program to EUR2.5bn. There is furthermore an unspecified increase in support for energy performance enhancement for communal buildings. All of these should bear immediate positive impact. An increase to the 2030 offshore wind build out target by 5GW is very long term and much depends on a number of other issues, such as planning, support schemes, power prices and electricity system constraints. We see an impact from the mid 2020s at best. All in all, the package is positive, but unlikely to alter the outlook very materially for 2020.

- Italy has also put in place support for energy transition-related construction: Increase of tax relief for energy optimization retrofits such as isolation, heating and water systems change. Alongside, there is an increased bonus for seismic protection reinforcement. The tax relief amounts to 110% of costs incurred, which we see as a strong incentive. This should benefit residential and the SME sector even if, on average, this type of work represents comparatively small projects.

- In France, companies across all sectors have access to public loan guaranties (PGE), which have seen a very wide uptake. This helps with liquidity bridging but will also bring about greater financial strain in later years as a result of higher debt. The “solidarity fund”, which compensates very small businesses for revenue loss, is a silver lining but won’t change the overall picture given eligibility and caps. The same holds for the postponement of social security and tax payments as it is on a case-by-case grant basis. The overall stimulus plan focuses on sectors likely seen as more strategic, i.e. automotive and airlines. France’s already low carbon footprint resulting from the prevalence of nuclear power is a likely explanation.

- The UK already had a sizeable program in place since 2019. It announced a cross-cutting GBP 330bn loan guarantee scheme in the last budget in March. Because it is a small business and large company scheme, there is a risk that some companies may not be captured at all. VAT payment deferral until June helped with liquidity but is not a stimulus measure.

- While Spain is supporting companies across sectors through the government loan scheme ICO, this is reserved for medium and large companies. At the same time, government bidding activity is down 50% as of Q2 2020.