What is trade credit insurance?

What does trade credit insurance cover?

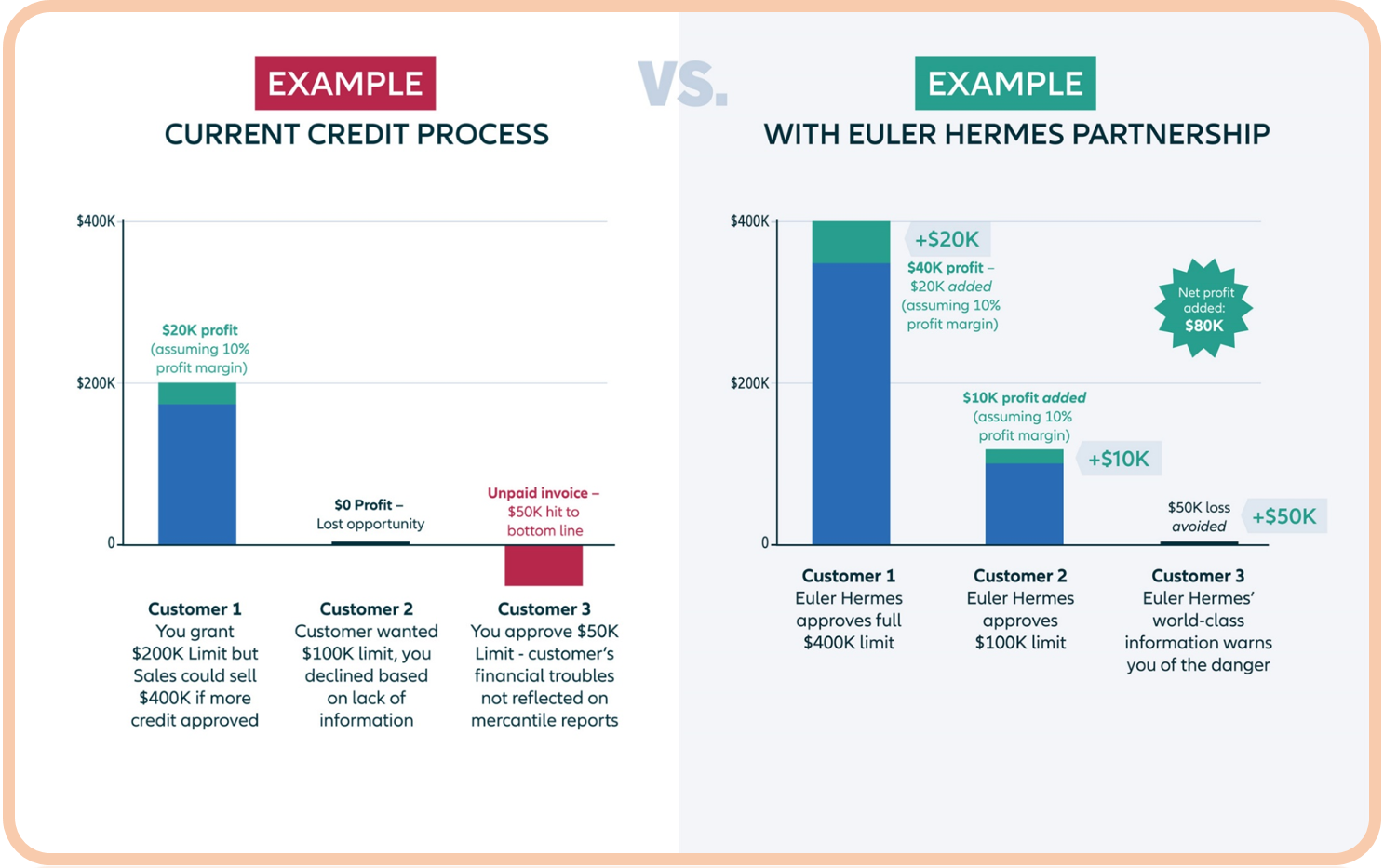

Trade credit insurance coverage protects businesses from non-payment of commercial debt. It covers your business-to-business accounts receivable. If you do not receive what you are owed due to a buyer's bankruptcy, insolvency or other issue, or if payment is very late, the policy will reimburse you for a majority of the outstanding debt. This helps you protect your capital, maintain your cash flow and secure your earnings while extending your competitive credit terms and helping you access more attractive financing.

With trade credit insurance, you can reliably manage the commercial and political risks of trade that are beyond your control. It can help you feel secure in extending more credit to current customers or pursuing new, larger customers that would have otherwise seemed too risky.

What does trade credit insurance cost?

The credit insurance cost of your trade credit insurance policy will vary depending on your industry, your annual revenue that needs to be insured, your history of bad debts, your current internal credit procedures and your customers’ creditworthiness, among other factors.

If you sell to clients in a mix of industries and countries, your trade credit insurance rates will reflect the risk determined to be associated with all of them.

How does it work?

Customers Health Check

Credit limit calculated

Business as usual

Trading limit updates

Business building

Making a claim

We investigate and indemnify you for the insured amount if policy terms have been met.

Top 8 reasons to buy

Protection

Peace of Mind

Competitiveness

Funding

Profitability

Cash Flow

Information

Growth

Solutions by company size

-

SMEs

-

Large-sized Companies

-

Multinational Corporation (MNC)

Policies and features

-

Corporate Advantage

-

World Program

-

Excess of Loss (XoL)

-

Transactional Cover

Why work with us?

55,000

83+million

AA

Let's get in touch today!