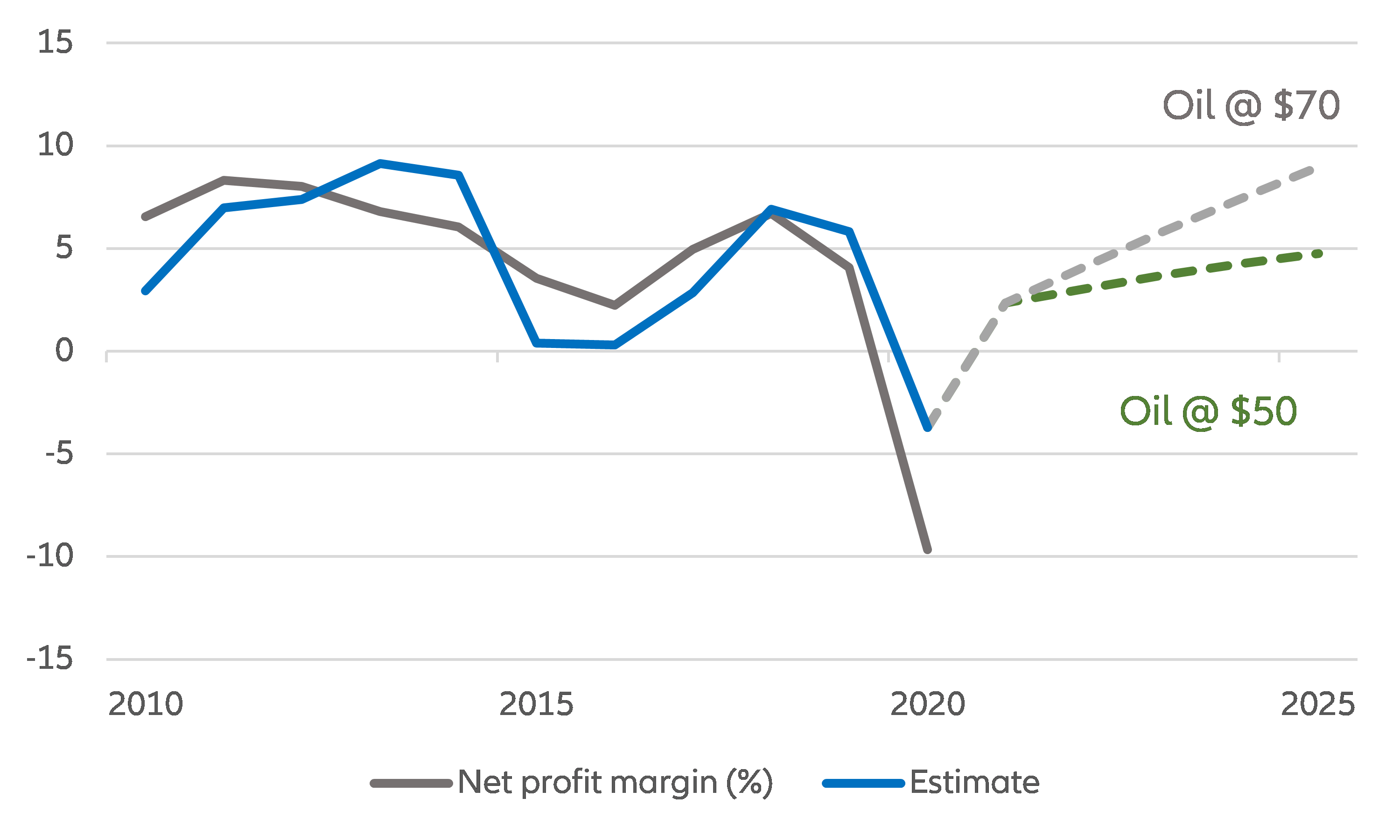

Turning off the (profit) tap. After a year of low oil prices and low demand that pushed most major oil companies into losses, the hit to profitability will continue in 2021 and 2022. We estimate that every USD10 drop in the annual average oil price leads to a profit margin decrease by 0.80 points and that every 1 million barrel/day drop in global consumption leads to a profit margin decrease by 0.65 points. With oil prices likely to be around USD48 in 2021 and USD57 in 2022, and consumption to bounce back to the 2018 level by 2022, we forecast profit margins at 2.3% and 4.2% in 2021 and 2022, respectively, well below the historical average of 5.7% seen during 2010-2019.

Figure 1 – Major oil profit margins (%)

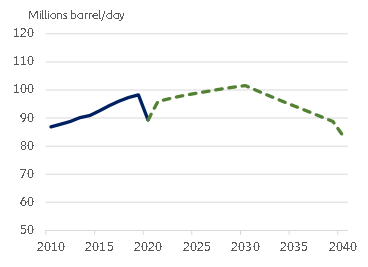

With peak oil around the corner, and fading tax cuts and subsidies, expect a reshaping of the sector, along with a reshuffling of risk. Oil demand is likely to peak by around 2030 in a “business-as-usual” scenario (Figure 2), taking into account global demographic projections and demand factors such as the fleet of electric vehicles (as transport is the most oil-intensive sector). In a “net zero” scenario, or if regulatory pressures grows rapidly, this peak could happen even sooner.

Figure 2 – Peak oil demand forecast

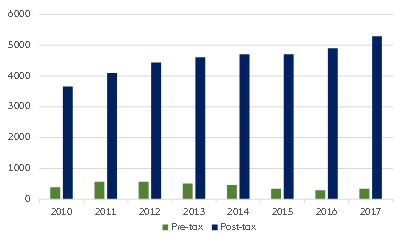

Moreover, subsidies and tax breaks for fossil fuels are very likely to decrease in the future, amid intensifying political, social and investor pressure to tackle climate change. This will eliminate a sizable source of support for the sector (see Figure 3). The new Biden administration in the US has already signaled its intention to go big on renewables (USD2trn investment plan) and to stop supporting the oil & gas (O&G) industry (pause of exploration, halting subsidies etc.). China has also signaled that change might be on the agenda: recent development plans laid out by state-owned PetroChina, Sinopec and CNOOC are tilted towards clean energy.

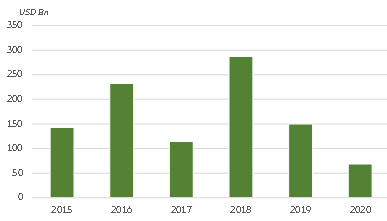

Figure 3 – Global fossil fuel subsidies (USD billions)

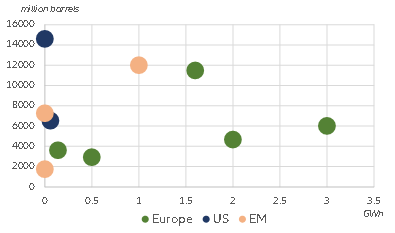

Against this backdrop, European companies have increasingly committed to renewable energy (see Figure 4), but US firms have rather focused on cleaner technologies close to their traditional activities (e.g. LNG, hydrogen), on R&D spending to develop carbon-capture technologies and on other actions (e.g. reforestation) that could offset their footprints. Even companies with large proven reserves or in emerging markets appear to be preparing for a future without or at least with less oil consumption.

Figure 4 – Installed renewable capacities and proven oil reserves

After a quiet 2020 in M&A activity (see Figure 5), we expect more deals in the sector, especially more “survival” deals, given the tight financial situations. Some of those potential deals could have the same impact on the sector as the consolidation wave of the late 90s: chatters around an ExxonMobil – Chevron megadeal have intensified recently.

Figure 5 – Oil & gas deals

Beyond consolidation in the O&G segment, we expect more spin-offs in the energy sector. One of the greatest strengths of Big Oil is its size, and size matters when it comes to raising capital. To do so with better terms, Major Oil should spin their renewables activities off. This would allow them to (i) reassure markets with regard to their intentions and fend off accusations of greenwashing, (ii) benefit from better valuations of renewable firms and consequently from cheaper cost of capital. Currently, renewables-focused firms are on average trading at P/E ratios twice as high as that of supermajors. Although so far most major companies, especially European firms that are moving forwards with renewable development, have stated that they are not planning to spin themselves off, we believe that they would do so if the valuation spreads persist when they successfully scale their renewable businesses.

We also expect more joint ventures and strategic partnerships as they offer paths to penetrate a new region (see the Equinor/BP deal that allows BP to invest in renewables in northern US) or to mobilize skills and capacities which are not core to O&G such as the Equinor/Microsoft partnership on the Northern Lights carbon-capture project.

Overall, this would result in the energy sector being composed of financially resilient “traditional” O&G firms mostly exposed to regulatory risks, whether through their own activities or their clients, and a reshuffling of financial risk among a variety of players.