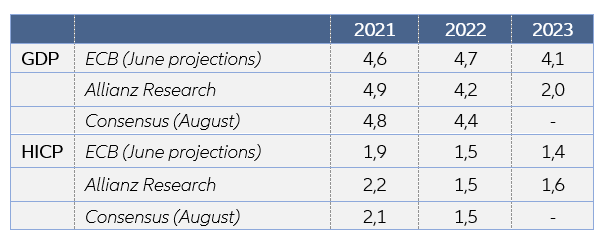

Despite the roaring return of inflation in H2 2021, the ECB should not flinch at next week’s policy meeting. In particular, it should refrain from taking an unnecessary bet on how the pandemic, the economy and yields (and in turn US monetary policy) will develop over the next quarter by precommitting to a lower PEPP purchase pace. First up, the ECB will present a new set of macroeconomic forecasts next week: Thanks to a stronger-than-expected Q2 rebound – notably in the Eurozone periphery in contrast to a disappointing growth performance in core economies – the ECB is likely to marginally upgrade its 2021 GDP forecast closer towards +5% (broadly in line with our own). The focus, however, will be on any adjustments to its 2022 Eurozone GDP forecast as it will provide some insights into the ECB’s assessment of the recovery’s strength. We expect the ECB to take a more cautious stance on the outlook for next year, reducing its current forecast of +4.7% closer towards +4% while broadly maintaining its 2022 forecast. This reflects to some extent a more front-loaded recovery in 2021. At the same time, though, upside potential for 2022 is capped by lingering downside risks, including the fresh rise of Covid-19 cases across Europe – which could well weigh on investment and consumption plans even in absence of renewed lockdowns – as well as persistent supply challenges that threaten to clip the wings of the industrial recovery.

As far as inflation is concerned, the recent upside surprises in the HICP (+3% y/y in August, fueled by supercharged base effects and one-offs) certainly call for an upward revision to the ECB’s 2021 forecast. More interesting will be the ECB’s inflation forecasts for 2022-23 since they will give an indication of whether the ECB still categorizes the current inflation overshoot as largely transient. We expect no major adjustments to inflation forecasts and expect them to remain firmly below 2%.

These adjustments in the macroeconomic projections would represent no game-changer for the monetary policy outlook. If anything, elevated uncertainty about the strength of the recovery, particularly at the turn of 2021/22, would justify prolonged policy support, which according to our analysis the ECB can well afford to extend, given the inflation outlook.

Figure 1: Macroeconomic projections (%)

With the Covid-19 recovery seemingly on track, financing conditions favorable and sovereign issuance expected to lighten towards year-end (as ECB Executive Board member Philip Lane recently admitted, supply is a key determinant in the calibration of PEPP purchases), has the time finally come to commit to lower PEPP purchases ahead? Wouldn’t the moment be opportune to follow the Fed’s recent move and engage in a “dovish tapering” by committing to lower PEPP purchases in Q4 2021 compared to the two previous quarters while signaling that policy will remain very supportive thereafter? We think not.

Rather than pre-committing to a certain purchase pace - and in essence tying its hands by taking an unnecessary bet on how the pandemic, the economy and yields (and in turn US monetary policy) will develop over the next quarter - the ECB should focus on reintroducing more flexibility when it comes to the implementation of PEPP. After all, committing to a lower purchase PEPP pace now could well set the ECB up for a “hawk” trap – i.e. a situation in which an unexpected rise in yields/tightening in financial conditions over the course of Q4 may require an ad-hoc policy shift toward higher purchases.

For the PEPP, the ECB should opt for a “seagull twist. Seagulls glide for long periods of time, saving energy by riding thermals and only flapping when necessary. Similarly, the ECB should take back the flexibility to react to actual market conditions, committing to a PEPP pace that ensures favorable financing conditions without quantifying it a priori.

In any case, for the successful delivery of both a “dovish tapering” as well as a “seagull twist”, communication will be key. The two messages to hammer home at the ECB press conference will be that 1) PEPP tapering does not constitute policy tightening and 2) policy after PEPP will remain very supportive, with a boosted APP program in place (no concrete figures needed) to cushion the PEPP cliff-edge.

Landing is among the toughest maneuvers for most birds - it is complex and requires a series of well-coordinated movements. Similarly, life after PEPP will need to be well-planned. A PEPP retirement confirmation for end-March 2022 should not be expected ahead of the December meeting. After all, waiting until December would equip the ECB with more visibility on the Delta threat to the recovery and the Fed’s tapering plans, as well as a fresh set of macroeconomic forecasts. To mitigate the March PEPP cliff-edge, we expect monthly asset purchases under the APP to be lifted at least for a few months to EUR40-60bn so as to continue to ensure favorable financing conditions.

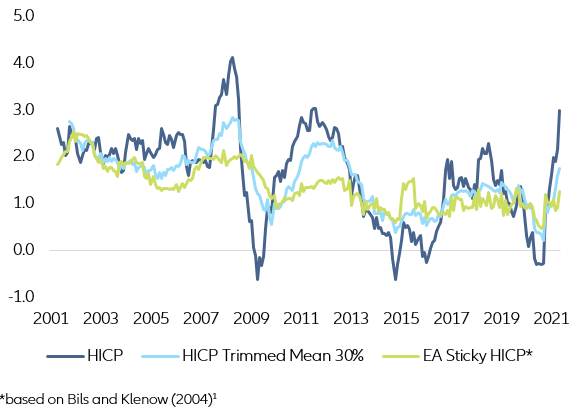

The roaring return of inflation to rates last seen in 2008 is also not yet cause for action, with underlying inflation in the Eurozone rather muted and medium-term inflation risks still tilted to the downside.

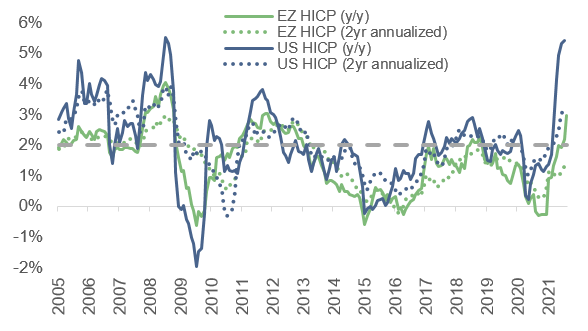

Reflation is not inflation – mind the rollercoaster base effects! As we have pointed out before, base effects play a large role as inflation slowed markedly in 2020 following the Covid-19 shock. To demonstrate these rollercoaster base effects, we look at two-year annualized inflation rates, which show that the upturn in inflation is in fact much tamer than headline figures suggest.

Figure 2 – US vs. Eurozone headline and core inflation (%)

Underlying inflation in the Eurozone remains rather muted…The US and Eurozone play in separate leagues when it comes to inflation, with the latest reading of headline inflation at 5.4% y/y in the US compared to the Eurozone’s 3% y/y. While it is true that the Eurozone’s inflation peak is still ahead, with the US recovery leading the pack by a few months, even then, inflation should top out below +3.5% y/y before year-end - a far cry from the outrageous inflation rates seen in the US.

Figure 3 – Eurozone underlying price pressure remains contained (y/y in %)

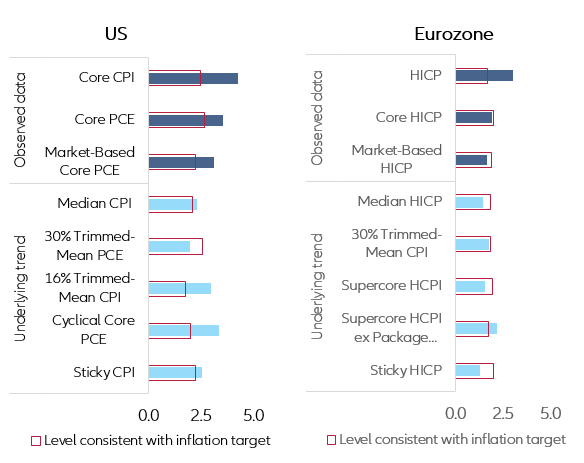

Moreover, in the Eurozone, the headline HICP has risen above target, but almost all indicators of underlying price pressures show a distance from the levels consistent with the inflation target (Figure 4). In contrast, in the US, it is both observed measures of US inflation (CPI, core CPI and market-based measures) and underlying inflation trends (sticky CPI, trimmed CPI/PCE etc.), which now register above levels consistent with the inflation target. This does not mean that immediate tightening measures are to be expected. It merely means that the Fed is now entering the phase of deliberate overshooting following its new average inflation strategy.

Figure 4 – Underlying inflation trends differ in US and Eurozone

There are several reasons for this divergence:

• The Eurozone recovery is still less advanced: With -4.5% in Q2, the output gap is still much wider than in the US (-0.2%).

• In the Eurozone the impact of Covid-sensitive inflation items is smaller than in the US. In July, 80% of the year-on-year change in the US CPI was attributable to Covid-sensitive items. In the Eurozone it was only around 20%.

• Companies in some US sectors have stronger pricing power (e.g. communication)

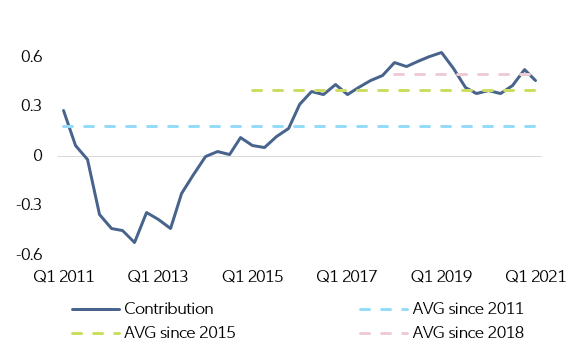

...including housing costs in the HICP would not alter that picture markedly. Of course, the composition of the consumer price indices is also different between the two regions. The key difference concerns the inclusion of housing costs. But even when we compare apples with apples, this is not a game-changer. Including owner-occupied housing (OOH) costs in the HICP, as the ECB intends to do following the strategy review, Eurozone inflation would be only 0.4ppt higher (Figure 5).

Figure 5 – Contribution to Eurozone HICP when including OOH (in pp)

The medium-term inflation outlook remains unchanged with risks still tilted to the downside. We do not think that the Covid-19 crisis is a game-changer when it comes to inflation. Yes, uncertainty about the inflation outlook has risen but on balance we are not out of the low inflationary woods yet, i.e. risks remain tilted to the downside.

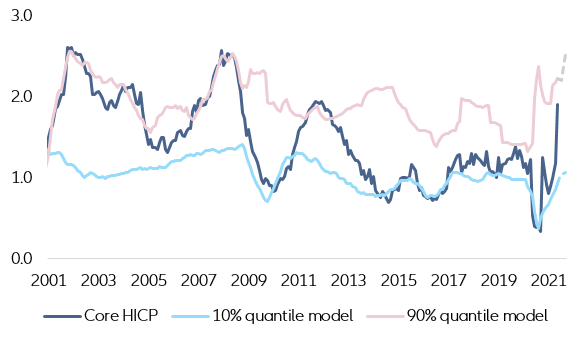

So how high can Eurozone core inflation rise by year-end as the economy continues to recover and heads towards capacity? To find out, we applied our core inflation model (based on the output gap, import prices of intermediate and consumer goods, and inflation expectations) to high inflation phases (90% quantile) and low inflation phases (10% quantile). This results in a band that captures well the historic peaks and troughs. After bottoming out at +0.4% last year, core inflation should continue to rise but settle at a temporary peak of around +2.5% y/y (Figure 6).

Figure 6 – Core inflation should not exceed +2.5% y/y this year

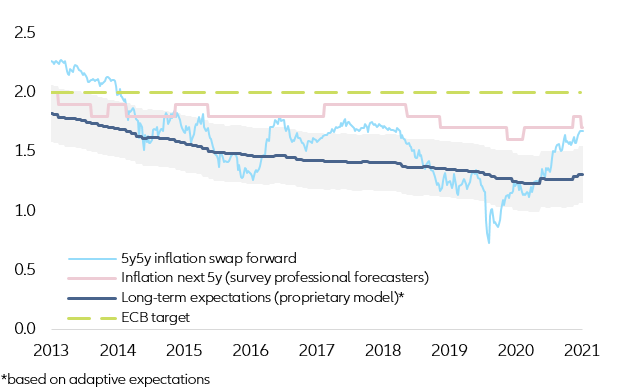

However, the road towards the medium-term inflation path is likely to be bumpy due to various base effects, one-offs and pandemic effects. The fog will not clear until the beginning of 2022. We maintain our view that the Covid-19 crisis will not lead to an inflation regime switch. This is also the scenario that currently prevails in the bond market: While market-based inflation expectations might have recovered to levels close to professional forecasters’ mid-term estimate, the long-term inflation expectations derived remain well below the inflation target.

Figure 7 – Even after strategy review, markets doubt inflation target

The challenge for the ECB is therefore not to contain excess inflation, but to steer inflation expectations in the direction of its long-term target. The higher inflation reading of the next few months might therefore turn out to be more of a boon than a threat.