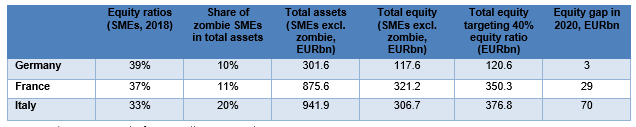

On top of emergency liquidity measures provided to European SMEs to fight Covid-19, we estimate that Italian SMEs need EUR70bn of recapitalization, French SMEs EUR30bn and German SMEs EUR3bn — after excluding pre-existing zombies. While state-guaranteed loans have so far helped companies avoid a liquidity crisis, European SMEs are facing excessive debt levels, deteriorated profitability and undercapitalization, a bad combination for medium-run solvency, with French and Italian SMEs being most at risk. French non-financial corporations’ debt is expected to have reached more than 81% of GDP in Q2, much above Germany’s levels of 43% and the Eurozone average of 63%. This comes against the backdrop of below peer equity ratios (37% of total assets, see Figure 1) and strongly deteriorating profitability: French non-financial corporations’ margins have lost more than -7pp since the start of the year and stand at the lowest level among EU-27 countries. While the debt issue is less of a concern in Italy (65% of GDP) in a context of a higher resilience of margins, equity ratios of Italian SMEs also stand below 40% level considered as adequate.

Figure 1 – Equity gap, EURbn

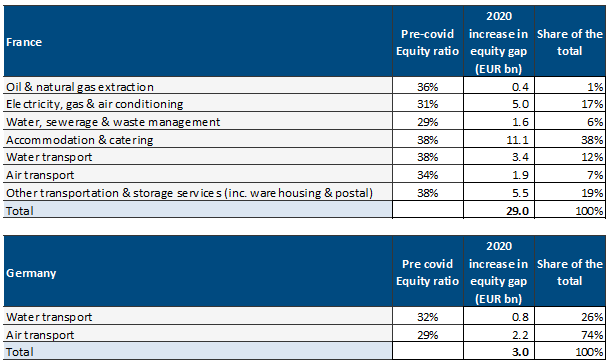

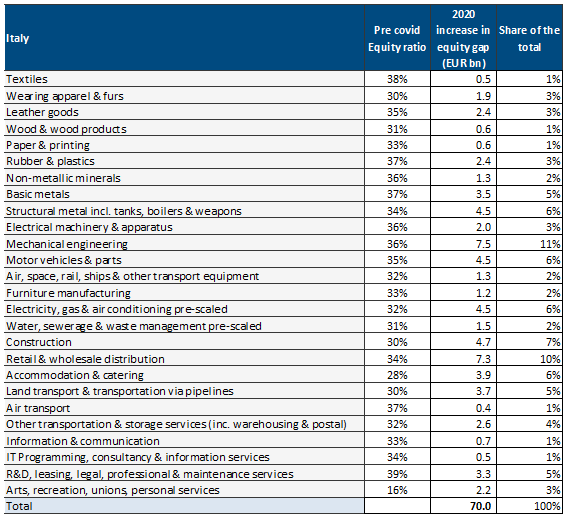

Which sectors are the most at risk? Excluding zombie SMEs, and looking at the pre and post Covid-19 state of equity ratios, the accommodation and catering sector in France is most at risk, followed by transportation and storage services. The accommodation and catering sector represents 38% of the increase in the equity gap foreseen in France, i.e. EUR11bn, but this sector is also far from immune in Italy (EUR3.9bn) – see Figure 2. Machinery equipment and trade (combining retail and wholesale) in Italy are next on the ‘watch list’, with an almost similar additional equity gap (EUR7.5bn and EUR7.3bn, respectively). We expect the ‘other transportation and storage services’ sector to remain high on the list in both France and Italy (EUR5.5bn and EUR2.6bn, respectively). More globally, Italian sectors are over represented in the ‘watch list’ since they all appear to be undercapitalized compared to their German and even French counterparts, with several sectors posting a below 35% equity ratio prior to the Covid-19 outbreak (notably wearing apparel, wood and wood products, structural metal, construction, land transport). In France, the equity gap is concentrated in a much more limited number of undercapitalized sectors. The transportation sector, including both maritime and air transport, highly impacted by the Covid-19 crisis, is one of them, with equity gaps at a record EUR3.4bn and EUR1.9bn, respectively. Those two sectors are the only ones to watch in Germany, where all the other sectors had above 40% equity ratios prior to the crisis.

Figure 2 – Equity gap by sectors (excluding zombie SMEs)