- A new wave of knowledge-based investment is causing both business creation and rising insolvencies. After a lost decade, corporate investment is on the rise in France (+3.8% on average in volume in 2017-18) as new technologies drive automation and change production processes across sectors. Information & communication now account for half of investment growth. This new wave of knowledge-based investment is affecting mainly agrifood, retail, accommodation & catering, transportation and other services, a subset of sectors where we observe both increased business creation (+15% in 2018) and rising insolvencies (+6.6%).

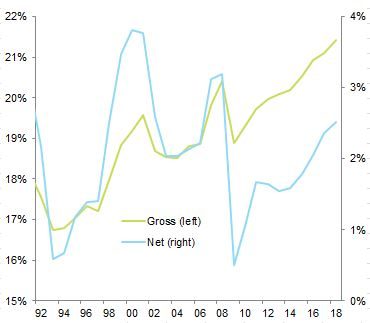

- What does this mean for companies? They will need sounder financial ratios to deal with a higher rotation of capital. Gross investment of French companies reached a record high level in 2018 (21.4% of the value added, +3pp from 15 years ago), while their net investment value remained muted. This is because the pace of capital depreciation reached a record high level in 2018 – 18.9% of the value added – with knowledge-based information technology being at the top with 30% (against 15% for machinery). Sound financial ratios will be key in the near future as debt-laden companies won’t be able to frequently renew their capital and therefore won’t be able to withstand strong pressures from competition.

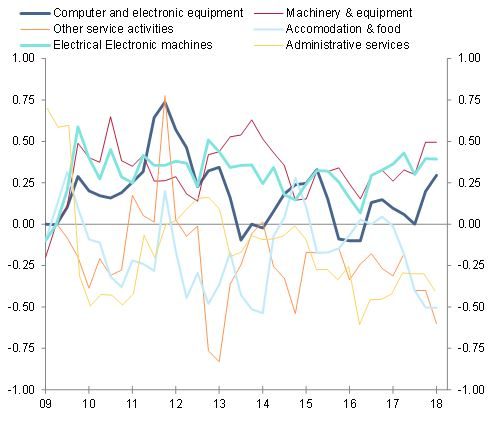

- Companies will also increasingly compete for skilled workers. We see a clear decoupling in job creation and growth of salaries between knowledge-based sectors (digital, machinery and engineering) and traditional job-intensive sectors (administrative work, financial industry, distribution and retail). The most striking point is the diverging trend between the retail sector (for the first time in negative territory since 1993, with -2.5k of jobs lost in 2018) and the out-performing ICT sector (jobs related to a tech function made up half of employment creation in 2018 or 70k of new jobs). At the same time, highly qualified workers are likely to be increasingly scarce even in a context of high unemployment, requiring companies to develop hoarding strategies.

- Companies will consider the case of relocating production in France. A paradoxical impact of the current innovation wave in France is that it has triggered more trade growth in goods (+4.8% in 2018) and lower trade growth in services (+1.7% in 2018), in contrast to trends observed globally. It seems that the new wave of automation and the increasing degree of digitalization of the logistic function are favoring a relocation of the investment function.

A new wave of knowledge-based investment is causing both business creation and rising insolvencies

After a lost decade, corporate investment is on the rise in France as new technologies drive automation and change production processes across sectors. In 2016, corporate investment in volume was about the same compared to 2008. But between 2016 and 2018, it grew by +3.8% per year in volume (on average), easily above average GDP growth (+1.9% on average). And it has continued to grow despite staggering capacity utilization rates (from 85.8% in 2018Q1 to 85.1% in 2019Q1).In terms of automation, France has one the lowest levels of equipment in Europe, with 132 robot units per 10,000 employees (Germany has 309 units, Italy 185 units and Spain 160 units, according to the International Federation of Robotics). However, something of a catch-up is materializing and a wave of knowledge-based investment by new fast-growing companies is behind this trend. In 2017, information & communication became the top investment driver for the first time in France’s history.

On the FT1000 2018 European fastest-growing companies ranking, Paris came in second with 62 companies, concentrated in technology, business services, retail, transport, energy and agrifood. In these sectors, the innovation wave is sparking both business creation and rising insolvencies. Of course, vulnerability to technological change is not the only reason behind business insolvencies in France, which are structurally high and partly explained by financing gaps. But even when GDP growth is high (2017), when insolvencies should decrease, some sectors, particularly consumer-driven ones, do not show the same pattern, with upward trends in insolvency numbers.Among the three trade sectors, retail trade and car sellers show an upward trend in insolvencies, while wholesale trade does not share the same pattern. This shows that in the value chain of the main goods, downstream players are the most exposed, since there is often more competition for them, while upstream players are more often in a monopolistic situation. This is particularly true for the car value chain (car sellers in front of carmakers).In agrifood, accommodation & catering and transport and other services the upward trend in insolvencies was never broken, but these are also the sectors where business creation has grown the most, particularly in 2018, despite lower GDP growth this year. The ‘Trade, transport, accommodation and catering’ item grew by +15%, making up half of the growth observed in business creations in 2018. In this subset of sectors, insolvencies also grew by +6.6% in 2018.

Chart 2: Insolvency trends per sector: Levels compared to 2011 vs. 2019 evolution