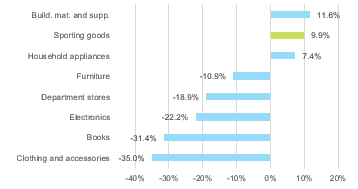

Sporting goods are one of the rare winners from the Covid-19 outbreak amid a decimated discretionary retail industry: we expect U.S. retail sales of sporting goods to hit an all-time high of USD48bn in 2020. After falling in March and April because of state-wide retail restrictions, U.S. retail sales of sporting goods recovered significantly in May, boomed in June and have kept growing at double-digit rates ever since amid growing enthusiasm for sporting activities. From January to August, they were up +9.9% year-on-year (see Figure 1).

The segment’s strong performance does not entirely come as a surprise. Over the past twenty years, sales had already displayed strong growth of about +2.9% per annum, second only to e-commerce. The increasing demand for performance gear among amateurs, the progressive casualization of the work dress code as well as the more recent “athleisure” trend (sportswear as fashion wear) have proven strong tailwinds in a country home to leading sportswear brands Nike and Under Armor. We believe this momentum could last well into 2021 for three main reasons:

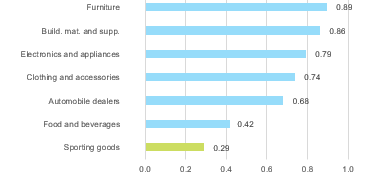

- Sporting goods sales are largely inelastic to GDP – correlation to GDP stands at 0.29 vs 0.74 for fashion stores and the segment came out largely unharmed from past recessions. (Figure 2)

- We anticipate a K-shaped recovery for the U.S. economy , with strong dispersion in growth between economic sectors. This will typically translate into reduced consumer spending for activities that are seeing limitations and restrictions, freeing up purchasing power for goods and services that are both available and in demand.

- Anecdotal evidence suggests the sanitary crisis has prompted a fraction of the population to adopt healthier lifestyles – including more time dedicated to sporting activities.

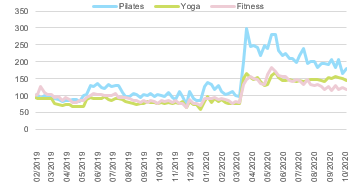

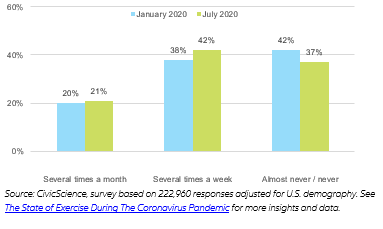

What may have taken the industry by surprise is precisely the pace at which consumers have adapted to the new normal. Though several large fitness chains have gone bankrupt since March and restrictions remain on collective sporting activities, sports enthusiasts seem to have maintained and even increased their routine. Looking at search data for sporting activities that can typically be done from home using a popular video streaming service, we observe a peak in demand related to fitness, yoga and Pilates workouts (Figure 3) in April and May, with interest still up 40% to 80% from last year as of October 2020. The same survey conducted in January and late July 2020 by market research firm Civic Science also shows a significant increase in sports engagement even after the most severe restrictions on activity were lifted (Figure 4).

Reports from app download data specialists AppAnnie and Sensor Tower point to similar conclusions. Interestingly, some of the most popular fitness apps were developed or acquired by leading brands such as Nike (Nike Run Club), Adidas (Runtastic) or Under Armor (MyFitness Pal) and come with premium features for paid subscribers.

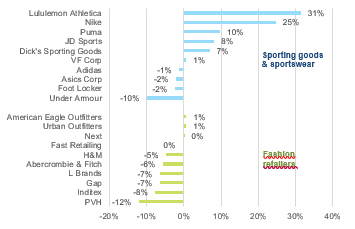

What does this mean for companies? Because sportswear accounts for an estimated 20-30% of the wider apparel market, its resilience is good news for textile manufacturers - China, Vietnam, Bangladesh, Indonesia and Cambodia host the majority of contract manufacturers working for Western sportswear brands. Together with personal protection equipment (face masks, etc.), it is a rare bright spot for an industry plagued with collapsing demand from fashion brands. Looking at two peer groups comprising leading international sportswear and sporting goods retailers, and leading fast-fashion retailers, we observe a huge divide on the expected pace of recovery – the majority of sports specialists should be close to or above their 2019 sales levels by 2021 already, while it would take at least one more year for fashion specialists (Figure 5). The trend observed in the U.S is not an exception – the momentum seems even stronger in Germany and, while less impressive, it is also noticeable in China and France for instance.

Much like in other segments of the retail and consumer goods industries, we believe the ongoing sanitary crisis is also contributing to widening the gap between best performers and followers as regards the adoption of multichannel business models. Nike and Dick’s Sporting Goods, which will both hit record revenues this year, were able to navigate through times of store closures thanks to e-commerce, whose sales grew by triple digits under lockdown. Both derived more than 30% of their revenues through digital channels in Q2 2020 already.In contrast, fast-fashion heavyweight Inditex hopes it will reach 25% by 2022 at best. Looking beyond sportswear, we anticipate more and more household goods companies to follow the example set by companies such as Dyson (household appliances) or Apple (consumer electronics), which also boast strong direct-to-consumer activities. The incentive for sportswear brands to push their own retail operations is even stronger as it allows them to fend off competition from internet pure-players and capture the market shares from defunct or ailing retailers, in particular department stores.

Figure 1 – Retail sales by segment, % change year-on-year (January-August)