It is too soon to tell the long-term effects of the Covid-19 crisis on inequality in Latin America, but income and labor markets already seem to be Patient Zero. The pandemic has exacerbated the existing structural inequalities in Latin America’s labor markets, including a very high skill premium in terms of wages; a high correlation between the ability to work remotely and education, hence with pre-pandemic income; a very high ratio of the minimum wage to the mean or median wage, which indicates a larger share of economically vulnerable workers, and the predominance of the informal sector, whose workers have no access to furlough schemes or unemployment insurance. In this context, job and income losses hit the lower-skilled and uneducated workers the hardest. In addition, preexisting occupational differences in terms of gender and age have translated into greater disparities and future vulnerabilities as the burden of additional housework and care responsibilities fell on women. As a result, the earnings gap is set to grow further.

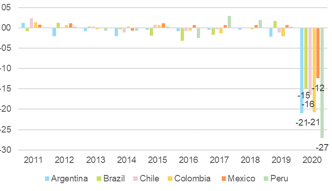

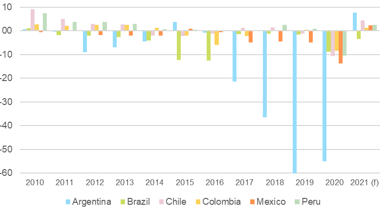

Figure 1 demonstrates the sharp decrease of total weekly hours worked to population, a measure of labor force dynamics, in Argentina, Brazil, Chile, Colombia, Mexico and Peru. The largest contraction in 2020 was seen in Peru (-27% y/y), while Argentina and Colombia both recorded a decline of -21% y/y. Mexico saw a sharp decrease of -12% y/y after six years of positive growth. In terms of the rate of employment, the story is similar: Peru had almost 12pp decrease, while in Chile the employment rate was -6.5pp lower and in Brazil -4.6pp lower.

Figure 1: Growth of ratio of total weekly hours worked to population (aged 15-64), growth in %

Sources: Datastream, ILO, author’s calculations

Sources: National statistical offices, Datastream, Allianz Research

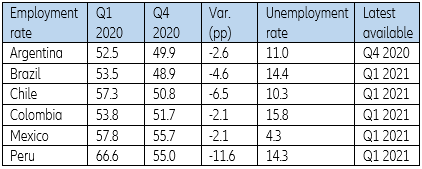

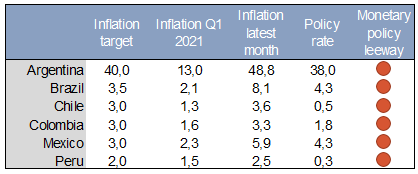

Now, an alarming rise in inflation threatens to rub salt in the wound as food and fuel expenditures as a percentage of total consumption are exorbitantly high in the region. As a result, we estimate that 80 million people, or 18% of the total population in the six largest Latin American economies, are at risk of falling below the poverty line. Food and fuel expenditures as a percentage of total consumption range from 32% in Mexico to 53% in Argentina (in the US it stands at 12%, see Figure 2). In the 2000s, rising commodity prices helped reduce income inequality in Latin America by creating greater demand for agriculture and mining labor, in turn increasing low-skilled employment and wages. However, the recent surge in inflation, coming after historic levels of liquidity were injected into in financial markets in response to the crisis, has already forced countries such as Brazil and Mexico to tighten their purse strings and increase policy rates: they now stand at 4.25% in both countries. It is likely that both countries will experience between two and three more hikes in the next 12 months as we think the Fed is currently at ease with a temporary overheating of the economy and Latin American countries will need to manage imported inflation.

Table 2: Monetary policy leeway

Sources:Datastream, central banks, Allianz Research

Although the shocks that have sparked rising inflation are expected to be temporary, the diversity, magnitude and extended horizon in which they have been affecting inflation imply a risk for the price formation process, threatening consumer discretionary income.

Since the 2008 financial crisis, combined energy and food expenditures have risen steadily in Argentina, Brazil and Chile, Colombia and Mexico. The pandemic in turn sparked a further surge: In Argentina, food prices are +56% higher now than in March 2020 – though Argentina has been struggling with general inflation for a while. In Brazil, food is +17% more expensive than at the beginning of the pandemic; Colombia has seen a generalized increase of +12%, while Mexico has faced +7% and Peru +5.5%. Only Chile has kept the price increase relatively at bay (+5.8%). We still expect commodity prices to consolidate going forward, mostly because supply should increase (OPEC+ production increase, US shale to rebound, Iran deal). From Q4 onwards, we believe prices will be broadly stable, averaging at USD65 as both demand and supply should normalize to pre-Covid levels (as a reminder, the average Brent price in 2019 was USD64; the spot as of Q3 is at USD75.7).

Figure 2: Food and fuel expenditure as % of total consumption

Sources: EIU, Allianz Research

At the same time, disposable income saw a generalized drop in our sample. This gap between inflation increases and disposable income growth creates a cost of living pressure (see Figure 3). In Argentina, while disposable income decreased by -13.1% y/y, inflation was 42%. Though Argentina is a special case, in Brazil disposable income decreased by -5% y/y while prices rose +3.2% y/y. In Chile, inflation was at 3.0% while disposable income decreased by -7.7% y/y. Colombia had a similar situation with an inflation rate of 3.5%, while disposable income fell by -5.8% y/y. Disposable income fell in Mexico by -10.4% and inflation was penciled in at 3.4%. In Peru, disposable income fell by -8.7% and inflation was kept at bay at 1.8%.

In our sample alone, the moving poverty line, because of the changes in basic goods basket affordability, endangers the socioeconomic standing of 80 million people or 18% of the total population in these countries earning between USD2 and USD5.5 (2011 PPP) daily . This portion of the population is especially of interest as it is right below the middle class, but above the deprived portion of the population. As such, it is a group that can be dragged into poverty and deprivation with a financial shock and is in danger of lower nutrition and food security because of the increase in prices of the basic basket of goods. For reference, the share of this vulnerable population in the total population ranges from 8.4% in Argentina and 13.4% in Chile to as much as 21.1% in Mexico and 23.3% in Colombia.

Against this backdrop, the Food and Agriculture Organization (FAO) estimates that over 42.5mn people could go hungry in Latin America, equivalent to the entire population of Argentina, or twice that of Chile. It is therefore unsurprising that there is a rise in left-oriented governments that promise to rescue populations from the “neoliberal poverty trap”, but do very little to draw a credible path that delivers on these promises.

Figure 3: CPI and disposable income growth gap, in pp y/y

Sources: Datastream, EIU, IMF, author’s calculations

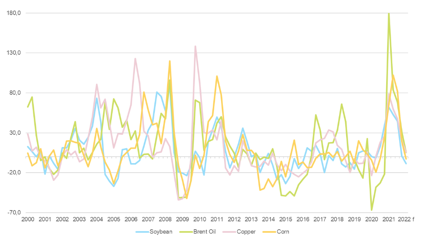

How can policymakers pull Latin America out of the doldrums for good? In the short-term, import economic growth from the favorable external situation. Agrifoods and other commodity prices have weathered the crisis relatively well and began to rally in the last quarter of 2020. From both the supply and the demand sides, we can expect commodity prices to remain high this year . Whether it will be another structural “supercycle” like the one in the 2000s is yet to be seen, but there is an opportunity to rebuild sustainable growth by creating opportunities for foreign direct investment to help with the green transition via the investment programs around the globe. Taking advantage of the expansionary phases in the US, China, and Europe would provide a much needed boost for Latin American economic growth.

Figure 4: Commodity prices growth, in % (y/y)

Sources: Bloomberg, Allianz Research

However, a necessary condition for private investment to gravitate towards Latin America is a stable business environment and political stability. Populism and divisive narratives do not help the cause of bridging the gap between the rich and the poor in one of the most unequal regions. It is important for decision-makers in the region to focus on saving lives and keeping peace in the short term as well as to lay the groundwork for post-pandemic economic growth, inclusive employment and poverty reduction.

As for the long term? A focus on reforms, education, and productivity is essential. The history of the region indicates that during the commodity boom of the 2000s, the incentives and drive for new reforms were undermined. Hence, there has to be a careful framing of reforms and decision-makers need to work on building trust with the population to have these reforms embraced. The proposed fiscal and health projects in Colombia were not well-received because the perception of the population was that it would not be beneficial for them to expand the tax base but would only leave them poorer. However, in Chile, a new constitution was welcomed with open arms because it was perceived as an improvement from the current one, which was tainted with a legacy the country would rather leave in the past. There is a way to implement reforms in the region, but they need to come with immediate perceived benefits and need to be planned and timed so that there is an avoidance of blockades, demonstrations and protests, not only for the sake of business continuity and private investment, but also for labor outcomes.

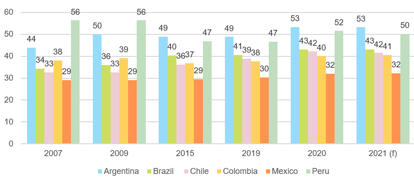

Education investments should also take the spotlight in a post-pandemic recovery. In the 2000s, the enrollment gap in secondary education between rich and poor households in Latin America was 12pp; in the 2010s, the difference was reduced to 8pp (see Figure 5). This improvement is at risk as a consequence of the pandemic. With the decrease in income, households might feel encouraged to increase labor supply, as well as to have their children be incorporated into the workforce. However, this increase in labor supply could risk lowering wages and hinder social mobility for youth if they are taken out of education, putting them at risk of being caught in a poverty trap. Better access to education can help bridge the skills gap, boost innovation and create the more inclusive growth that Latin America so desperately needs.

Figure 5: Differences in enrollment rates between the richest and the poorest households

Sources: United Nations Education, Scientific and Cultural Organization; and World Bank

Finally, participating and being further incorporated in global value chains can help developing economies to make the transition from commodity exporters to manufacturing post-pandemic. This can also produce better outcomes for the populations and create spillovers of “learning by doing”. The organic knowledge sharing and diffusion of technology that comes with global value-chain integration could allow new businesses to overcome the high technical entry barriers.

Author

Insurance and Wealth Markets Expert