Executive Summary

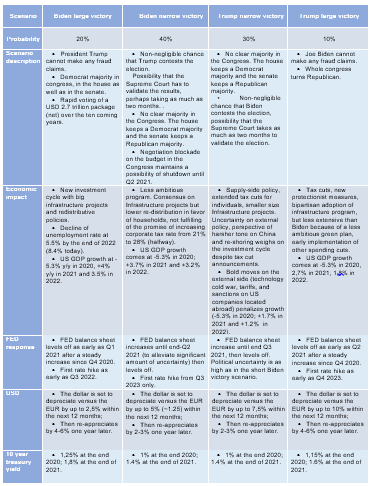

- The U.S. elections will spark a period of high uncertainty and market volatility until the end of the year. It could take one to two months after 03 November to finalize the results due to the record high use of mail-in ballots amid the Covid-19 pandemic. With the outcome likely to be contested by the two camps, a judiciary battle of one or two months is also possible, and market volatility could significantly increase during this time. We identify four possible election outcomes, with our central scenario being a narrow contested victory of Joe Biden, with the Senate still in the hands of the Republicans (40% probability).

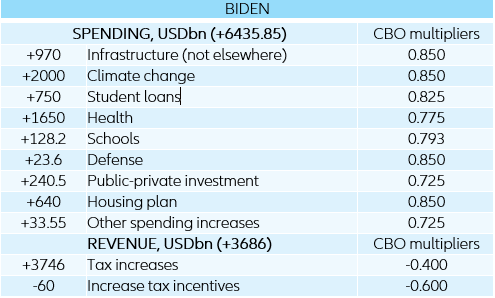

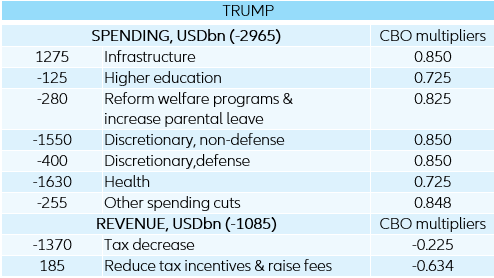

- Choosing between the two candidates will mainly mean choosing between a bigger or smaller federal government. Joe Biden’s economic platform aims at being more redistributive, with a likely net rise of USD3.7trn in taxes over the decade, mostly affecting the highest income earners. It is also demand-side oriented: A Biden win could see public spending rise by USD6.4trn at the horizon of 2030. In contrast, the incumbent U.S. president offers supply-side oriented propositions, including USD3trn of net spending cuts at the horizon of 2030, coupled with USD1.4trn of tax cuts, causing a USD1.1trn net cut in overall government receipts.

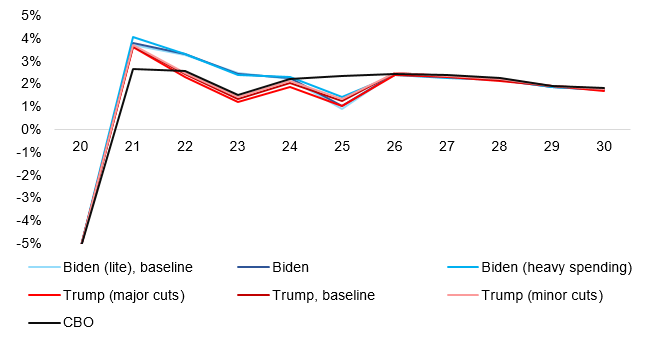

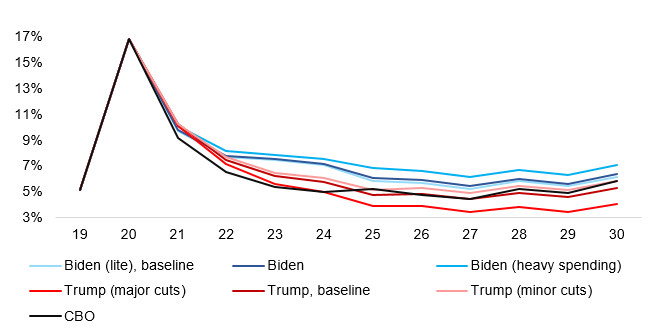

- What will this mean for short-term growth? As Biden’s platform also emphasizes improvements in infrastructure, which is usually associated with the highest multipliers that real activity can benefit from, his victory could result in an extra 1pp of real economic growth in 2021. This supplementary boost should increase until 2024, reaching at least 1.5pp, 2.3pp and 2.2pp of real growth contribution in 2022, 2023 and 2024, respectively. A Trump victory would sustain real economic growth by 0.9pp in 2021, 0.7pp in 2022 and 0.3pp in 2023 as a result of the recovery infrastructure package in the short to medium term. After that, the negative impact of the long-term spending cuts would offset the positive impacts of tax cuts.

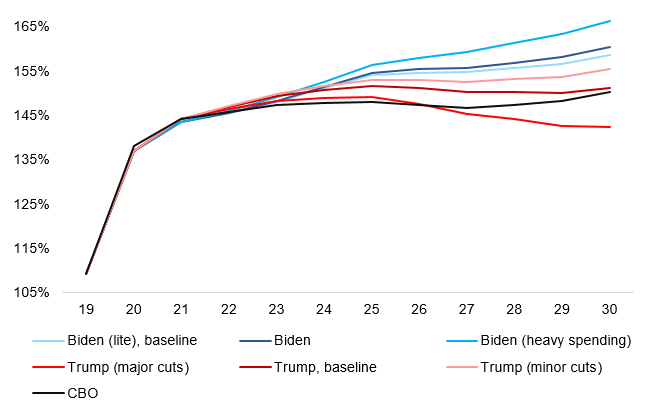

- Over the long-term, public debt will be the real winner of this election. It should reach 159% of GDP at the horizon of 2030 (compared with 137% expected in 2020), a trajectory which is common to the two candidates despite radically different economic orientations (public debt at 151% of GDP at the horizon of 2030 in the case of a Trump win).

- In this context, we expect the U.S. economy’s growth potential to be structurally impaired. Between 2021 and 2030, it could reach +1.4% with a Biden victory, and +1.25% in the case of a Trump victory.

- In our view, political choices in terms of reshoring or redistribution will not create a new regime of very high inflation. We expect a slight overshoot of the 2% target between end -2022 and the beginning of 2023, and a stabilization close to 2% thereafter.

Four different scenarios for the outcome of the U.S. elections

The 2020 Presidential elections are likely to intensify uncertainty in the U.S. COVID-19 has compelled some states to use more “mail-in” ballots which the President has strongly opposed, citing the possibility of fraud. Conceivably, it could take one to two months after the 03 November election to count those ballots, and there is a small possibility that Trump could contest the results, putting the outcome of the election in the hands of Congress or the Supreme Court.

Tangible signals of nervousness are already visible in different segments of the market, as the price to get protected against adverse moves of volatility in November has significantly increased. Over the last few weeks, companies have rushed to issue debt in anticipation of much more challenging and tighter conditions during and after the elections. Market volatility is likely to significantly increase from November until the end of the year because of these elections.

According to public polls, Joe Biden now benefits from 50.7% of vote intentions, while President Trump currently stands at 42.6%. However, bet polls suggest that the race could be much tighter. We have identified four different scenarios, with impacts summarized in Figure 1.

- Scenario 1. Narrow contested victory for Joe Biden (40% probability), with the Senate still in the hands of Republicans. In this scenario, Biden wins but there is a non-negligible chance that President Trump could contest the election, with either Congress or the Supreme Court eventually validating the results. Over the medium-term, because of Republicans still controlling the Senate, Biden has to wait until the second half of 2021 before seeing an effective execution of his economic platform (starting with infrastructure projects) and has to compromise on the most liberal aspects..

- Scenario 2. Narrow contested victory for President Trump (30% probability), with the Senate still in the hands of Republicans. Democrats ask for precise recounting. President Trump has also to wait until the second half of 2021 before we see a materialization of a large wave of new tax cuts, while infrastructure projects could receive a swifter approval of the Congress because of their bipartisan aspect.

- Scenario 3. Large victory for Joe Biden (20% probability), with a clear majority in the Congress for Democrats. In this case, the new U.S. President can implement his economic platform quickly with more liberal orientations. The multiplier impacts are much stronger and quicker. In the beginning of 2021, more leftist or liberal orientations could trigger a significant correction of the equity market, requiring a strong intervention of the Fed in order to tame volatility. This instability would last only during Q1 2021 as the perspective of a new investment cycle would reassure the market later.

- Scenario 4. Large victory for President Trump (10% probability), with no clear majority in the Congress. The House remains in the hands of Democrats. President Trump manages to implement tax cuts albeit with delays (second half of 2021). His foreign policy is more assertive, in particular targeting China, with negative impacts on global equity markets. De-globalization would accelerate at a global level.

Figure 1: Four different scenarios for the U.S. elections