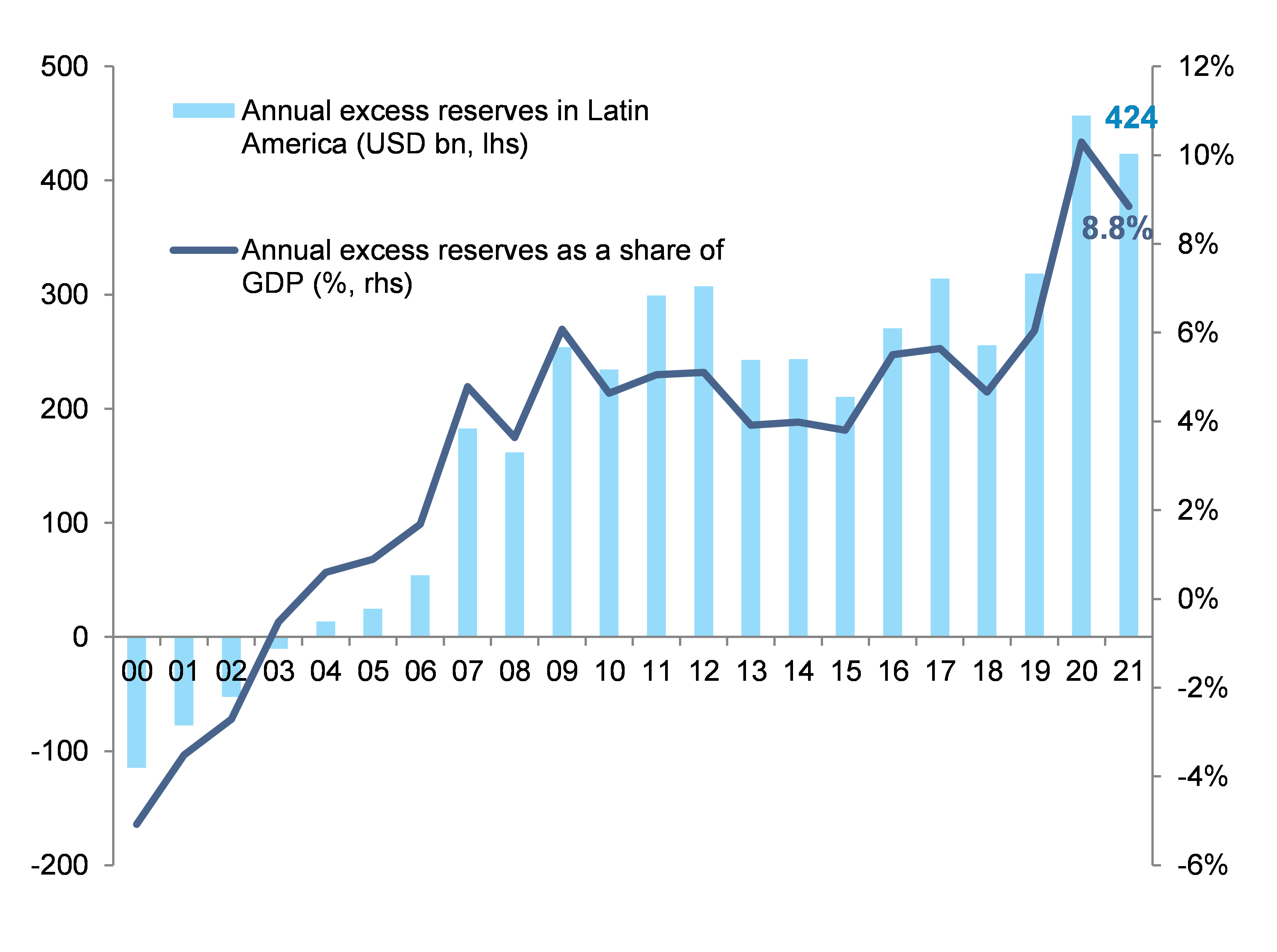

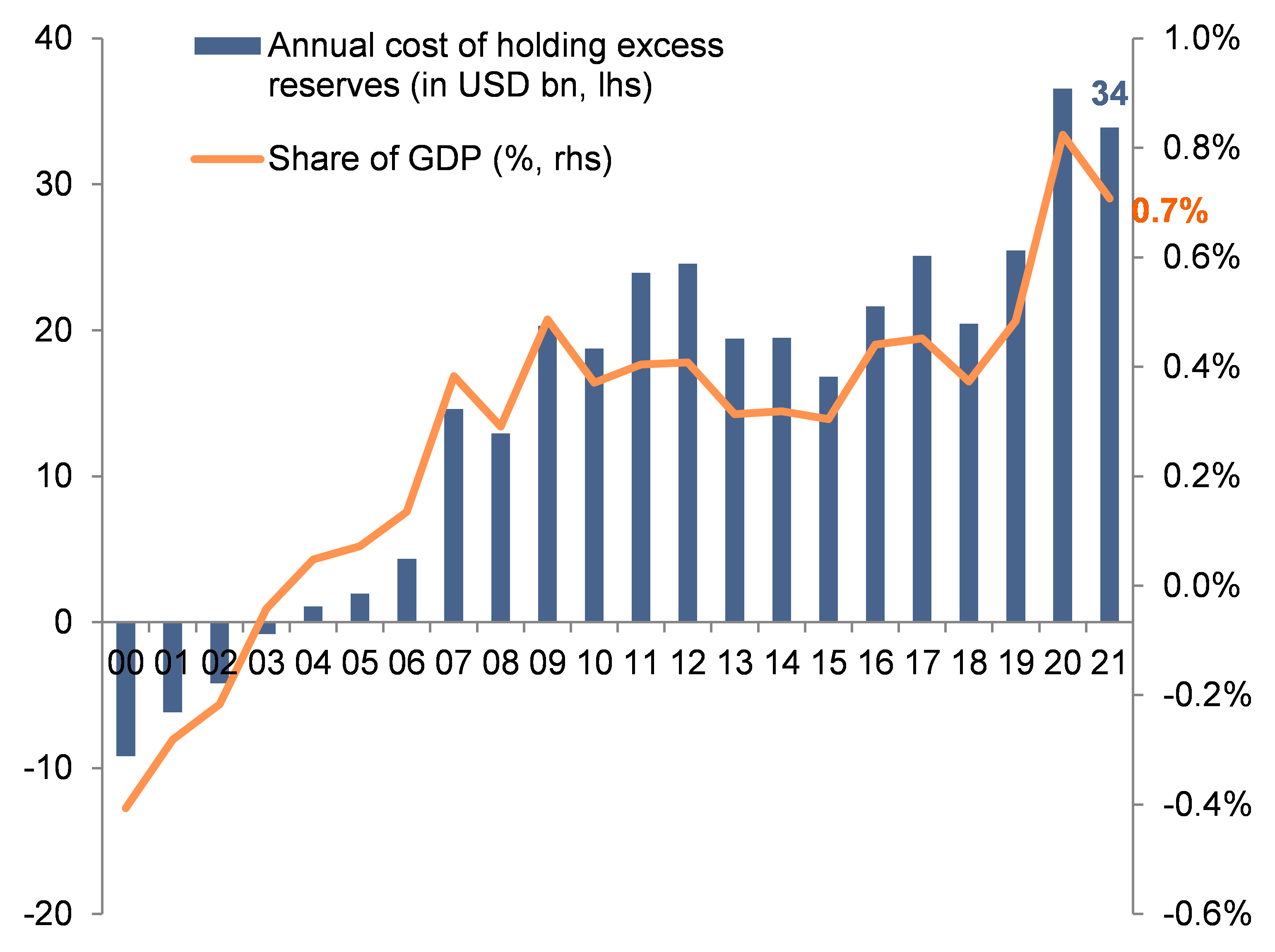

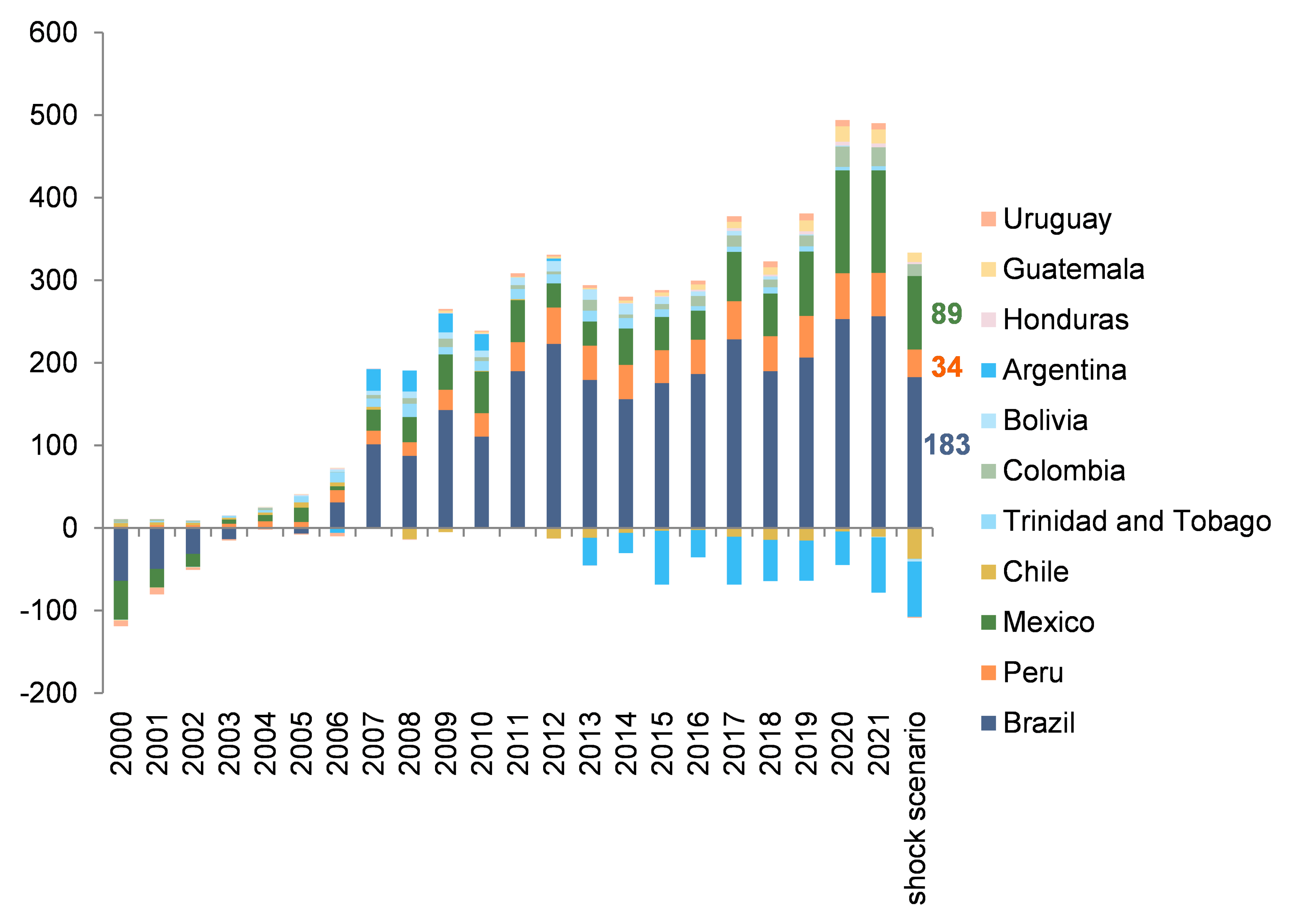

In 2021, Latin American countries could be holding "excess" FX reserves of around 8.8% of GDP, with an opportunity cost to economic activity as high as 0.7% of GDP. We define excess FX reserves as covering more than 100% of a country’s external financing needs. In the past, reserves were used as a hedge against volatility and speculative attacks, and have been Latin America’s way of shielding itself from the drawbacks of financial liberalization. As a result, the region as a whole has become less vulnerable to the types of financial crises it lived through from the 1970s to the 1990s (with the exception of Venezuela, Argentina and Ecuador). However, FX reserves could amount to around USD424bn i.e. 8.8% of Latin American GDP in 2021 (after 10% of GDP in 2020 and an average of 4% since 2004). Central banks holding such reserves in low-yielding US treasuries is not optimal: We estimate that the opportunity cost for not using these reserves for more productive investments has averaged 0.4% of GDP every year in the last 15 years, and could go to USD34bn or 0.7% of GDP in 2021.

Figure 1: Baseline scenario - “Excess” FX reserves in Latin America (USDbn and % of GDP)

Figure 2: Baseline scenario - Annual cost of “Excess” FX reserves in Latin America (USDbn and % of GDP)

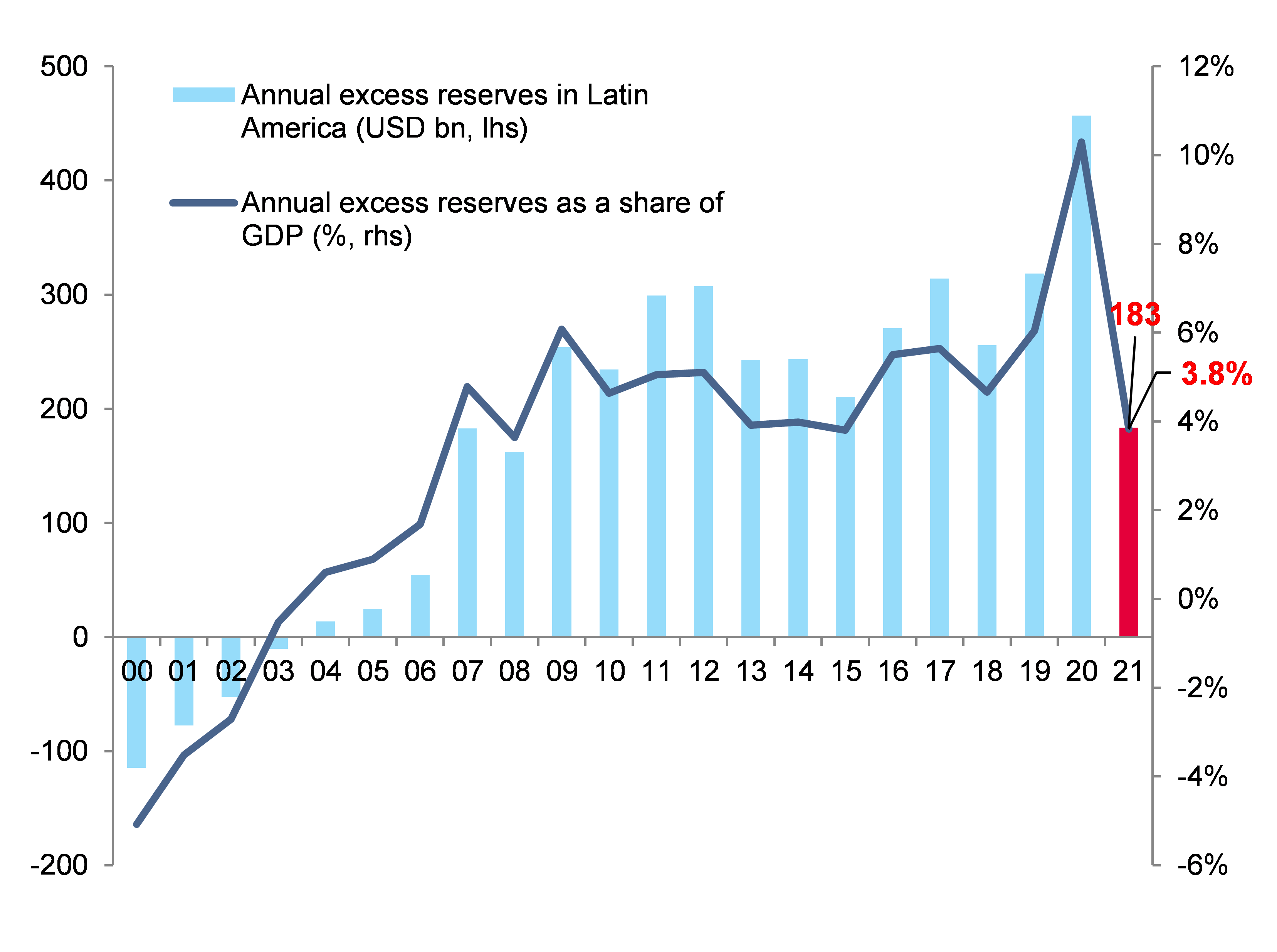

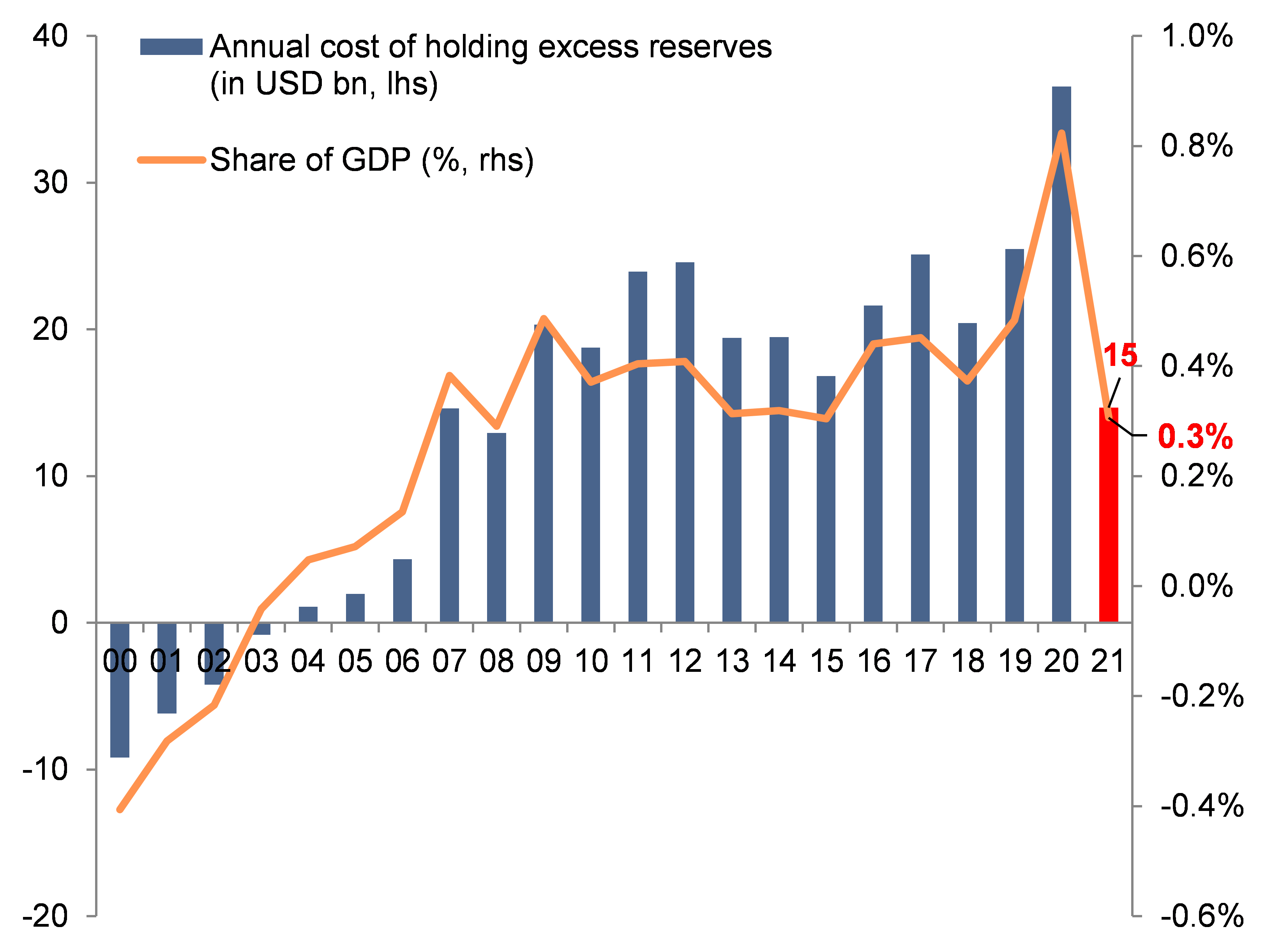

While most Latin American countries are now less at risk of a financial crisis, we simulate the impact of a sudden stop on “excess” reserves. In a worst-case scenario, a huge shock on financing needs would still leave excess reserves of USD183bn or 3.8% of GDP this year (vs. USD423bn in our baseline scenario). In Figure 3, we replicate the largest increase of financing needs as a percentage of GDP ever recorded in the past 20 years for each country. The opportunity cost of holding reserves in low-yielding securities in a shock scenario would amount to 0.3% (see figure 4).

The bulk of the excess reserves lies in Brazil, Mexico and Peru (see figure 7), even in the worst-case scenario, while Colombia and Guatemala also have a sizable cushion. However, in case of a shock or sudden stop, FX reserves in Chile, Bolivia and Argentina would not cover all financing needs, while Uruguay would be borderline in that case.

Figure 3: Adverse/shock scenario: “Excess” FX reserves in Latin America (USDbn and % of GDP)

Figure 4: Shock scenario - Annual cost of “excess” FX reserves in Latin America (USDbn and % of GDP)

Figure 5: Adverse/shock scenario: “Excess” FX reserves in Latin America, by country (sample of 11 countries out of 35, USDbn)

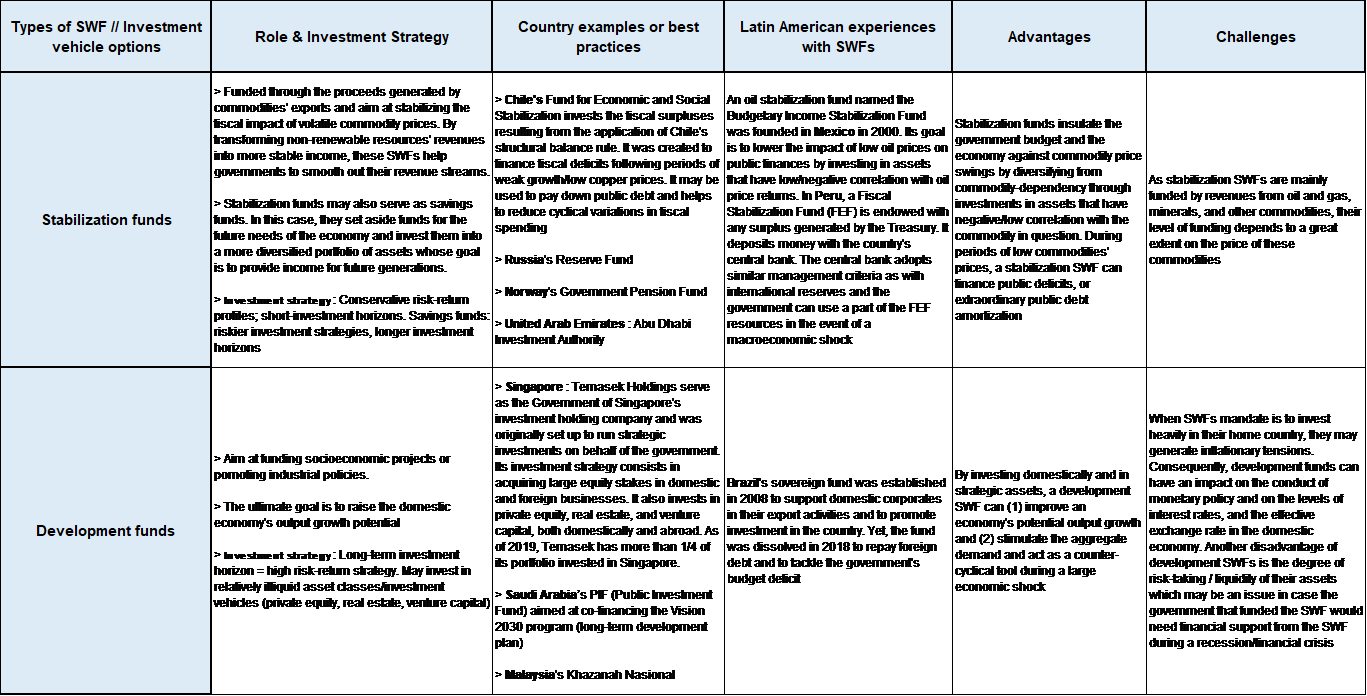

Redirecting excess reserves to long-term productive investments would help Latin America bridge its infrastructure gap, boost productivity and thus enhance the business environment, creating more opportunities for companies. Mexico, Brazil and Peru in particular have potential for development funds. With fewer vulnerabilities than ever, better-established macroeconomic frameworks and a pressing need to restart the economy and rebuild social and hard infrastructure after Covid-19, it now could be the right time for Latin American countries to redirect some of their excess reserves to risker projects. Using Sovereign Wealth Funds for “stabilization” (meant to insulate the budget and protect against volatility in commodity prices) and “development” (to help fund projects or industrial policies that increase economic output) would make sense (see Figure 6). This would entail a more aggressive investment strategy in the long-term (higher yielding portfolio) and a mobilization of resources to fund infrastructure investment or other structural policies.

Figure 6: Stabilization and development funds, examples and strategies

While larger Latin American countries seem to have adopted the savings fund (Panama) or the stabilization fund model to some extent (Mexico, Peru, Chile), the Peterson Institute of International Economics only ranked Chile’s fund in the top 10 global funds in 2019. The PIIE examines the performance of funds on average over 33 indicator elements across four categories: structure, governance, transparency and accountability and behavior. Mexico’s oil stabilization fund ranks 35th out of 64 funds analyzed, while Peru’s stabilization fund ranks 52nd out of 64.

In addition, so called “development funds” remain scarce. Brazilian’s sovereign wealth fund was dissolved in 2018 to help rebalance fiscal deficits. Today, the Brazilian central bank invests most of its reserves in more liquid and risk-free assets such as US Treasury bonds, with a large opportunity cost. As for Mexico’s Fondo de petroleo, it was ranked 51st out of 64 by the PIIE (due to shortcomings on the disclosure of governance, investment policies, risk management and mandates) and its investments only focus on hydrocarbons.

Sovereign wealth funds exclude foreign exchange reserves held my monetary authorities only for traditional Balance of Payments or monetary policy purposes. Hence, theoretically, countries with reserves exceeding Balance of Payments needs can transfer them to SWFs for long-term investment purposes. In the case of many Latin American countries, FX reserves accumulation is based on foreign exchange market interventions by central banks within the context of current account surpluses and/or capital inflows but also in the case of accumulation of profits of state-owned companies in the 2000s. In the case of reserves that originate from current account surpluses or capital inflows, they become part of the central bank’s stock of foreign exchange reserves, and they do not constitute “free fiscal assets” at the disposal of a government as they have counterpart liabilities. As a result, if the government wishes to “spend” such reserves, it must borrow to cover its new liabilities. Thus, if a government wants to set-up a sovereign wealth fund, and use its CB excess foreign exchange reserves as equity, it has to operate in a specific way. For instance, the China Investment Corporation (CIC) had to issue yuan-denominated bonds to buy up reserves from the PBOC for overseas investment purposes. This means that Latin American countries will have to rely on market financing to issue. Similarly, in an objective to use its foreign exchange reserves for domestic infrastructure investment, the Reserve Bank of India and the Ministry of Finance worked on a proposal which aimed at establishing two wholly owned subsidiaries of the India Infrastructure Finance Corporation (IIFC). The two new subsidiaries would have borrowed funds from the RBI and lent to Indian companies implementing infrastructure projects domestically.

But setting up a fund is not enough, as the PIIE ranking shows: a commitment to transparency, disclosure of risk management, investment policies and governance is essential to the success of a fund, its investments and perception by the markets. Latin American countries would have to embark on this project gradually and in full transparency to avoid spooking markets and maintain confidence in their improved fundamentals.