Executive summary

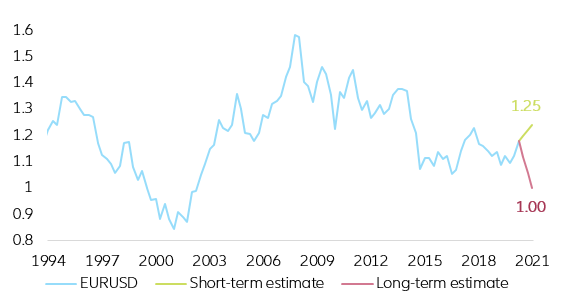

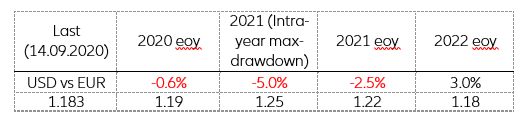

After its peak on 20 March 2020, the USD has depreciated 10% against the EUR (1.174 as of 21 September 2020), going back to levels last seen in mid-2018. This rapid depreciation has raised many questions about the future of the dollar. Though forecasting exchange rates is a form of Holy Grail for forecasters, we decided stick our neck out and present our methodology that separates short- and long-term factors affecting the price determination of the EUR/USD exchange rate, and our results:

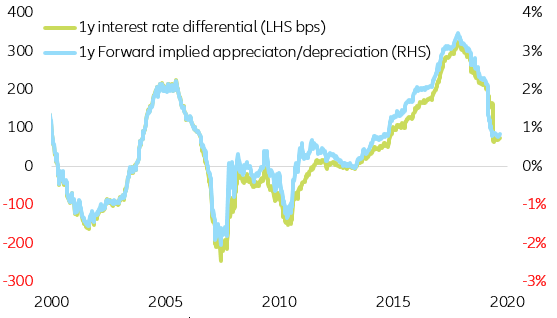

- Due to the recent anchoring of both USD and EUR short-end of the curves, by their respective central banks, Forward EUR/USD rates contain no relevant information about the future path of the EUR/USD exchange rate.

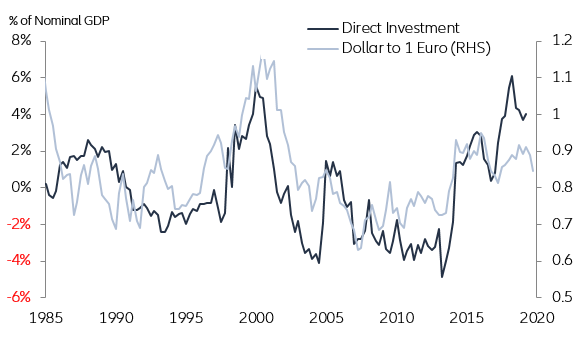

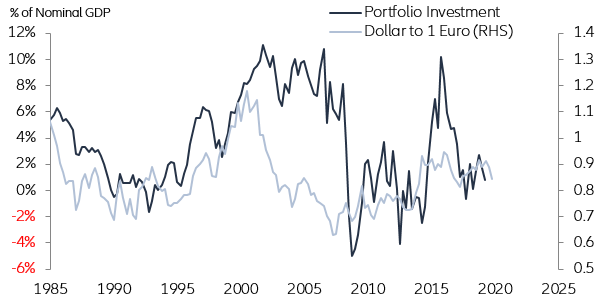

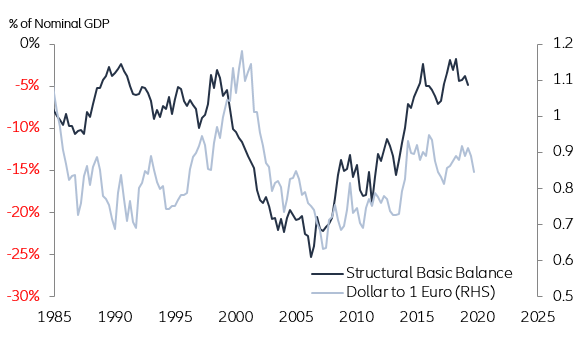

- Our modeling approach based on the U.S. balance of payments hints at a mild appreciation of the USD vs. the EUR in the mid- to long-term (converging towards parity in the long-run). Nevertheless, this methodology does not reveal much information about short-term developments.

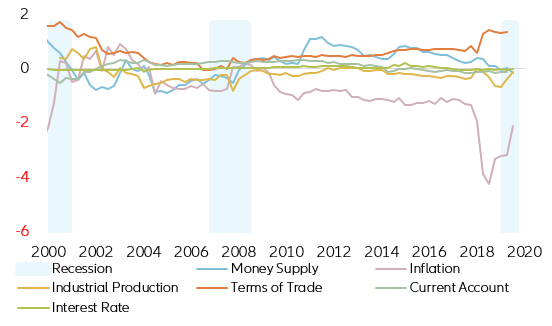

- Our monetary model suggests that if current economic and financial dynamics do not suddenly change, the dollar is set to depreciate versus the EUR by up to 5% (~1.25) within the next 12 months. Yet, it also suggests that if the U.S. would start reverting to pre-Covid-19 dynamics, the EUR/USD would start a slow but steady climb towards parity.

- Overall, by combining both balance of payments and monetary approaches, and under the assumptions that the Covid-19 economic shock is set to fade away in 2021-2022 and that U.S. funding dynamics are set to slowly converge to pre-Covid-19 trends, we conclude that the USD can depreciate by as much as 5% (~1.25) in the next 12 months. Thereafter, it could resume its upward trajectory, slowly converging at a 2 to 3% annual rate towards parity.

Market forwards

When trying to forecast currencies, a traditional and widely used approach is to look at FX forward markets. Theoretically this approach makes a lot of sense, as it shows at what price you can hedge your future EUR/USD exposure over different time horizons. However, does the forward price contain relevant information about the future path of the EUR/USD? Does the overused sentence “The forward market is pricing ….” bring anything to the table?

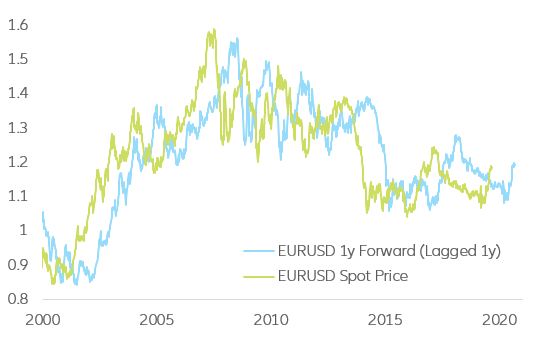

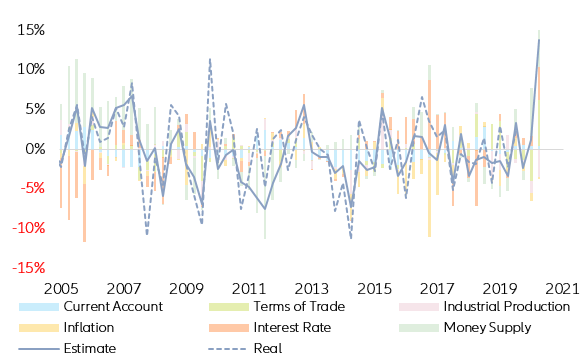

Historically the forecasting power of the EUR/USD forward market, especially in short-term horizons, is very limited (Figure 1). One just has to compare the forward implied spot rate with the realized spot rate to see that the estimate is inaccurate not only in terms of level but also, most of the time, in terms of direction.

Figure 1. EUR/USD 1y Forward