EXECUTIVE SUMMARY

- Giving up gas imports from Russia, which account for 36% of total EU gas supply, will not be easy for Europe. We estimate the amount of energy at risk across the EU at almost 10% of final consumption. In Hungary, Slovakia, Czechia, Latvia and Germany, more than 20% of final energy consumption depends on gas from Russia. In the short run, according to our calculations, Europe has about one month of supply in reserves, which should take it until end-March, thanks to the relatively mild winter. But the EU will need to replenish stocks ahead of next winter. Switching suppliers - which could help bridge another one-two weeks - calls for markedly boosting imports from other countries, increasing the supply of other energetic substitutes and/or reducing demand for gas (natural gas as well as electricity and heat produced from natural gas).

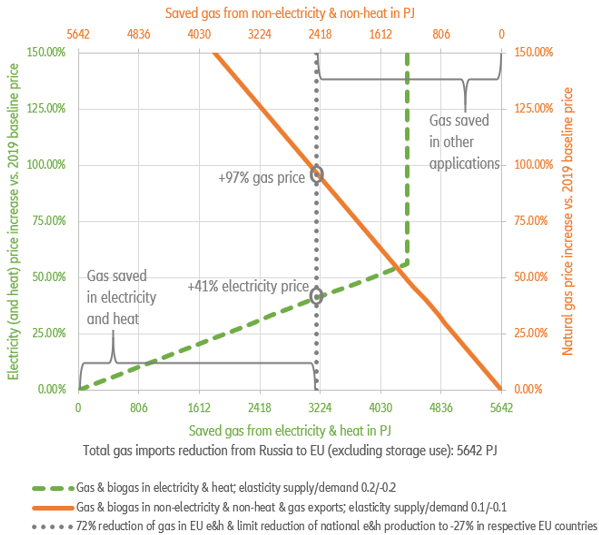

- Drawing parallels to the 27% loss of electricity from nuclear power in Japan after Fukushima, and analyzing the reaction of supply and demand to price increases, we find that the expectation of a lasting +40% electricity price increase and a +100% gas price increase would reduce demand by between 8-10% and increase supply of energy from natural gas and its substitutes by 8-10% in the short-term to compensate for the total loss of Russian gas imports. The EU retail price increase of +30% for electricity and +50% for gas in the 12 months up until January 2022 is already a move in this direction.

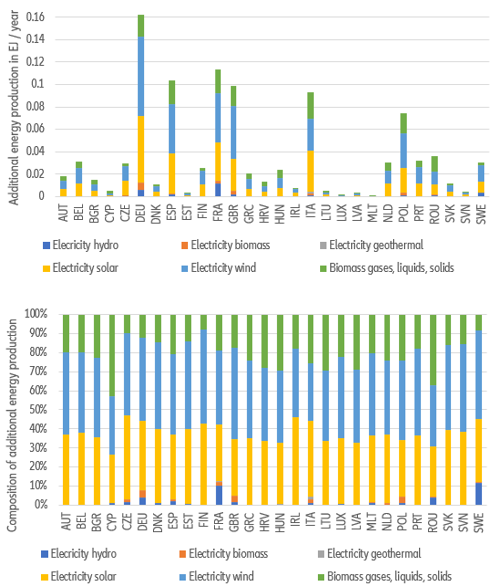

- Now more than ever, Europe needs an ambitious and coordinated action plan to ensure energy security for the next winter. Regaining energy sovereignty calls for a commitment to expand renewable energy production in the EU by 1 exajoule (278 TWh) per year or by the amount of Russian gas imports within six years. This would require annual investments of EUR170bn or 1.3% of EU GDP. Our proposal includes the addition of 44 TWh per year for the largest contributor, Germany, which is in line with the mid-term goals of the announced revision of the German renewable energy law.

It will not be easy for Europe to do without gas imports from Russia, which account for close to 36% of total EU gas supply. Hungary, Slovakia and Czechia have the highest shares of energy consumption at risk. In 2019 , domestically produced and imported natural gas, biogas and LNG in the EU added up to a total of 17800 PJ energy from methane. Out of that, Russian imports constituted 36%. Subtracting from the imports the amount used to bolster stock levels (i.e. 700 PJ) leaves us with around 5600 PJ of Russian gas that will need to be replaced should Europe decide to put a ban on gas imports or Russian authorities decide to retaliate against sanctions by shutting down gas exports to Europe . Factoring in the EU's 2019 gas exports of 2500 PJ, a total of 14600 PJ (17800 PJ -700 PJ - 2500 PJ) of gross available energy from methane (including biogas) was used for inland consumption. It is assumed the EU will want to continue to meet similar levels of gas exports.

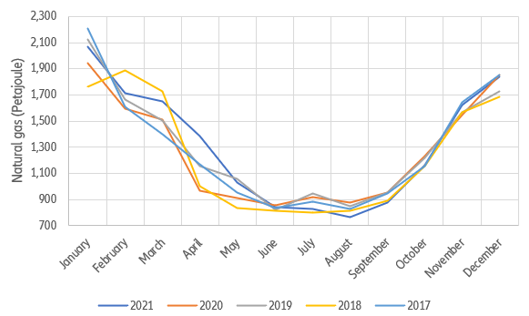

Figure 1 - Total EU gross available energy from methane (in PJ)