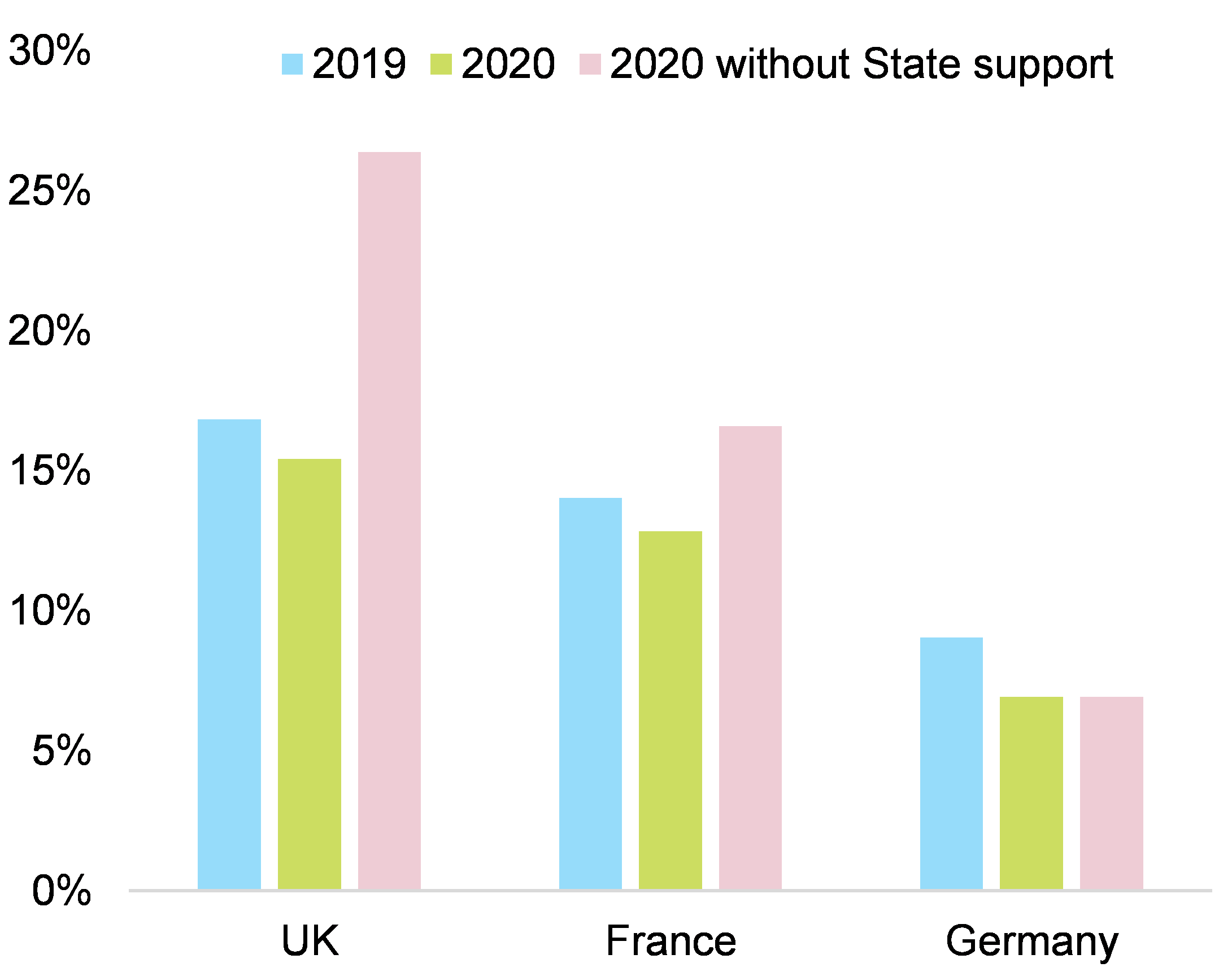

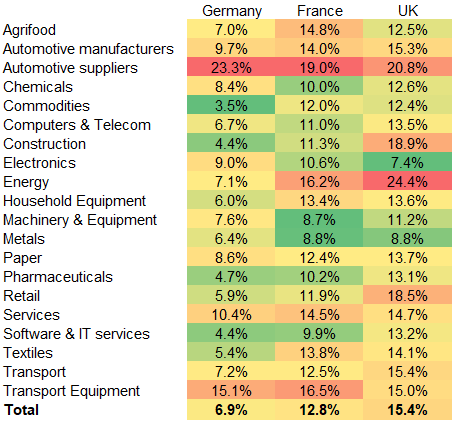

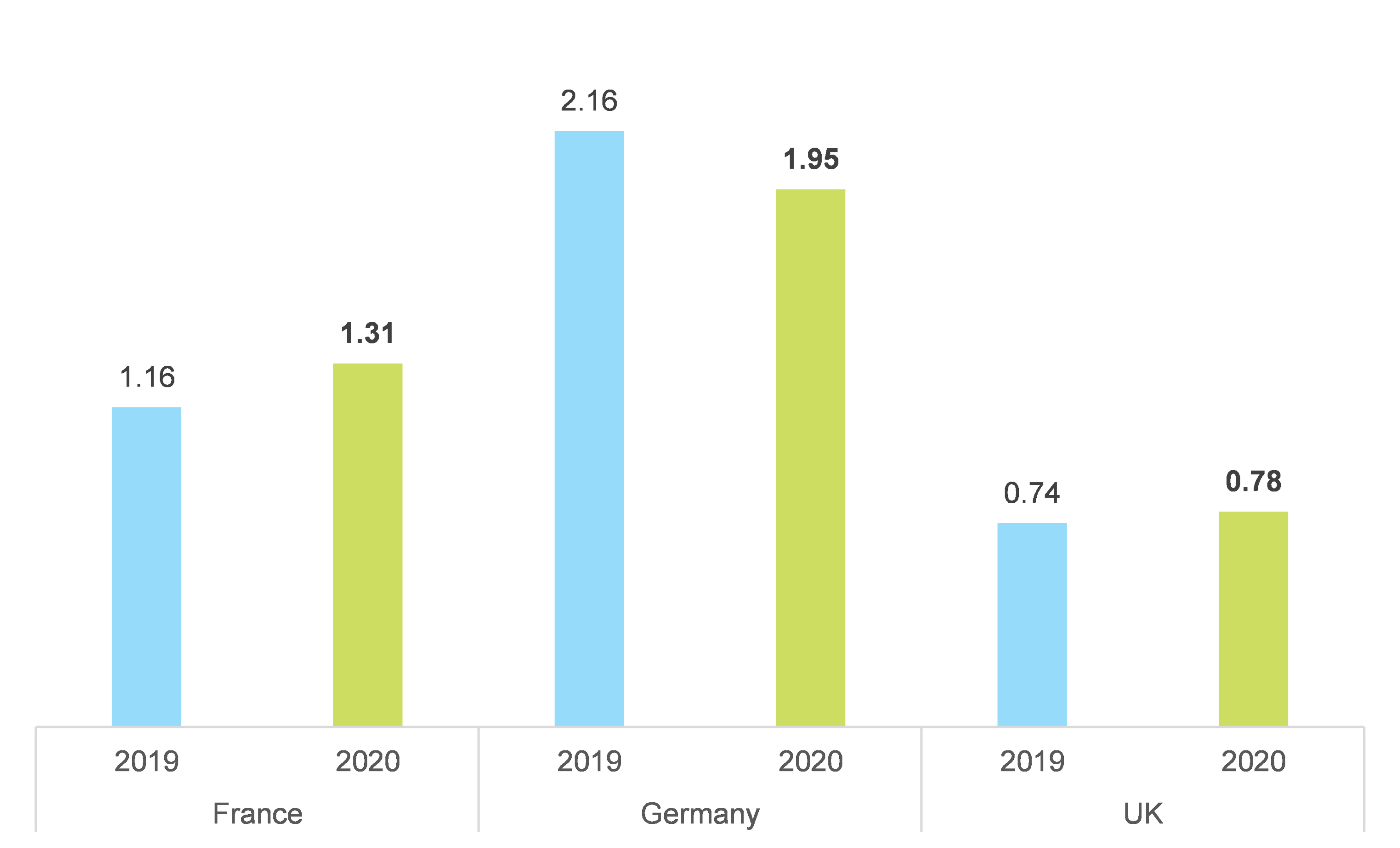

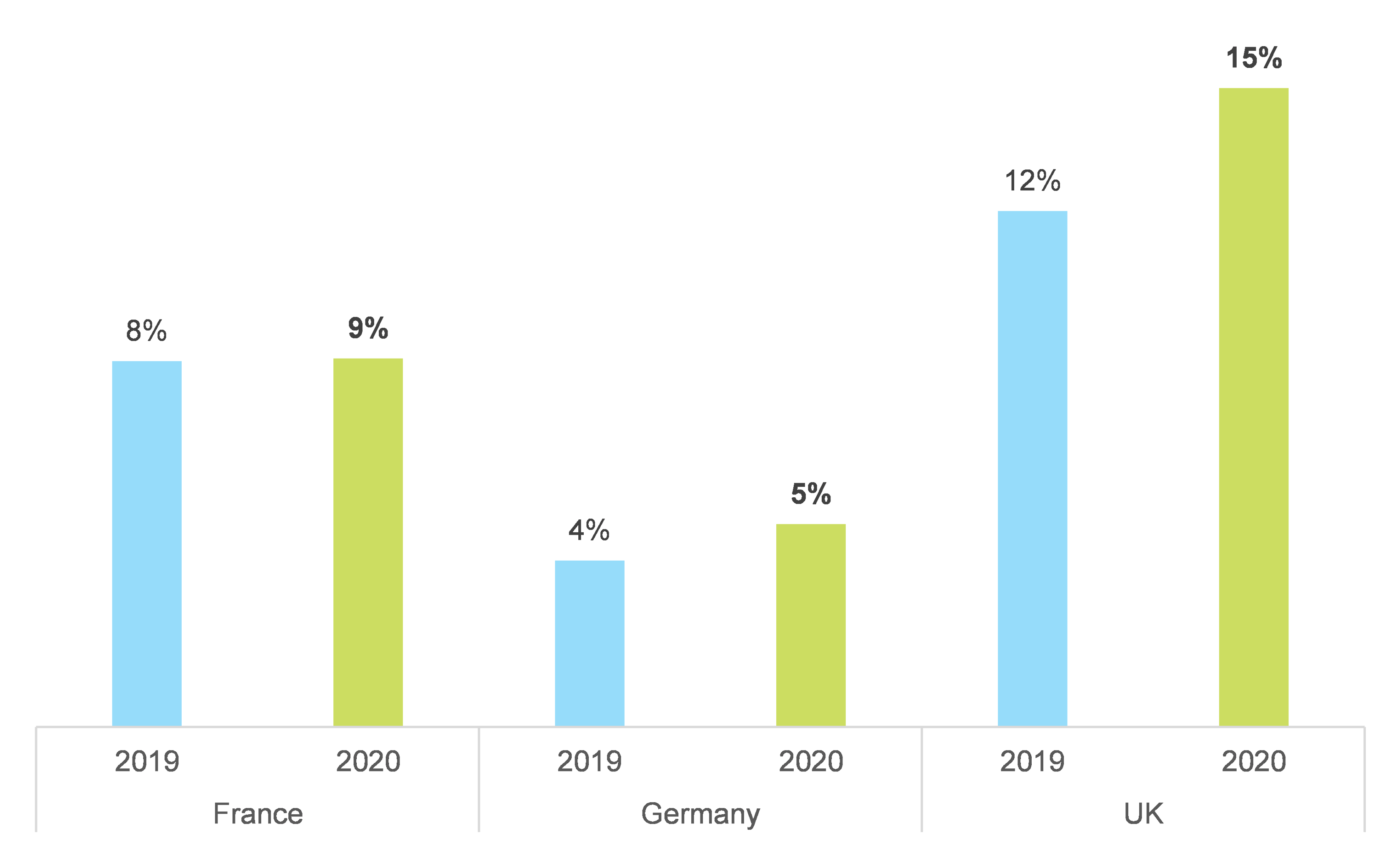

In 2020, state support softened the blow of the Covid-19 shock, reducing the number of fragile SMEs by more than 8,000 in Germany, France and the UK. Yet, we find that 7%, 13% and 15% of SMEs in the three countries are still at risk of insolvency in the next four years. Our past research has identified three leading indicators that can help detect corporate distress four years before a bankruptcy: profitability, capitalization and interest coverage. Applying these criteria to close to 525,000 SMEs, we find that 7% of total SMEs are at risk in Germany, 13% in France and 15% in the UK. This compares with 9%, 14% and 17%, respectively, in 2019, which means that state support not only cushioned the blow of Covid-19 but overcompensated for it, with direct subsidies (including partial unemployment schemes) and tax deferrals fully covering non-financial corporates’ losses in value added from 2020.

Without state support, the share of fragile SMEs would have been much higher in France and the UK, at 17% and 26% respectively (see Figure 1), as margins would have lost more than -5pp. Interestingly, in Germany, the share would have remained relatively stable despite a shock of close to -3pp for margins from peak to trough. This is because fragile SMEs in Germany have worse financial indicators (profitability, capitalization and interest coverage) compared to those in France and the UK. Hence, in the absence of state support, these fragile SMEs would have been more likely to transform into zombies and thus become insolvent faster.

Figure 1 – Share of fragile SMEs in 2020