Executive Summary

- Even though Germany narrowly avoided a technical recession in 2019, economic activity is still considerably weak as we expect GDP to grow by only +0.6% in 2020. In this environment, credit risk will most likely increase and be at top of mind for companies, lenders and investors.

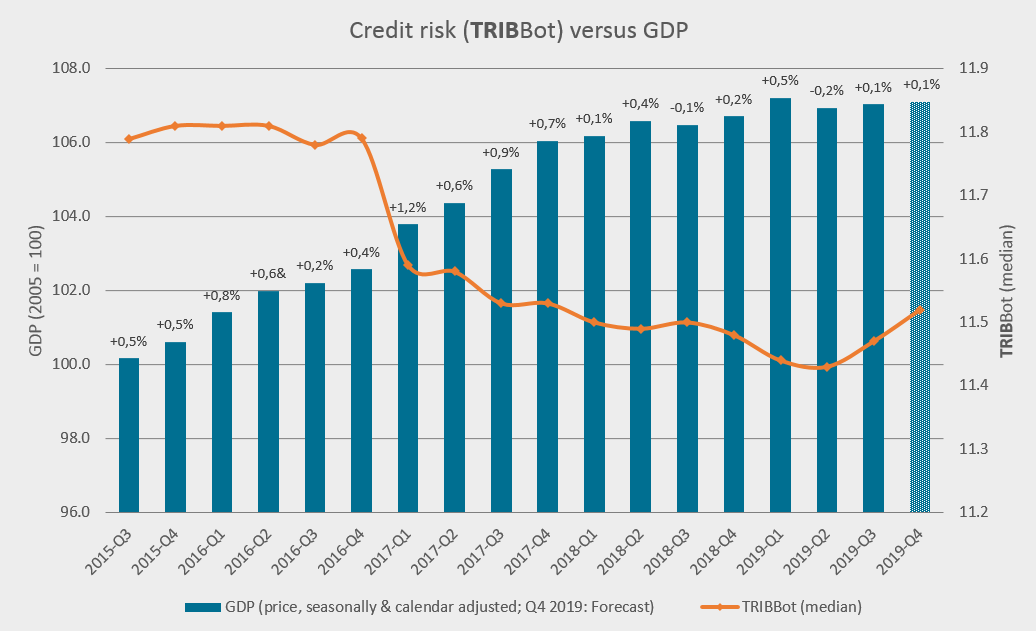

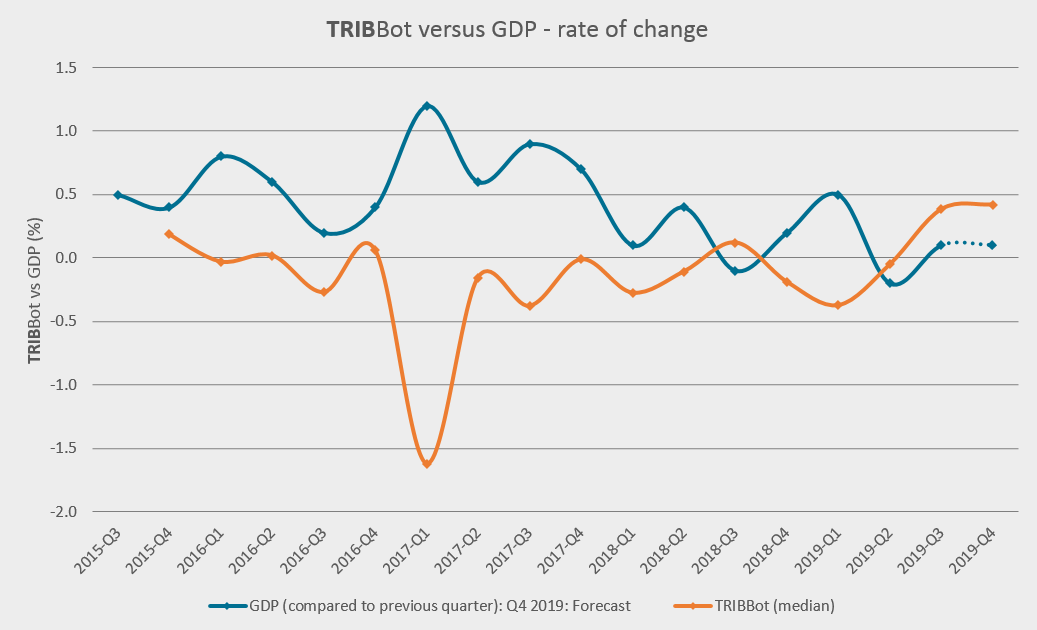

- Our standardized credit risk assessment (TRIBBot) for roughly 22,000 German SMEs and MidCaps shows that median credit risk significantly decreased with the economic expansion in recent years but started to show the first signs of a trend reversal in recent quarters. In Q3 2018, the credit risk, i.e. the risk that a company may not be able to repay the loans granted or not completely, increased slightly for the first time since 2015, while at the same time, GDP showed the first decline in years (-0.1% q/q).

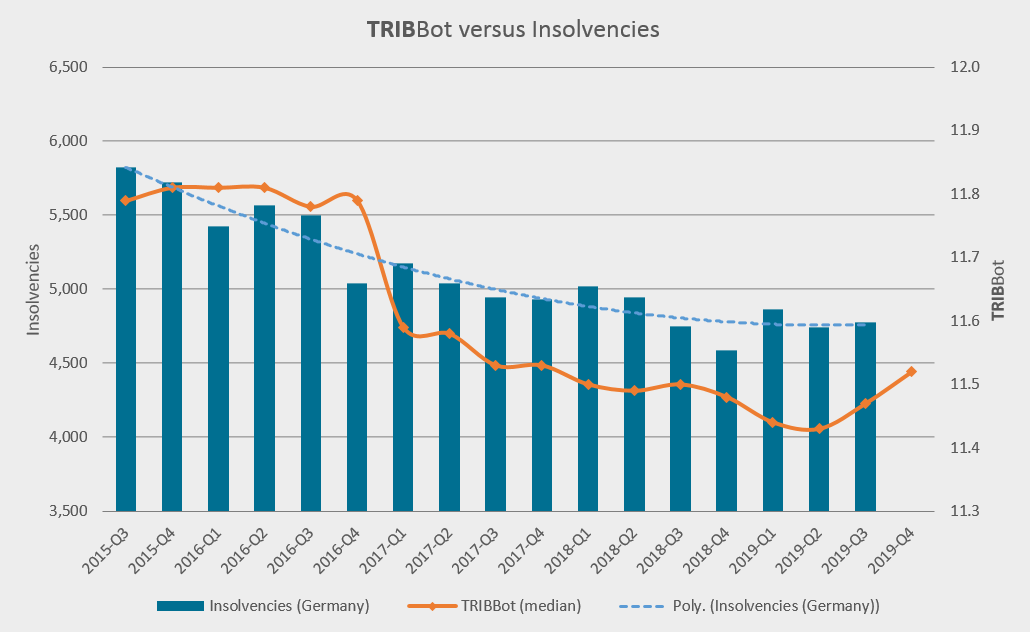

- Germany’s economic output contracted again in Q2 2019 by -0.2% q/q, confirming the ongoing slowdown throughout 2019. Although SMEs are generally sensitive to economic downturns and are getting increasingly exposed, as a result of ongoing structural changes in various sectors, the subsequent amplitude of the increase in credit risk in Q3 and Q4 2019 signals not only a reaction to the weak economic environment but a general trend reversal. We expect the credit risk of SMEs to continue to rise in 2020. Overall, we expect business insolvencies to rise by +3% in 2020 after being stable in 2019.

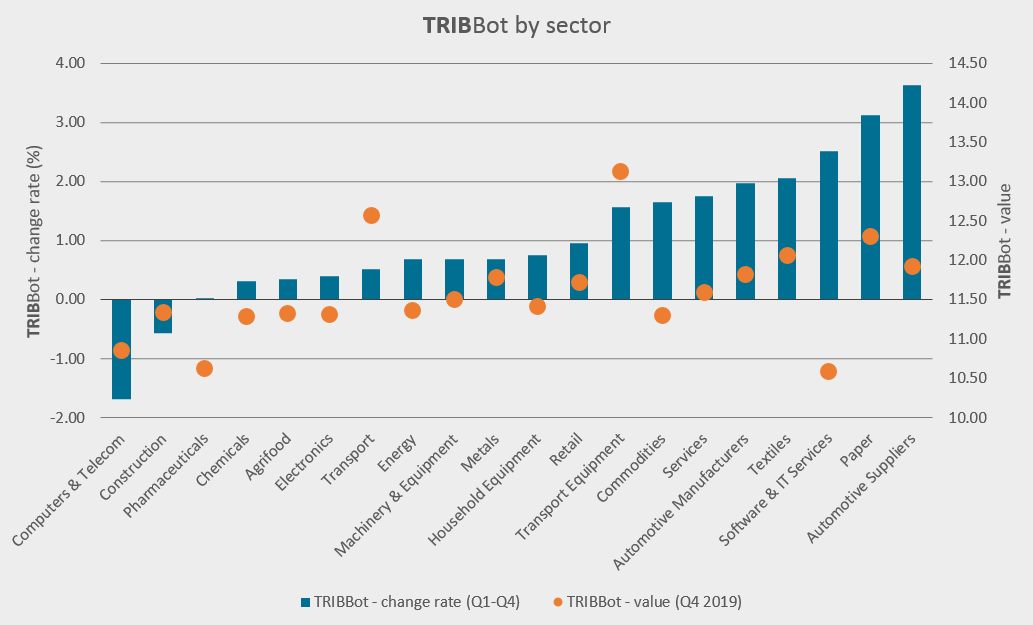

- Looking at sectors, the increase in credit risks was primarily limited to sectors that already had an above-average credit risk in the first place. Automotive suppliers have seen the biggest increase by far. The companies in this sector are exposed not only to growing political and economic risks but also to major structural changes, which has driven up their overall credit risk disproportionately. On the contrary, credit risk declined in Q1-Q4 2019 in the computers & telecom and construction sectors despite the generally negative cyclical trends. These sectors have been profiting the most from the still very robust consumer spending and strong construction activity in Germany.

Germany will remain the Eurozone laggard in terms of economic growth

Even though the German economy narrowly avoided slipping into a recession in 2019, this is hardly any reason to celebrate. In view of the cautious outlook for global trade and the automotive industry, and lingering elevated political uncertainty surrounding trade and Brexit, mini GDP growth rates can be expected at best in the coming quarters. Leading indicators point only to a tentative stabilization in industry so that the risk of another negative quarterly GDP growth reading or a technical recession remains elevated in 2020. Only the more pronounced acceleration in global trade in 2021 will put the German economy on a more robust footing. Domestic demand will continue to be the backbone of the German economy. Private consumption and investment in construction will remain the key drivers of economic growth in 2020 and 2021, but gradually loose some steam in line with the slowing labor market. Fixed investment will largely stagnate in 2020 and stage a gradual recovery only in 2021 as export growth is picking up more markedly again.

Fiscal policy will remain very supportive, but a larger stimulus package is only likely if the German economy experiences a more pronounced setback. After the German GDP growth of +0,6% in 2019 we also expect GDP growth of only +0.6% in 2020, about half the rate for the Eurozone as a whole, after which it should rise to +1.1% in 2021.

A weakening economy drives up credit risks of SMEs

Changes in the macroeconomic environment tend to impact companies’ creditworthiness in very different ways. Ultimately, the impact depends on the origin and extent of the changes relative to a company’s sector, individual positioning and financial situation. Our SME rating methodology, which is also the basis for the standardized credit assessment approach used in this analysis, starts with the sector risk assessment, which is determined by the sector outlook (expectations about a given sector’s performance) and sector volatility (a sector’s sensitivity to changes in the business cycle).

On an individual basis, economic uncertainty usually affects a company’s order intake and order backlog first. As SMEs tend to have less diversified income streams and are usually positioned farther down the value chain, they are regularly more exposed to cyclical downturns, facing an immediate impact on their credit risk through declining revenues and profits, diminishing financial flexibility and generally more limited access to funding. In short, it is safe to assume that a weakening economy will affect SMEs’ credit risk sooner than later.

Increase in credit risk of SMEs since early 2019

The analysis and assessment of credit risks of SMEs and MidCaps in this study is based on an AI-based standardized credit risk assessment (TRIBBot), which estimates the credit quality of small and medium-sized companies on a weekly basis.

The TRIBBot, developed by Euler Hermes Rating, is based on the unique combination of a comprehensive set of proprietary (e.g. Euler Hermes) and open data and information on SMEs and MidCaps; the specific algorithm developed and owned by Euler Hermes Rating and the TRIBRating methodologies for assessing credit risks of European SMEs and MidCaps. TRIBBot shows a high discriminatory power and historical robustness and thus represents a new and unique tool for the analysis and assessment of credit risks.

TRIBBot follows the framework of the country-specific rating methodologies used by TRIBRating and is thus based on the rating factors and their weightings defined in these methodologies[2].

The three broad factors in assessing credit risks of SMEs are the sector risk, the business risk and the financial risk. The sector risk is determined by assessing the sector volatility and sector outlook. We put considerable importance on the assessment of sector volatility since each sector responds differently to fluctuations associated with economic, market or innovation cycles. The business risk is determined by assessing the SME’s competitive position and concentration risk, which we view as the main sub-factors for identifying SMEs' business risk. The financial risk is an important factor for the assessment of SME credit risks. Sub-factors of the financial profile include size, profitability, leverage, capitalization and interest coverage. Once the three broad rating factors and their sub-factors have been assessed, the factors are weighted in the scorecard as shown below.

In addition, the methodology includes four notching adjustments that address other rating factors, which are not fully scalable and so cannot be included in the rating grid. Notching adjustments are made for liquidity, debt structure, strategic and operational management as well as governance and financial policy. The notching adjustments can either lower the final rating, have no rating impact or – in very rare cases – improve the final rating.

Figure 1: Main TRIBBot factors and weightings (Germany)

.png)

-of-smes-in-germany.png)