• Give priority to the middle class and to social mobility

In the hopes of strengthening the U.S. middle-class, Biden plans to invest USD50bn in workforce training, including community college, business partnerships and apprenticeships. Such investments should widen access to postsecondary education, and help pull students/ trainees out of lower-income jobs. Additionally, an extra USD8bn will be dedicated to improving community college facilities and technology. In parallel, a USD70bn investment and a series of grants will go towards historically black colleges and universities, as well as other minority-serving institutions.

• Foster employability to offset an increasing minimum wage.

Biden’s promise to impose a USD15 hourly minimum wage would dramatically raise labor costs in the U.S. and considerably weigh on companies’ margins as a result. To compensate, the Biden administration will have to propose several programs to support American Small and Medium Enterprises (SMEs). Indeed, they already need tremendous support. As a result, a series of future programs could be dedicated to fostering American SMEs’ productivity, such as a USD150bn public-private investment package favoring minority entrepreneurs and the establishment of a USD60bn True Small Business Fund. Biden also plans on doubling down on the State Small Business Credit Initiative (USD30bn) and increasing funding towards Community Development Financial Institutions to USD60bn, among other initiatives. This very part of Biden’s economic platform should appeal to both sides in Congress. Plus, as some of the packages mentioned right above are included in Biden’s major plan to foster middle-class competitiveness, it might help get the Senate to approve the latter as a whole.

What this means for companies and competition: a soft paternalism towards lower profits. Part of the Biden administration’s policies could be characterized as economic paternalism, or an effort to oversee and persuade businesses to act in ways more beneficial to the public and less towards maximizing profits, very much the opposite of the Trump administration’s approach. For instance, Biden plans to implement a number of changes to the corporate tax code, including raising the corporate tax rate from 21% to 28%, imposing a 10% surtax on corporations which offshore jobs, incentivizing renewable energy efforts and imposing a minimum tax on corporations who would otherwise pay nothing. These changes to the corporate tax code would provide more than half of the total expected revenue increases, which along with changes to the individual tax code, would total approximately USD3.7trn. Of course the changes would reduce corporate profits. The pharmaceutical industry is explicitly targeted for price and profit reductions. We estimate the long-term relationship between profit margins of non-financial companies (non-financial companies’ profits expressed as % of GDP) and the effective tax rate, factoring in a rise of this effective tax rate from 12.5% today to close to 20%. In this configuration, the corporate margin rate could evolve close to 5-6% compared with an average of 7.4% since 2010.

On the spending side, Biden’s most significant plan is a rapid move towards green and renewable energy – although its implementation will likely be slower than his more progressive colleagues would like – with a goal of net zero emissions by 2050, resulting in USD400bn in spending in the first term on key clean energy inputs like batteries and electric vehicles. Over a ten-year period, spending on green energy including R&D and sustainable infrastructure is slated for almost USD2trn, with public-private partnerships and state governments potentially bringing the total up to USD5trn. Spending on services such as healthcare, housing and social programs are expected to cost another USD4trn. Other strategic sectors include infrastructure spending on transportation, schools, and 5G.

Similarly, the new administration will also emphasize a rebalancing of forces in corporate and global competition. Biden has promised to support stricter privacy safeguards and antitrust oversight on social media platforms such as Facebook, Twitter and Google, but has not indicated that a breakup of the oligopoly is in the making. Regarding financial services, Biden was a senator from Delaware, where many credit card and bank companies are registered, and given his former advocacy for them, it’s unlikely that anti-trust actions would be aimed at them. Yet the Democratic party is likely to sway him towards more oversight and regulation. In contrast, other key sectors will be specifically incentivized, including medical supplies and essential materials such as steel and cement to revitalize manufacturing in conjunction with the USD400bn portion of the “Made in all America” initiative. R&D efforts that also fall under that program include USD300bn on 5G, artificial intelligence and biotechnology. Biden is also a staunch proponent of union jobs and supports traditional manufacturing such as automotive, where he hopes to create 1 million new jobs. Military spending is intended to be reduced and rebalanced, emphasizing new technologies such as AI, which will boost technology companies, and moving away from legacy systems, dampening spending on more well-established and traditional defense contractors.

An iron fist in a velvet glove in terms of trade and external policy.

We don’t expect Biden to undo what Trump initated in terms of protectionist policies. Since the beginning of Trump’s mandate, average U.S. tariffs have increased from 3.5% to 7%, with a peak above 8%. That peak was reversed at the beginning of 2020, thanks to an agreement in which China committed to increase its imports from the U.S. by USD200bn over two years. China is running behind on this commitment as only USD58.8bn out of USD140bn initially planned had been purchased as of 30 September. That means Biden will have some bargaining power to justify a slow back-pedaling in protectionist trade policy. It is all the more important to stick to this policy as 50 out 57 of technical commitments related to agricultural products have been fulfilled by China, while U.S. financial institutions gained a broader access to the market. Therefore, Phase I of the U.S.-China trade deal, while being late in terms of quantitative targets, has produced tangible results in terms of intellectual property rights and sanitary and phytosanitary standards as well as access to financial markets. Phase II of the agreement is unlikely to be reached rapidly because of this delay, and because it is overly ambitious with respect to industrial subsidies and state-owned enterprises. Biden will adopt a coordinated and less unilateral approach to China, in particular on technology and intellectual property. This multilateral approach, and the adherence to more ambitious climate standards are likely to revive non-tariff barriers via the implementation of new technical, phytosanitary or environment-friendly norms. We expect a status quo or slight progress with respect to tariff barriers. The most probable other aspects of Biden’s foreign policy, beside specific geo-strategic aspects, are the following:

• Reviving international organizations, with a focus on reforming the WHO and getting China to abide to international protocols;

• Asking for a “Summit for Democracy” in the first year of his presidency;

• Establishing a net separation between geopolitics and trade policy;

• Re-joining the Paris climate accord.

Climate change: watered down but still a green deal and above all a new industrial policy.

To combat climate change, Biden announced a gradual plan to reach a 100% clean energy economy by 2050.

• Paris agreement

Biden plans to recommit the U.S. to the Paris Agreement on climate change. He also said that he would integrate climate change initiatives into U.S. foreign policy, national security strategies and trade arrangements. To follow-up on this initiative, Biden wants to create further enforceable international agreements reducing global shipping and aviation emissions, as well as a global ban on fossil-fuel subsidies.

• Biden’s plan to address climate change

Moreover, as mentioned above, as part of its infrastructure plan centered on climate change, the Biden administration is expected to invest in energy and climate research as well as incentivize the rapid deployment of clean energy innovations. Of the USD2trn “Plan to Build a Modern, Sustainable Infrastructure and an Equitable Clean Energy Future”, USD300bn would be in favor of a “Plan for Research & Development and Breakthrough Technologies” along with the USD400bn “Buy American” purchase program to power domestic demand for national products, materials, and services. More specifically, the goal is to increase the use of electric vehicles, establish new appliance, build efficiency standards for consumers and set aggressive limits on methane pollution for oil and gas producers. As Biden already plans to dramatically hurt companies’ margins by raising taxes and the minimum wage, and taking into account that he will surely have to deal with a Republican Senate over the course of his presidency, his administration will have no choice but making sure this major plan primarily benefits the supply side. For some firms, it might actually erase the impact of the statutory tax increase, by offering major fiscal incentives – for example, on R&D, innovation, and efforts to transition to a more sustainable way of producing. Generally speaking, Biden’s Plan to Build a Modern, Sustainable Infrastructure and an Equitable Clean Energy Future will mark the unfolding of a new industrial policy for the nation, with potential for winning Republican votes in the Senate. All in all, Biden’s initiative should represent almost one third of the additional public spending he advocates.

• Environmental justice

Biden’s wishes to ensure environmental justice for all Americans by creating a specific office within the Justice Department. He will also direct funding and aid to disadvantaged communities (40% of the Plan for a Clean Energy Revolution and Environmental Justice). The intent of environmental justice is to lower climate change-related risks for the more vulnerable members of the population – the disabled, the elderly, and the children. Improving healthcare and reconstruction after natural disasters will also stand as priorities.

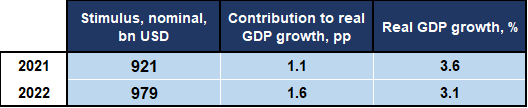

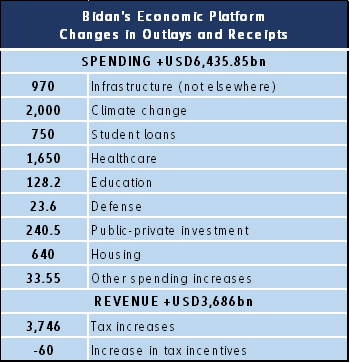

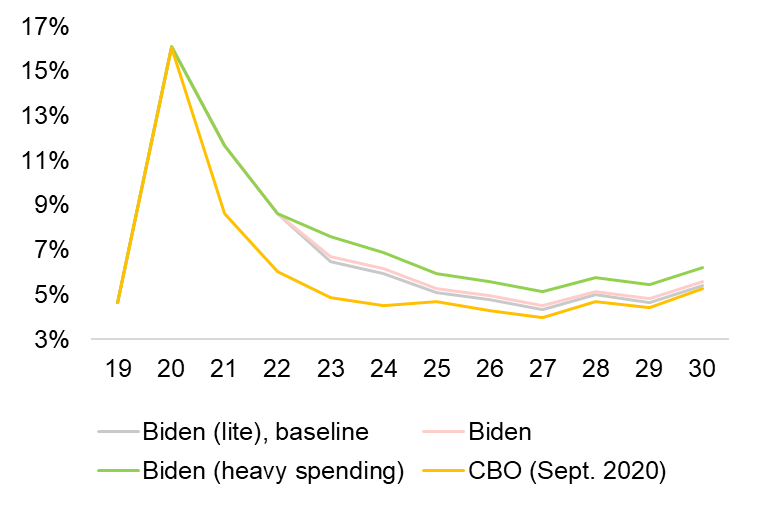

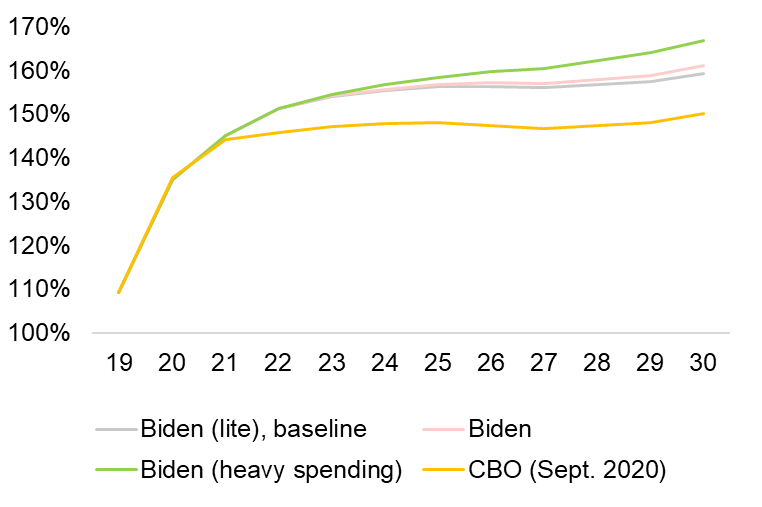

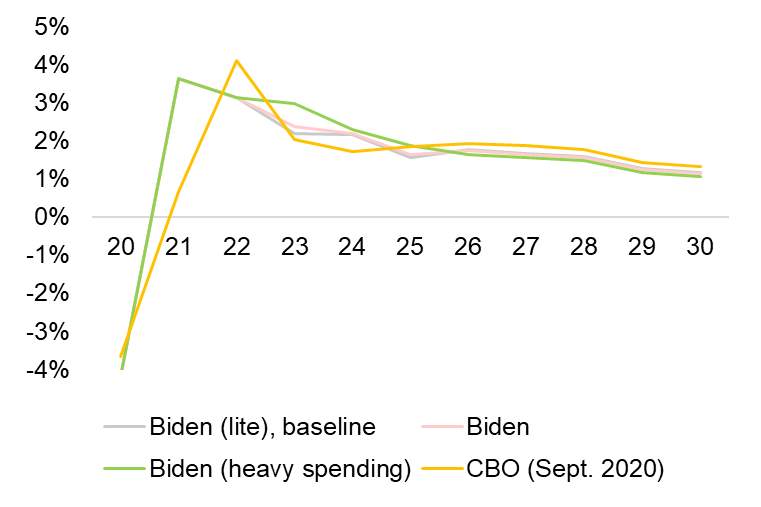

Short-term and long-term consequences for growth. All in all, the complete execution of Biden’s economic platform, which amounts to injecting an additional USD2.7trn net stimulus into the economy (+USD6.4trn in gross terms), could lead the U.S. public debt to reach 159-167% at the 2030 horizon, compared with 135% in 2020. Consequently, when estimating the U.S. economy’s long-term potential growth in function of four different variables – productivity and active population’s annual growth (yearly), imports and public debt in GDP percentage points – we expect a probable decline from +2% to +1.4% at the 2030 horizon. In the short-term, the two-year USD1.9trn fiscal stimulus should contribute +1.1 pp and +1.6 pp to real GDP growth in 2021 and 2022, respectively, bringing it to +3.6% y/y and +3.1% y/y, respectively.

Figure 7: U.S. public debt as a % of GDP at the 2030 horizon resulting from the execution of Biden’s economic platform