Oil prices below 45 USD/bbl increase recessionary risks for oil exporting countries

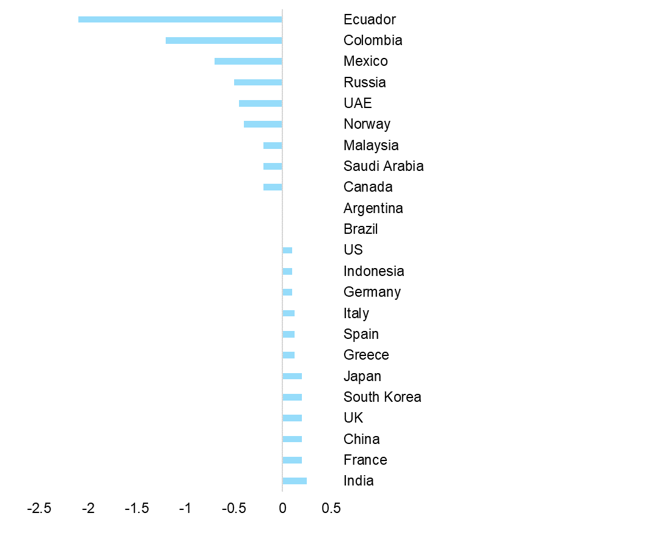

The negative growth impact is increasing with the time oil prices will remain below 45 USD/bbl In particular, oil-exporting economies are likely to suffer (see Figure 1) with Ecuador and Colombia expected to lose more than -1pp of real GDP growth for a fall in oil prices of 10 USD/bbl. Mexico, Russia and the UAE are expected to lose more than -0.5pp. The impact from lower oil prices for Saudi Arabia remains more contained, at -0.2pp for oil prices falling by 10 USD/bbl given that the positive impact on growth from higher export volumes and inventories will largely counterbalance negative effects from reduced incomes and some fiscal austerity. On the contrary, energy importers, notably the Eurozone, the US, India, China or Brazil, benefit from lower oil prices as it boosts households’ real purchasing power, though this effect can be partially offset by household preference for saving which is significant in some of these countries, notably in a context of high uncertainty.

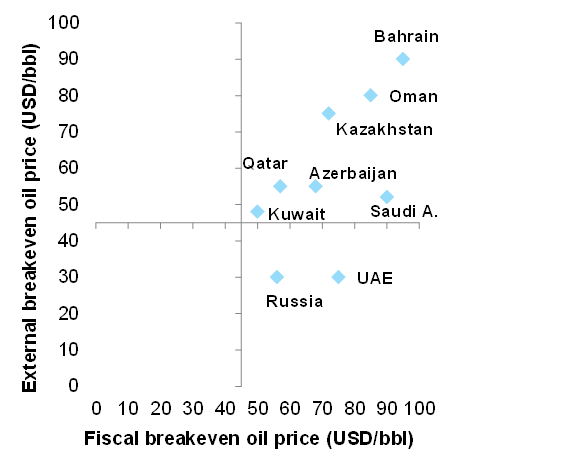

Lower oil prices will also result in deteriorating fiscal and current account balances for major oil exporters: only Russia and the UAE have an external breakeven oil price of around 30 USD/bbl

The nine major oil exporting countries in the GCC and CIS regions all have a fiscal breakeven oil price above 45 USD/bbl, and for most of them the external breakeven oil price is also above that level (see Figure 2). Only Russia and the UAE have an external breakeven oil price of around 30 USD/bbl. Hence, if oil prices remain below 45 USD/bbl for longer, especially Bahrain and Oman – which have already posted large twin deficits since the oil price slump in 2014 – as well as Kazakhstan would see their deficits rise to levels that may unnerve investors und cause downward pressure on the currencies. Bahrain and Oman are likely to get financial support from other GCC states in order to defend their currency pegs to the USD, if needed, as the richer neighbors would want to avoid contagion risks for their own currency pegs. Kazakhstan could again be forced by markets to a substantial devaluation, as occurred in 2015. In that event, contagion could spread to Azerbaijan – which also saw a massive devaluation in 2015 – although it is in a better initial position today. In the larger GCC countries and in Russia, the fiscal and external balances will remain manageable over the next 12 months thanks to sufficient assets in their respective SWFs. Russia, however, may experience a depreciation of the RUB by 10-15% in 2020, if the average oil price were below 45 USD/bbl.

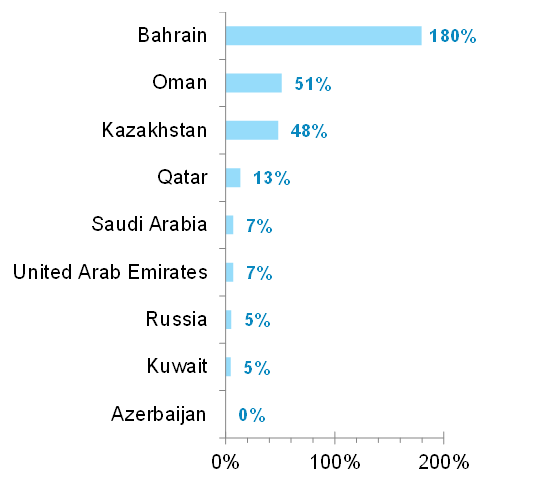

Sovereign or companies could quickly face problems repaying debt in Bahrain, Oman and Kazakhstan

Gross external financing requirement is defined as the sum of the current account balance and the external debt maturing within the next 12 months. In Bahrain this amounts to 180% of all FX assets held by its central bank and the SWF (see Figure 3), reflecting that the sovereign or companies could quickly face problems repaying debt in the event that external financing becomes more difficult. In Oman and Kazakhstan the corresponding ratios look more comfortable, at about 50%. However, it should be noted that Kazakhstan’s foreign assets comprise just USD10bn in official FX reserves and USD61bn held by its SWF. In the past, the country has been reluctant to use SWF assets in order to rescue its ailing banking sector. Hence, there is also a risk that rolling over external debt will become difficult especially for private-sector companies in Kazakhstan.

Figure 1 - Impact on GDP growth after 1 year from a permanent decrease in oil price of USD10bbl