Germany has been the first major European retail market to lift country-wide restrictions on “non-essential stores” on 20 April, putting an end to a five-week mandatory closure of a majority of non-food stores. While the move is most welcome for store owners left with zero turnover but bills to pay, we believe the industry is far from out of the woods. Taking into account segment size, seasonality and restrictions, we estimate that this five-week closure of non-essential stores could have cost German retailers as much as EUR26bn in turnover.

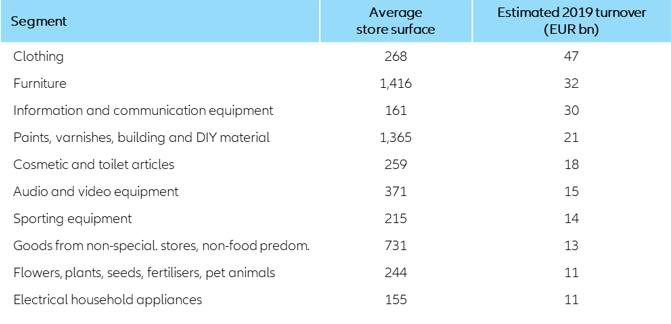

A two-speed exit from lockdown. A major feature of the progressive exit from lockdown is the exclusion of stores with a surface in excess of 800 square meters, a decision opposed by the country’s largest trade body (HDE). Because average store size varies widely between segments, this limitation is expected to introduce a two-speed reboot of the retail industry. Looking at structural data on German retail surface, we find that furniture retailers are the most likely to suffer from the limitation with an average store size of about 1,400 square meters. Department stores, with an average of 730 square meters, are borderline as well as electronics retailers (370sm), although to a lesser extent. Overall, we find that segments with an average store size below 800sm account for more than 80% of the turnover of non-essential stores.

Preserving liquidity is the number one priority. The return to normal will be very progressive with social distancing and stringent hygiene rules likely to last for months, and consumer confidence in the doldrums. Support measures to help companies bridge their financing needs will be of paramount importance, as well as careful cash flow monitoring:

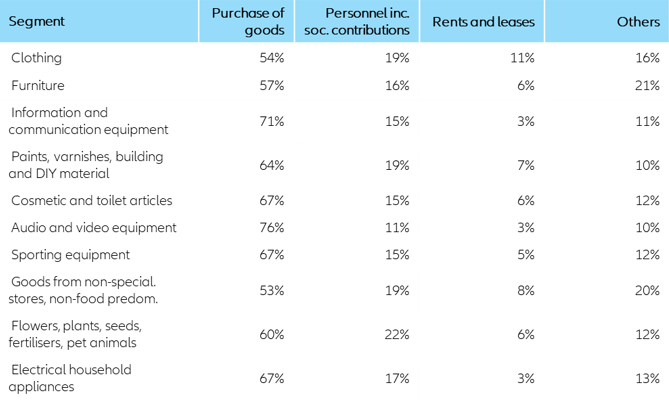

- Retailers will first clean up inventories and unlock capital tied up in stocks before placing new orders. Purchased goods account for about two thirds of expenditures of retailers, on average, with inventories ranging between 40-120 days of normal activity among large retailers and across segments. In some rare segments, inventories depreciate very quickly (fashion, flowers…) and retailers are more at risk to run short of cash.

- Because store footfall will only recover gradually, shop owners are also likely to use Kurzarbeit as long and as much as possible. Labour costs, including social contributions, account for about 15% of total expenditure on average.

- As for rents (5% of total expenditure on average), anecdotal evidence abound of tenants trying to negotiate terms or postpone rent payments, even among well-established household names. Evidence from the UK and the U.S. show that timely rent payments have collapsed in past weeks.

Figure 1 – Top 10 non-essential goods segments in Germany and average store surface