Executive summary

After several episodes of stress observed in the U.S. money market, the Fed decided to inject liquidity into the banking system and restart Treasury Security purchases. We identify three factors that explain the mismatch between supply and demand on the money market:

• Technical factors such as liquidity needs for tax collection purposes or regulatory aspects, though they do not represent an entirely convincing explanation for us.

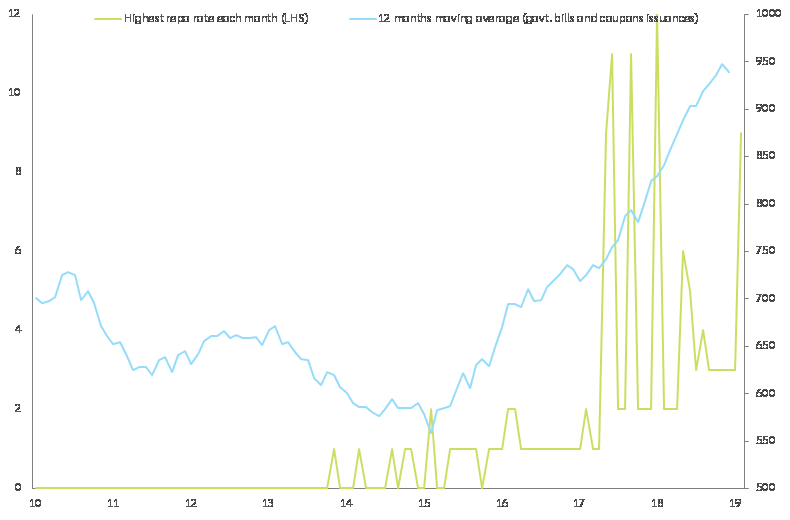

• A larger volume of debt issuance by the U.S. Treasury, despite normally being well coordinated and telegraphed to banks.

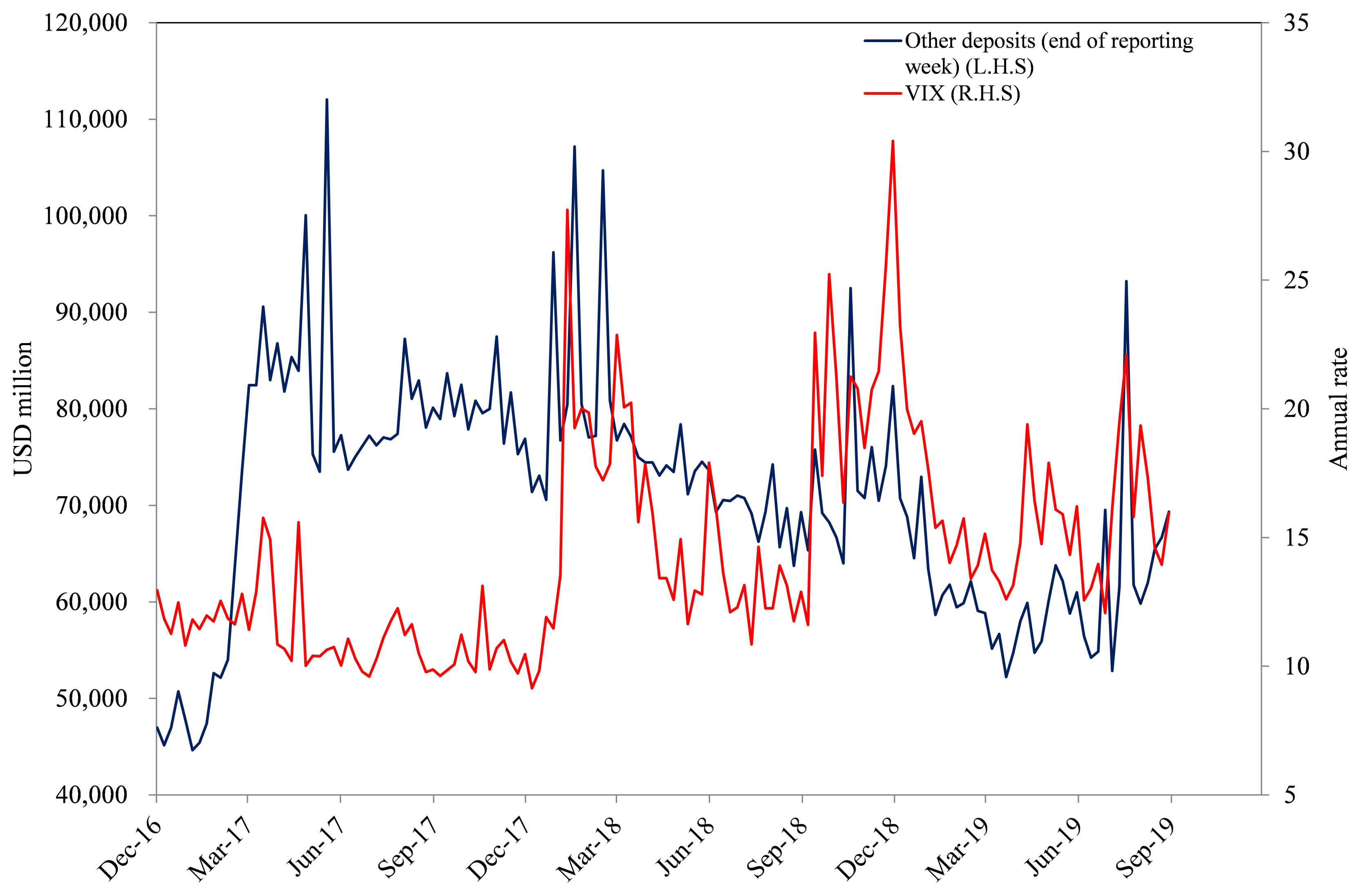

• Margin calls, i.e. liquidity flows related to the functioning of the derivative markets.

In our view, the situation needs to be closely monitored for the following reasons:

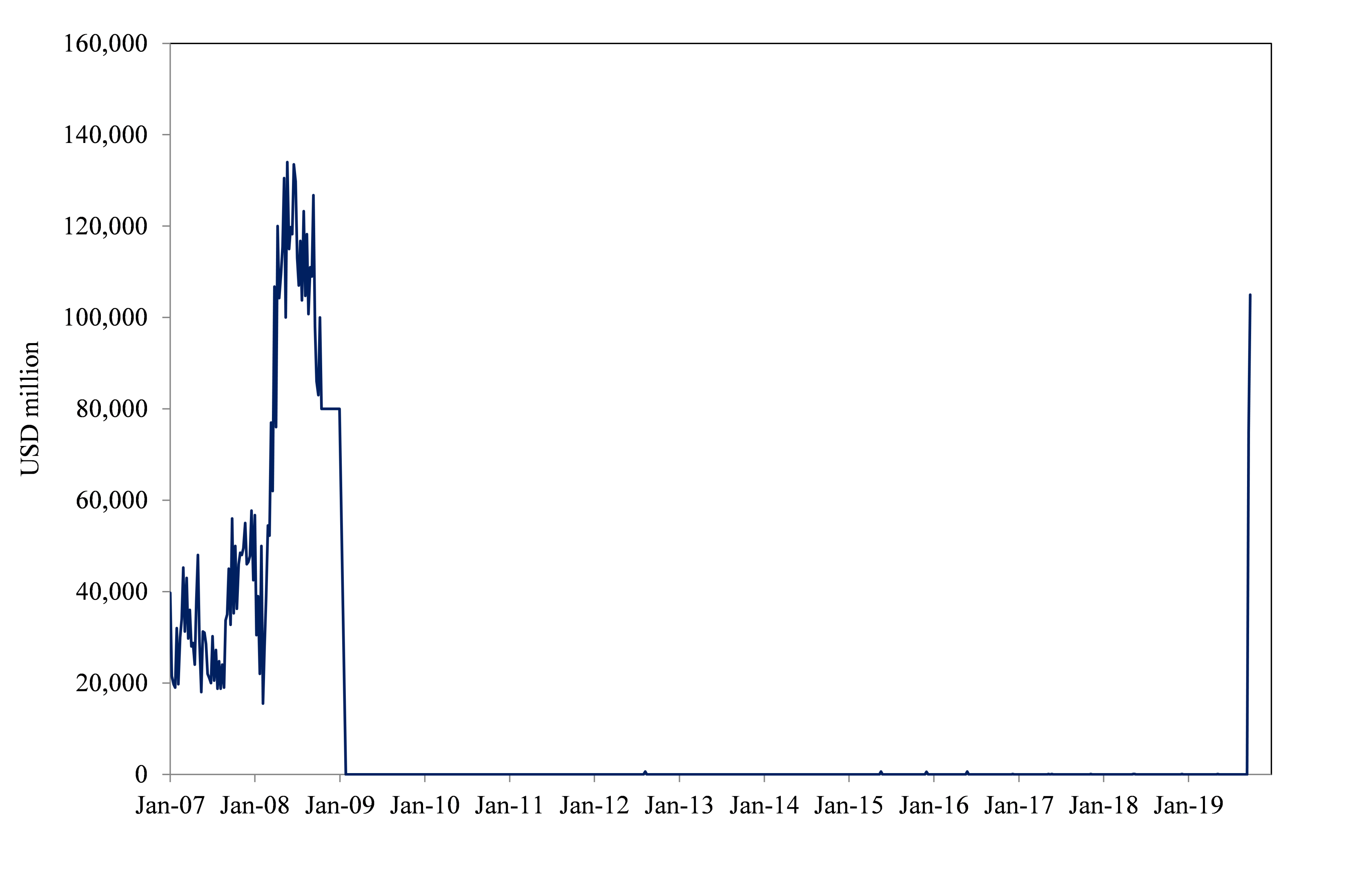

• Wholesale funding, which in the past nurtured risky activities and contributed to the subprime crisis, has not totally disappeared.

• New episodes of stress on the U.S. money market could have repercussion effects on the credit market, which is close to a bubble situation.

• Smaller banking institutions could suffer from more difficult access to liquidity funding, meaning that Small and Medium Enterprises (SMEs) (mainly financed by smaller banks) could in turn be exposed to tighter credit conditions and therefore higher risk.

• Any accident in the U.S. money market would potentially create a shortage of liquidity at a global level, with severe consequences for emerging economies.

• With tightened access to cash, highly leveraged investors could face difficulties in financing, for example, their margin calls, and therefore be incited to initiate fire sales with a strong and negative impact on the markets.

1. Tensions on the U.S. money market have triggered a prompt reaction of the Fed

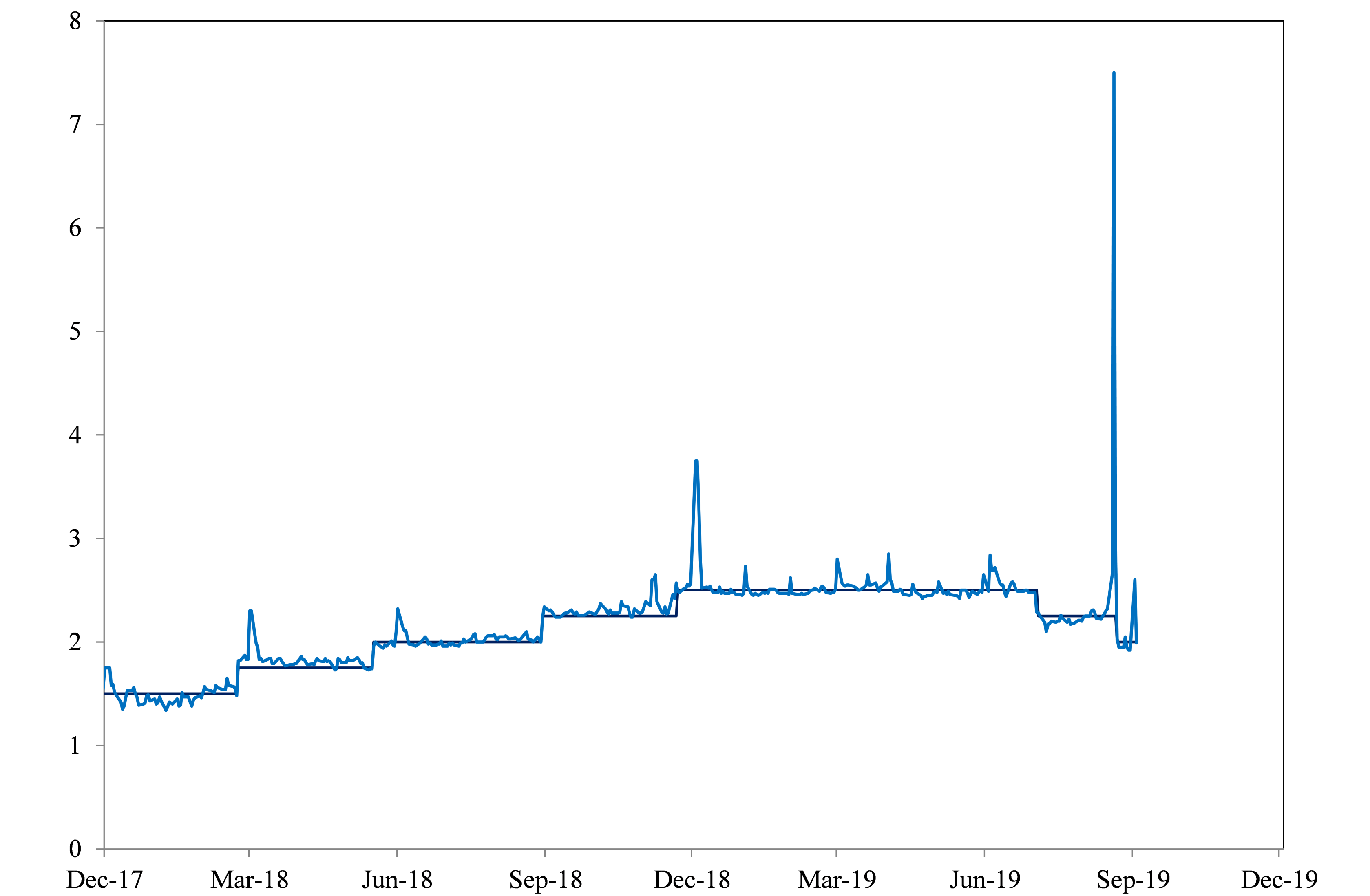

On 12 September 2019, the overnight repo rate rose to an intraday high of 10% and averaged 7.50%, well above the Federal Funds target, which was then at 2.25% and was cut two days later to 2% (Figure 1).

Figure 1: The overnight repo rate and the Federal Funds Target rate