Senior Economist for Asia Pacific and Global Trade

I’m excited to launch this blog dedicated to Asia-Pacific economic insights. I hope that you find the content beneficial and particularly look forward to your valuable feedback, comments, questions or suggestions!

For this first entry, I will focus on the Chinese economy. This is no surprise, considering the importance of the country in the region (and the world), and especially given the ongoing Omicron shock there. The continued zero-Covid policy and the resulting partial or full lockdowns across some cities have had social impacts and sparked sharp reactions in public opinion, both locally and abroad. Being an economist, I will however focus my comment on the economic impact of recent events, and the ensuing policy reactions.

Let’s start with the latest data releases. China’s Q1 GDP came in at +4.8% y/y, above expectations and up from +4.0% the previous quarter. However, beyond this robust headline number, there are underlying weaknesses. The March data clearly show a slowdown in the Chinese economy, following the stronger-than-expected first two months of the year. In March, industrial production slowed to +5.0% y/y (from +7.5% in January-February) and fixed asset investment to +7.2% (from +12.2% in January-February). More strikingly, retail sales contracted by -3.5% y/y (after +6.7% in January-February), highlighting the impact of the ongoing sanitary situation on Chinese consumer confidence and spending.

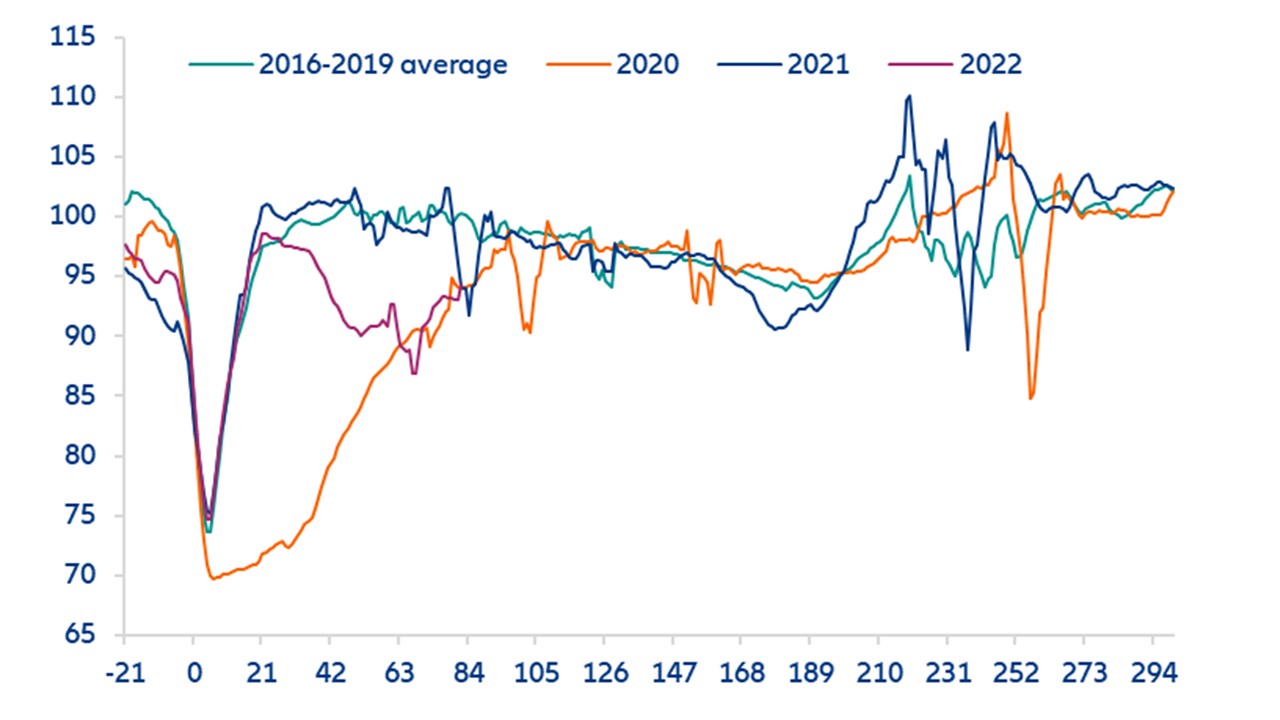

Looking forward, Q2 is likely to experience a weak start as April remains under pressure from the zero-Covid policy. However, high frequency data on traffic congestion and the sanitary situation suggest that, at the national level, the shock of ongoing outbreaks may be peaking. In our central scenario, we indeed assume a return-to-normal in national aggregate mobility in May. That would imply GDP growth could reach +4.6% in 2022. Though this falls short of the official target of “around +5.5%”, reaching this level of growth itself will still require further policy efforts.

* population-weighted average of 100 cities

Sources: Refinitiv, Allianz Research. See our report “The cost of the zero-Covid policy for China and the world”.

Over the past weeks, the PBOC announced a 25bp cut in the reserve requirement ratio for all banks (and an additional 25bp for selective smaller banks), along with guidelines on how to further support the real economy. On the fiscal side, March data confirm that fiscal spending and related areas (e.g. infrastructure investment) accelerated. Going forward, we expect another policy rate cut from the PBOC, continued liquidity provision, targeted support for specific sectors or types of companies (e.g. SMEs, high-technology, transportation, etc.) and a relaxation of some macro-prudential measures (e.g. for the real estate sector and local government financing vehicles). The larger policy effort is likely to come from the fiscal side, with additional public investment along with tax and fee cuts for companies and households.

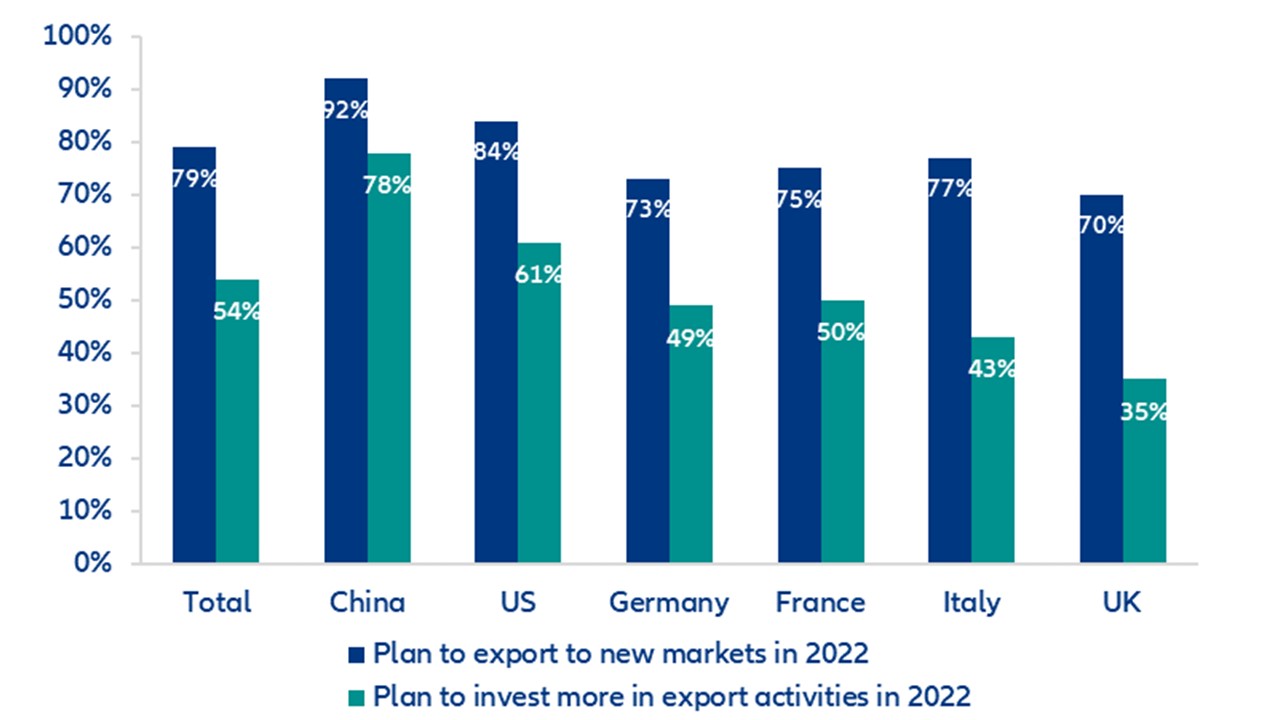

China observers will also need to be wary of another downside risk to the economic outlook: US-China tensions. These never really disappeared and President Biden’s administration could decide on potential import quotas on Chinese products amid the politically sensitive context in both countries (US mid-term elections and 20th Party Congress in China in November). The invasion of Ukraine could also fuel fresh decoupling momentum. Such a downside risk comes in a context where strong export performance was a tailwind for the overall Chinese economy in 2020 and 2021. Before the Ukraine and Omicron shocks, Chinese firms were still very optimistic regarding export opportunities and their investment intentions in 2022, according to our Allianz Trade Global survey .