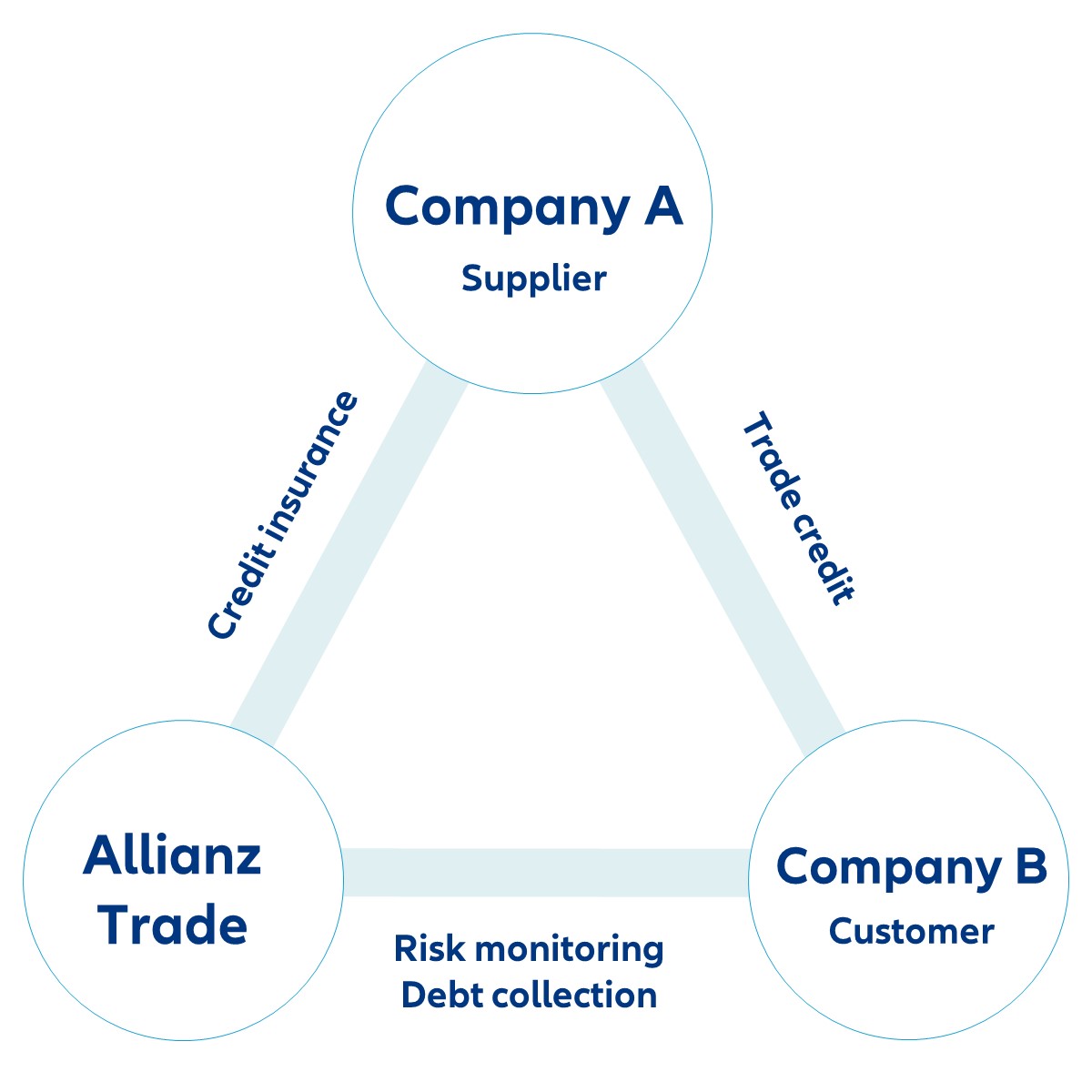

Trade credit insurance has one simple purpose. It protects you from non-payment of commercial debt and covers your business-to-business accounts receivable.

In other words, the main role of trade credit insurance is to provide prompt compensation for losses arising from the insolvency or default of your suppliers.

Please note that transactions with insured suppliers must be conducted within a set credit limit.

.png)

.png)