Understanding DSO Meaning: Improving Days Sales Outstanding

Summary

DSO refers to the average number of days it takes a company to collect payment after a sale. A lower DSO indicates faster payment collection, contributing to healthier cash flow. If your DSO is 32, for instance, it means you receive payments on average 32 days after a sale.

For businesses offering trade credit, monitoring DSO is essential. A high DSO may signal inefficiencies in collection or potential credit risks. By incorporating DSO analysis into broader financial planning, businesses can optimize cash conversion cycles and improve liquidity management.

How to Calculate DSO?

To calculate DSO for a given period:

DSO = (Accounts Receivable / Total Sales) * Number of Days

For example, if a company records €50,000 in sales with €35,000 in accounts receivable at month-end, its DSO calculation is:

(35,000 / 50,000) * 31 = 22.3 days

This means the company collects payments, on average, within 22 days. Importantly, DSO calculations only account for credit sales, excluding cash transactions.

DSO is often compared with Days Payable Outstanding (DPO), which measures how long a company takes to pay its suppliers.

DPO = (Accounts Payable / Cost of Goods Sold) * Number of Days

For instance, a company with €280,000 in costs of goods sold (COGS) and €30,000 in accounts payable at year-end would have:

(30,000 / 280,000) * 365 = 39.1 days

This means it takes approximately 39 days to settle supplier payments. Comparing DSO vs. DPO helps businesses balance cash inflows and outflows effectively.

The Role of DSO in Working Capital Management

DSO is a key element of working capital management, affecting both liquidity and operational efficiency. A high DSO ties up capital in receivables, reducing free cash flow. Conversely, a lower DSO enhances financial flexibility, allowing businesses to invest in growth opportunities.

Efficient receivables management, including proactive follow-ups and streamlined invoicing, helps lower DSO and sustain cash flow stability. Trade credit insurance, such as solutions offered by Allianz Trade, further safeguards businesses against late payments and customer defaults, ensuring financial resilience.

Interpreting DSO for Business Finance

Understanding DSO trends is crucial for assessing business performance:

- Increasing DSO may indicate delayed payments or growing credit risks.

- Stable DSO suggests consistent cash flow management.

- Declining DSO reflects efficient collections and enhanced liquidity.

For example, Company A expanding into international markets might see DSO rise from 10 to 15 days, due to longer payment cycles abroad. Company B, with an established customer base and a consistent one-month payment term, maintains a steady 30-day DSO.

Industry and Regional DSO Benchmarks

Benchmarking DSO against industry and country averages provides insights into competitive positioning:

- Global DSO average (2020): 66 days (Bloomberg)

- Highest DSO sectors: Machinery (92 days), Construction (82 days), Electronics (77 days)

- Lowest DSO sectors: Retail (26 days), Agrifood (43 days), Transportation (47 days)

- Longest DSO by country: China (94 days), Italy (88 days), Greece (84 days)

- Shortest DSO by country: New Zealand (40 days), Netherlands (45 days), Finland (46 days)

Before entering new markets, businesses should analyze regional payment behaviors to adapt credit policies accordingly.

Establishing a Credit Control Policy to Manage DSO

Businesses should tailor credit control policies to maintain an optimal DSO, balancing financial security and competitive payment terms. Key factors to evaluate include:

- Customer creditworthiness: Assess payment history and financial stability.

- Working capital trends: Monitor changes in cash reserves and liabilities.

- Delinquent DSO tracking: Identify late payments and high-risk accounts.

Incorporating financial ratios like current and quick ratios helps in maintaining financial equilibrium while optimizing DSO.

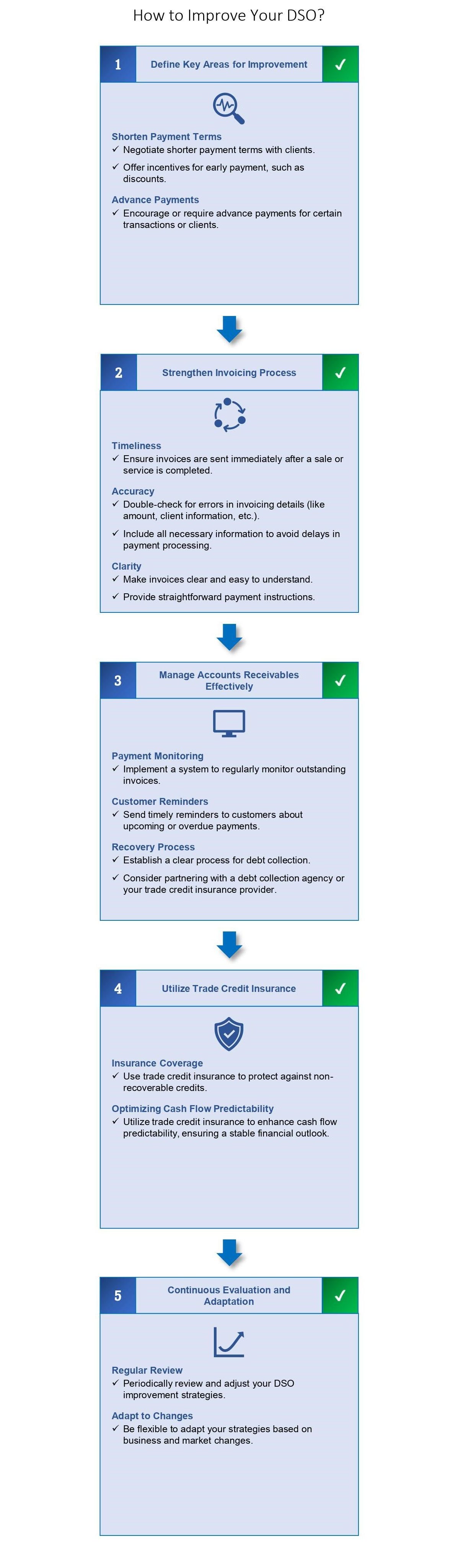

To enhance cash flow and reduce DSO, businesses can implement:

- Negotiating better payment terms: Shorten payment deadlines, offer early payment incentives.

- Strengthening invoicing processes: Ensure invoices are timely, accurate, and contain complete information.

- Optimizing accounts receivable management: Invest in payment tracking, debt collection strategies, or leverage trade credit insurance.

The Value of Trade Credit Insurance in DSO Management

Allianz Trade’s trade credit insurance provides an added layer of protection, ensuring stable DSO by:

- Mitigating default risks: Coverage against customer non-payment due to insolvency or delayed payments.

- Enhancing credit risk assessments: Access to in-depth credit evaluations and financial insights.

- Supporting financing opportunities: Trade credit insurance enables businesses to secure better loan terms from financial institutions.

By leveraging trade credit insurance, companies can proactively manage credit risks, safeguard revenue streams, and maintain financial stability even in unpredictable market conditions.

Conclusion

Allianz Trade: Empowering Global Trade

Why work with us?

DEDICATION

Corporate customers

INSIGHTS

Business transactions protected globally

ASSURANCE

by Standard & Poor's

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated withbad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.