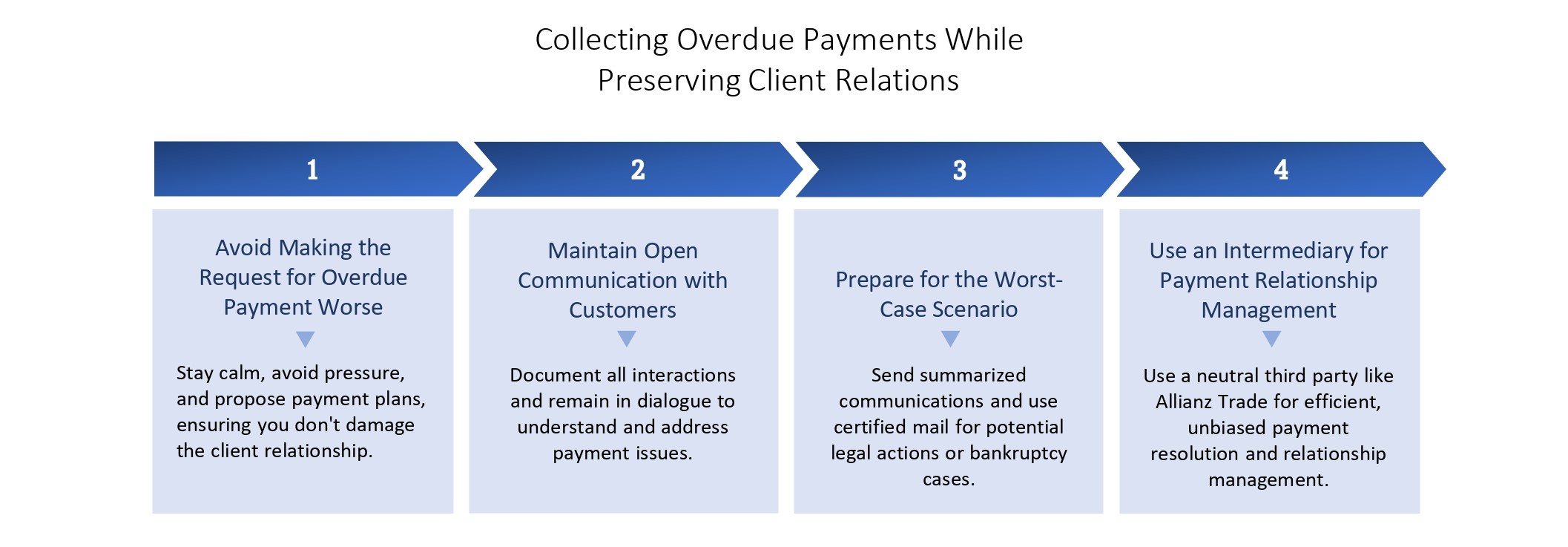

When it looks like a late-paying customer may turn into a non-paying customer, you must approach the situation with tact. Start by sending a letter summarizing all the previous contacts you have had and with whom regarding the overdue invoice. Inform the customer that the unpaid invoice will be referred to a debt collection agency after a specific date. Send the letter certified mail with a return receipt so you can prove the letter was received, should you need to take legal action.

If you find that the customer has declared bankruptcy, you should submit a proof of claim and supporting documentation that explains the debt with the bankruptcy court where the bankruptcy was filed. You must also stop sending overdue notices or calling about the debt. While there is no guarantee that your debt will be repaid, your proof of claim will be on record so the court-appointed trustee can determine if and how much you can be paid once the company is reorganized or liquidated.

Debt protection is a critical element in the arena of trade credit insurance, serving as a clear and direct solution for businesses grappling with overdue payments. This approach is particularly effective in illustrating the tangible benefits of trade credit insurance. By incorporating debt protection strategies, businesses can see a measurable decline in bad debts. Charts and data visualizations can be particularly enlightening, demonstrating how trade credit insurance can transform a company's financial health. By protecting against the risk of unpaid invoices, debt protection not only assists in maintaining financial stability but also plays a vital role in preserving healthy business relationships. With trade credit insurance, you're not just collecting overdue payments; you're also investing in the long-term viability and trustworthiness of your business relationships.