We protect globally operating companies from bad debts

Secure and Transparent International Protection

The solution for globally operating medium-sized companies with an annual turnover of 100 million - 300 million euros and affiliated companies in at least two countries.

Transparent multi-language contracts

Our contracts offer a high level of transparency and applicability worldwide, ensuring alignment with local regulations - and we have translations available for your local teams.

Reliable Security for Your Business

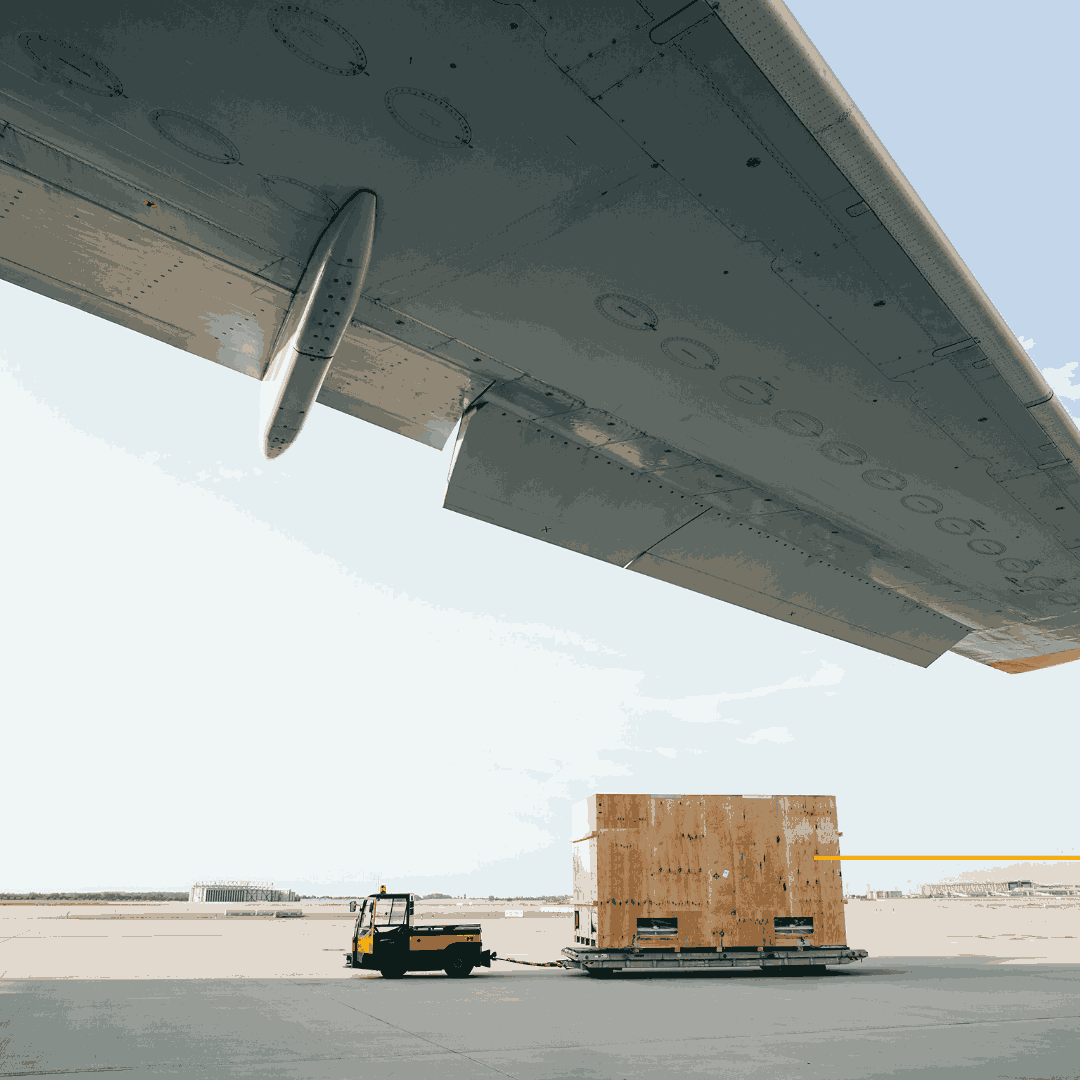

In the event of non-payment or insolvency of your customer, we will reimburse you for your claims arising from the delivery of goods, work, and services within the insured limits.

Strengthen Your Global Operations

Simplified Central Negotiation

Management of the master agreement and conditions are negotiated at your headquarters, hence apply to all units without local renegotiation.

Tailored Expertise for Your Needs

Our team create a made-to-measure solution for your globally operating company at headquarter level, while our local experts support your subsidiaries abroad in the day-to-day.

Comprehensive Global Risk Monitoring

Monitoring the payment behavior of 85 million companies in over 160 countries.

Why companies partner with Allianz Trade

DEDICATION

Corporate customer

INSIGHTS

Businesses accessible through our risk grading

ASSURANCE

by Standard & Poor's

How Trade Credit Insurance for Mid-Size Multinational protects your business

We analyse the creditworthiness and financial stability of your customers.

2. Credits limit calculation

Each of your customers has a credit limit - the maximum amount we will indemnify if that customer fails to pay.

3. Business as usual

You trade with your existing customers as you wish, with the risk covered up to the credit limit.

4. Trading limit updates

We keep you informed of adjustements to credit limits as they may be raised or reduced when conditions change.

5. New customers

You check the creditworthiness of potential new customers. We confirm agreement or explain if your request is declined.

6. Making a claim

If a customer fails to pay, inform us. We investigate and indemnify you for the insured amount if policy terms have been met.

You may be interested in our other solutions

Want to learn more about our products ?

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated with bad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly commited to fairness for all without discrimination, among on own people and in our many relationships with those outside our businesses.