- Chinese Big Tech (big data, cloud computing, AI, blockchain) and platform ecosystems could further disrupt the global insurance industry. Firstly, ecosystems might be owned or driven by tech giants pushing insurers to the periphery, with dire consequences for access to customers and data. Second, “early adopter” Chinese players such as Baidu, Alibaba and Tencent, which have already built a preeminent position in fintech ecosystems, could disrupt other markets as well.

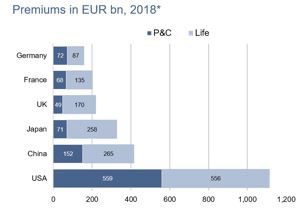

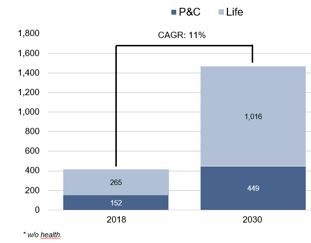

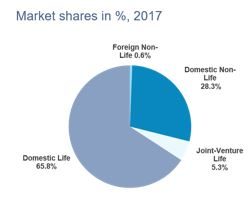

- China’s highly concentrated insurance market rose to #2 worldwide and should continue to grow by double-digits. Since the global financial crisis in 2008, insurance premiums (w/o health) have almost quadrupled to EUR 417bn (2018), making China the second biggest insurance market in the world. And there is still plenty of catch-up potential: Premiums per capita amount to EUR 294 in China; in all the other top five markets, people spend roughly ten times as much on insurance. Therefore, we expect double-digit growth in China’s premiums, in particular in the life sector, driven by demographic change.

- Regulatory hurdles to enter China’s insurance market have been lowered, and recent policy announcements are favorable for the further development of insurtech firms. The mid 2018-2019 stimulus (equivalent to 5% of GDP; a further 2.7% is expected in 2020), the accommodative monetary conditions targeted to the private sector and “Made in China 2025” are creating a conducive environment for insurtech companies to thrive, and encouraging the participation of foreign investors. The Chinese authorities’ push towards SMEs could unveil hidden jewels in the mid-cap insurance market segment for strategic partnerships along the insurance value chain.

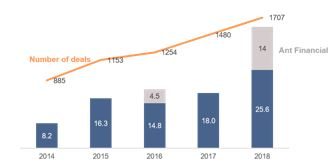

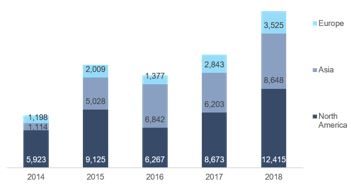

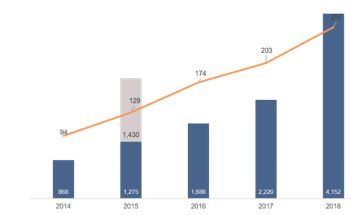

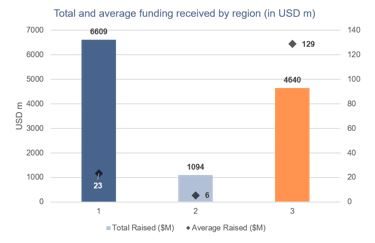

- In comparison with the U.S. and Europe, insurtech companies in China are very well-funded, and getting listed is an option:

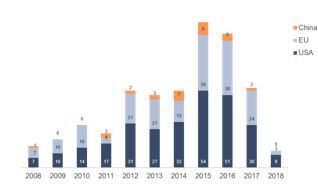

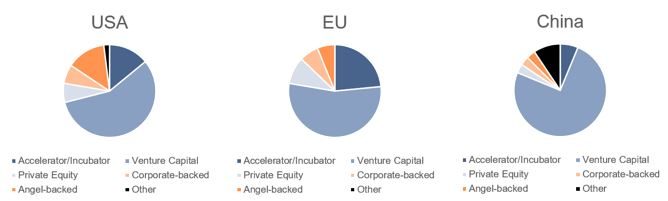

- There may be eight times as many American insurtech companies as Chinese ones, but the funding gap is much smaller. Whereas U.S. insurtechs raised EUR 5.8bn in total in 2018, total funding in China amounted to EUR 4.0bn – more than four times the European figure. However, venture capital accounts for a high proportion of financing; private equity or corporate-backed financing are hardly existent in China.

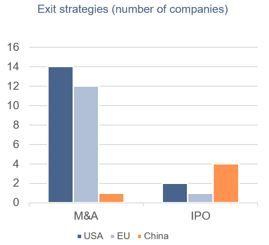

- Already four companies have made a public listing (Ping An Healthcare and Technology Company, ZhongAn, Pintec and Fanhua), more than in the U.S. (two) and Europe (one) together. The dominant exit channel of M&As is much less popular in China: only one insurtech (Chuangxin Insurance Sales) has so far been acquired by another company. The generous funding available in the market could actually be deterring corporate buyers or enabling startups to stay independent. Or it could be that the high concentration of the market leads to a dearth of corporate buyers. Either way, the lack of M&A in China increases the risks for investors.

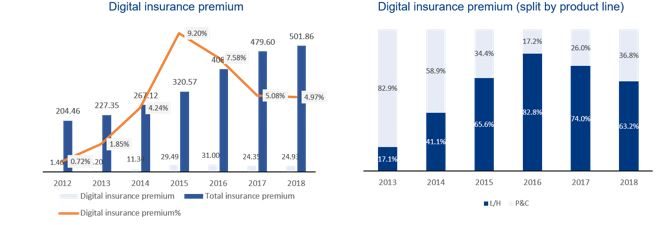

- China will be essential to the insurance world in a platform economy, thanks to scale, purpose and agility. The Chinese consumer is a godsend for insurtech companies, and tech-intensive distribution channels and products will experience exponential growth. In addition, regulators and authorities have the means and the will to nurture not only national but global champions in technologies and services. Global insurance giants can tap into the booming Chinese insurance x tech space, while their experience, especially from Europe (underwriting and product development, asset-liability management, privacy and consumer protection, for e.g.) could prove useful. We expect more strategic partnerships and co-investments between Chinese and foreign insurance actors going forward.

The Chinese challenge

Digitization through Big Tech (big data, cloud computing, AI, blockchain) is disrupting the global insurance industry. At the same time, platform ecosystems (more commonly referred to as the “platform economy”) are also on the rise, with the potential to dominate the markets. These developments pose a twofold strategic challenge for the insurance industry:

- Ecosystems might be owned/driven by tech giants such as Google, Amazon or Facebook (GAF), pushing insurers to the periphery, with dire consequences for access to customers and data.

- Chinese players, such as Baidu, Alibaba and Tencent (BAT), have already built a preeminent position in fintech ecosystems as they have scaled and innovated faster than anyone else. These “early adopters” could disrupt other markets as well.

This paper focuses on the second challenge, centering on the insurtech industry in China. An in-depth analysis of the Chinese insurtech landscape – in comparison to the U.S. and Europe – offers a glimpse of the future of the Chinese market and its players, their strategies and their prospects for success abroad.

Size matters. Purpose matters more. By the end of the next decade, the Chinese insurance market is set to become the world’s biggest in terms of premiums. At the same time, technology is being deployed at a massive scale to build highly automated insurance platforms. In addition, regulation and government policies are nurturing not only national but global champions. These trends together make for an awesome challenge for non-Chinese insurance players. Is China set to dominate insurance in the platform economy of the 21st century? The outcome hinges upon how the incumbents prepare themselves to compete with potential disruptors.

China is certainly the market to watch – and learn from. China has emerged as one of the most innovative and competitive economies over the last few years. The country is one of the largest investors in digital technologies and home to one-third of the world’s unicorns. Although internet penetration is only 59% in China, the number of internet users is almost three times that of the U.S, due to China’s large population of 1.4bn people. This digital-native population adopts new technologies and services early, but the Chinese government also fosters innovation, not only on a national level but also regionally, encouraging new technology clusters. The huge size of the Chinese market enables companies to scale easily and has strengthened Chinese “self-dependent” innovation. This marks a shift from producing Chinese versions of Silicon Valley companies to creating new business models.

Supporting this shift is the huge amount of money that is being poured into Chinese technology companies, resulting in a venture capital market that is approaching parity with the U.S.³: In 2018, global investors infused EUR 71bn into Chinese startups, counting for 32% of invested global venture capital. Furthermore, Chinese internet giants are increasingly tackling international markets. Apart from creating multifaceted and cross-industry ecosystems that touch every aspect of consumers’ lives (including financial services and insurance), Baidu, Alibaba and Tencent (BAT) have also invested in 42 companies overseas². In creating these ecosystems, the BAT companies were able to take out fragmented and inefficient offline markets and develop new capabilities.

The rise in capital infusion, as well as changes in Chinese society, such as changing demographics, urbanization and education, have paved the way for greater penetration of the insurance industry. Evolving customer needs and new lifestyles have created the need for new insurance products. Insurance penetration is still low – compared to Western countries – in particular in rural areas where access to financial services is also low. However, due to the changing demographics and increasing demand, the Chinese insurance ecosystem has been disrupted massively. Besides technological innovations, traditional insurance processes have been reconfigured to not only fit the different Chinese demand for insurance but also, in a way, to continuously improve and develop.