- After recent Turkish military intervention in North Syria, the U.S. administration retaliated through a tariff of 50% on Turkish steel. The direct impact of this measure should remain quite muted since the U.S. is a minor export destination for the Turkish economy.

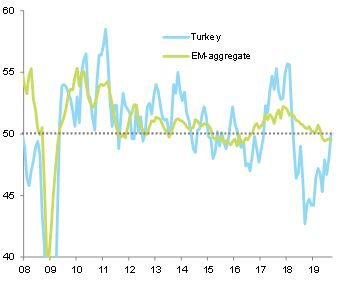

- However, indirect impacts, such as TRY evolution, debt rollover and payment behavior, would have wider consequences. The recent monetary policy easing was quite ahead of the curve and the TRY has already weakened (-5% in October to a 6-months low).

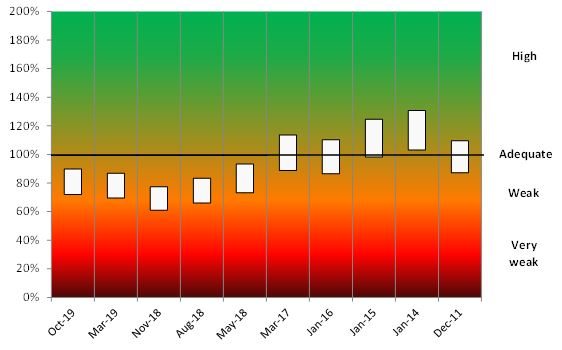

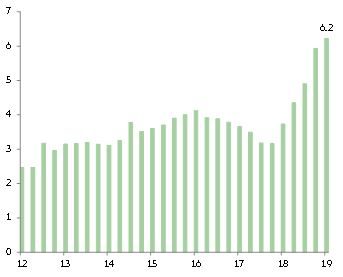

- Turkey's economy is not immune to a new shock. Though it has already exited from the deep recession experienced in H218, triggered by a sizeable exchange rate shock (-50% exchange rate depreciation, with a trough experienced in August 2018), GDP growth remains subdued (-0.2% in 2019 and +2.3% in 2020). It should recover to its pre-crisis level only in 2021.

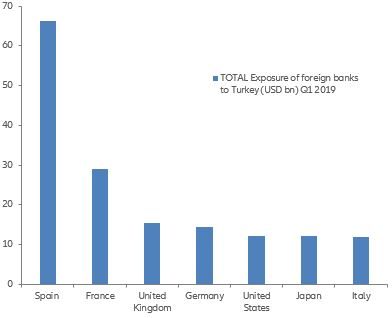

- The materialization of sanctions from Europe would be the true game-changer, as the main Turkish foreign exposures are with Europe (trade, financial). But Europe's exposure to the Turkish economy is significant, making harsh sanctions (financial sanctions) unlikely.

What’s new?

After recent Turkish military intervention in North Syria, the U.S. administration announced sanctions on Turkey through a hike from 25% to 50% of tariffs on steel imports from Turkey and a ban of three top officials’ financial accounts in the U.S. Trade tariffs were already put at 50% from August 2018 as the TRY currency crisis was seen as a competitive threat by the U.S. administration, and unwound in May 2019 as the financial situation in Turkey normalized.

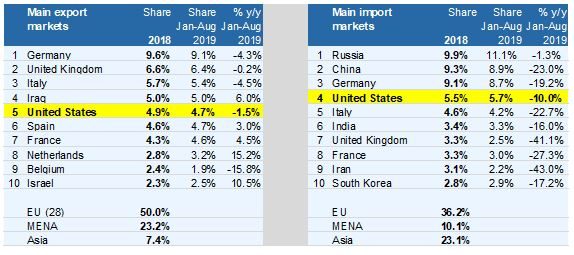

The direct trade channel of impacts appears quite limited at this stage. In 2018, Turkey’s goods exports to the U.S. amounted to USD8.3bn (4.9% of the total, 5th export destination) and its imports from the U.S. came in at USD12.4bn (5.5% of the total, 4th import source). Turkey’s export structure is fairly well diversified. Although the 5th most important export destination, the (already declining) share of the U.S. in Turkey’s exports of just below 5% suggests that any potential U.S. sanctions on Turkey would only have a moderate economic impact.

It would become problematic for Turkey if the EU would join the U.S. sanctions (as it did with Russia in 2014). But this is highly unlikely as the EU depends on Turkey for holding back a potentially huge influx of refugees to the EU – which President Erdogan has emphasized once again this week.