- On May 5th, President Trump announced plans to raise tariffs on Chinese imports, arguing that current US-China talks are going too slow. On May 10th, the Trump administration announced a hike in the tariff on USD200bn of imports from China to 25% (from 10% currently). Despite this escalation, we continue to think that an agreement is achievable. The G20 summit in Japan in June, where Presidents Donald Trump and Xi Jinping are expected to meet, could be the next moment of truth.

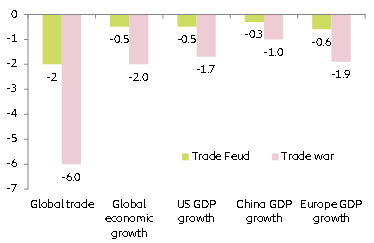

- Implication #1: A negative shock on trade and growth. This brings us to a Trade Feud Scenario (average US tariffs above 6%) and will cost -0.5pp of global GDP growth and -2pp of global trade growth over the next two years. If the US administration were to go further and tax all remaining Chinese imports by 25% (we see this as being unlikely as it would, in this case, impact a lot of consumer goods) and USD200bn of car imports by 25%, this would bring us to our Trade War scenario. This would push US average tariffs close to 12% and shave off -2pp from global GDP growth, bringing the global economy into recession.

- Implication #2: A negative shock of uncertainty. The investment cycle will be impacted at a global level. With the US’s latest move, it is difficult to foresee a fast de-escalation in the short-term. Uncertainty will likely remain high and hamper investment plans. For each four months of trade uncertainty, we estimate the cost to be -0.1pp of global economic growth. We reiterate our call of a possible technical recession in the US in the first half of 2020. In the Euro zone, the risk scenario could see growth being cut by -0.15 pp per year from our current estimate of +1.2% y/y in 2019 and +1.3% y/y in 2020.

- Implication #3: It is time for policy actions. The Fed and the ECB are likely to adopt a dovish stance. We don’t see rate cuts in the very short-term but a rate cut by the Fed as early as Q1 2020 is on the cards. China will likely adopt retaliatory measures (new waves of tariffs, economic patriotism) and step up easing measures. We pencil three RRR cuts of 100bp by the end of this year, and two policy rate cuts of 25bp (first time since 2015).

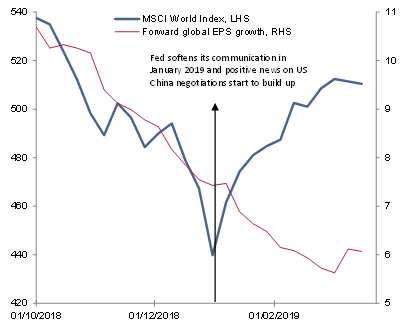

- Implication #4: Equity markets - brace for volatility. Another sell-off similar in size to Q4 2018 is conceivable. The S&P 500 is likely to correct by more than 20% and come back to the end-2018 level. Safe haven assets will benefit from this as the US 10Y sovereign yield is expected at 2%, compared with 2.44% today. We see the possibility for the RMB converging to 7 RMB per USD by end of 2019 (againt 6.7 end Q1) as authorities step up easing measures. This kind of movment in the CNY is likely to further impact global equity prices as it could be interpreted as a disorderly reaction to US tariffs.

- Implication #5: Credit market to see a large widening of spreads. Credit markets were tight before these events. We expect a significant widening of spreads to 200 bp from 155 bp today for the US corporate BBB segment. In China, industrial profits decreased by -3.3% in Q1 2019. We see a rise of credit risk in China due to a poor sales outlook for exporters and a rise in debt as authorities increase accommodative measures (bank credit to private sector up +13% y/y in Q1).

- To avoid this, the two sides need to come to a trade truce before the summer this year. A trade agreement continues to be our baseline scenario. Lingering effects of trade uncertainty will, however, remain visible.

On May 5th, President Trump announced plans to raise tariffs on Chinese imports, arguing that current US-China talks are going too slow. On May 10, after limited progress, the Trump administration announced that from May 10th, the tariffs on USD200bn of imports from China would increase to 25% (from 10% currently). The remaining untaxed US imports from China would also face duties shortly.

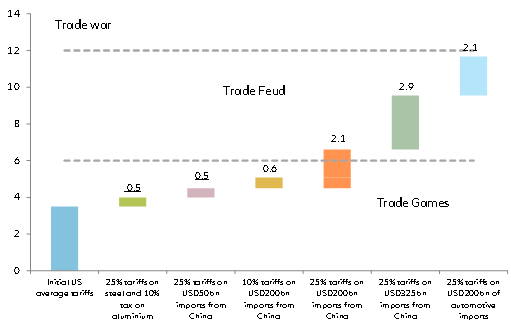

Good Bye Trade Games, Hello Trade Feud. In Q1 2018, we introduced a proprietary analytical framework around growing trade threats – Protectionism: Trade Games, Trade Feud or Trade War? We defined three scenarios based on a sensitivity analysis of average US tariffs ([3.5-6%]; [6-10%]; and close to 12%); the number of protectionist measures and the resulting global trade dynamics ([2-4%], [0-2%], or contracting). We called them respectively Trade Games, Trade Feud, and Trade War. Before May 10th, we were borderline Trade Feud with US average tariffs around 5%. Now we have clearly entered a full blown Trade Feud scenario. With the US implementing 25% tariffs on USD200bn imports from China (instead of 10% before), US average tariffs are now above 6% (see Figure 1).

Implication #1: Global GDP and global trade growth could lose -0.5pp and -2pp respectively.

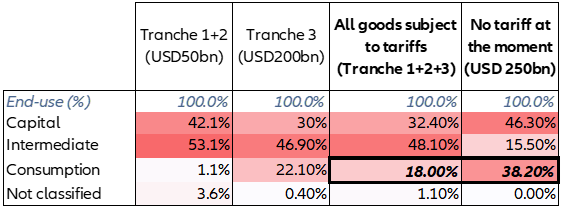

We estimate that this could cost -0.5pp of global GDP growth and -2pp of global trade growth over the next two years. The GDP growth forecast would be cut by -0.6pp in Europe, -0.5pp in the US and -0.3pp in China. If the US were to implement additional tariffs on USD325bn imports from China and USD200bn of car imports, we would move to a Trade War scenario (US average tariffs close to 12%). This would cost -2pp of global GDP growth, sparking a global recession, as well as -6 pp of global trade growth. Europe would lose -1.9pp of GDP growth, US GDP growth would drop by -1.7pp and China’s by -1pp. We consider that the scenario of a 25% tariff on USD325bn of remaining Chinese imports is still unlikely, especially since we are approaching Presidential elections, as it would really penalize the US consumer (Table 1).

Table 1. Good contained in each tranche by end-use category 2017 US import numbers