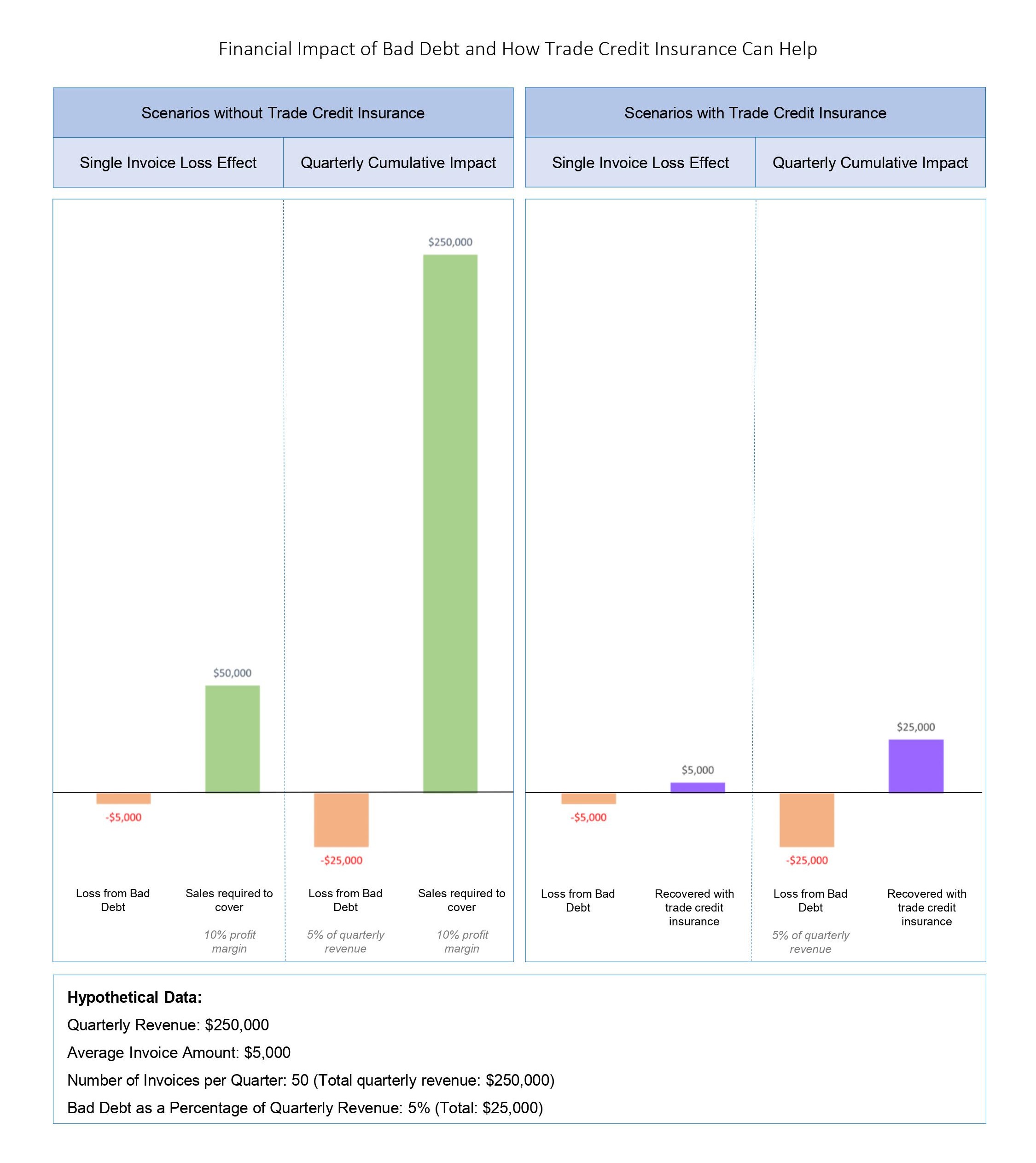

Bad debts are not good for a business. Sometimes, you may have followed all the steps to prevent cash flow problems and late payment, but you can still be impacted by non-payment. When a customer defaults on its bills or is in danger of doing so, the company extending credit to that customer faces a bad debt expense. The bad debt expense must be charged against your company's accounts receivable and consequently reduces the amount of accounts receivable on your company’s income statement.

Bad debt expense can be detrimental to a business’s long-term success, but fortunately there are ways to manage this expense and mitigate bad debt-related risks. In this article, we share information on bad debt protection cost, bad debt protection insurance, and bad debt protection vs credit insurance. An essential strategy businesses employ is financial risk mitigation. This involves identifying potential threats to a business's financial health and taking proactive steps to minimize those threats. Bad debt protection acts as a cornerstone in this approach, offering companies a buffer against unforeseen financial downturns caused by customer defaults.