Implementing Bad Debt Protection for Secure Transactions

While offering flexible payment options is crucial for increasing deal sizes, it's equally important to protect your business from the risk of unpaid invoices and bad debts. Visualize bad debt protection as a shield or safety net, safeguarding your financial health against the fallout of uncollected payments. Integrating trade credit insurance into your payment strategies acts as this shield, ensuring that your business remains secure even when extending credit to customers. This approach not only increases the confidence of both parties in completing larger transactions but also reinforces your business’s reputation as a reliable and secure partner, encouraging even more substantial deals in the future.

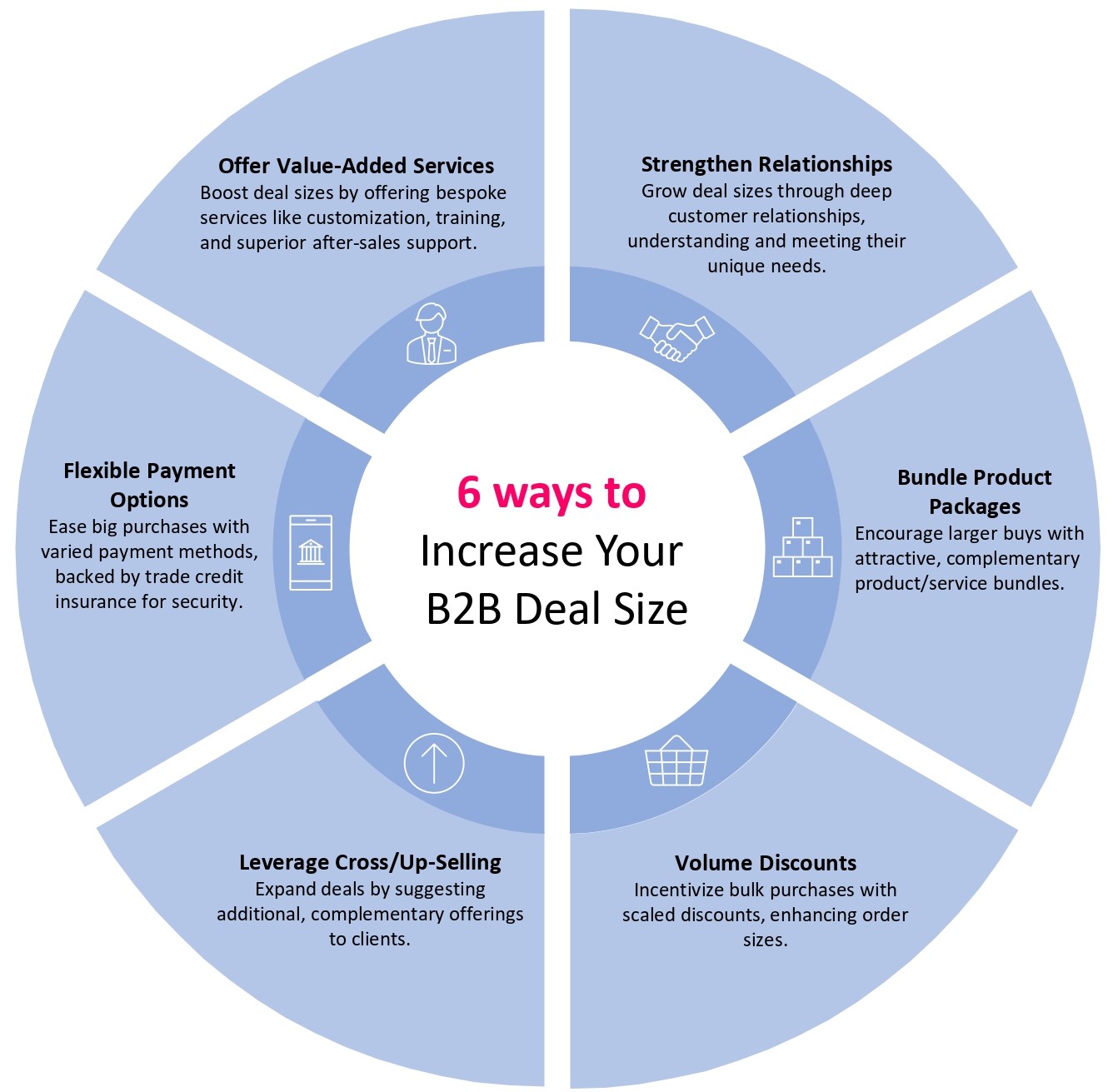

In conclusion, by following the above strategies, you can increase your average B2B deal size. By focusing on building strong relationships with customers', offering value-added services, and offering different payment options with trade credit insurance as a credit management tool, you can position your company with a competitive edge for long-term success in the B2B marketplace.

Contact Us

can help your business with us.

about Credit Insurance.