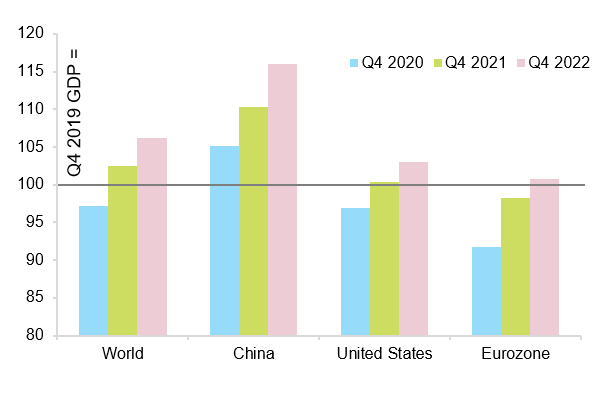

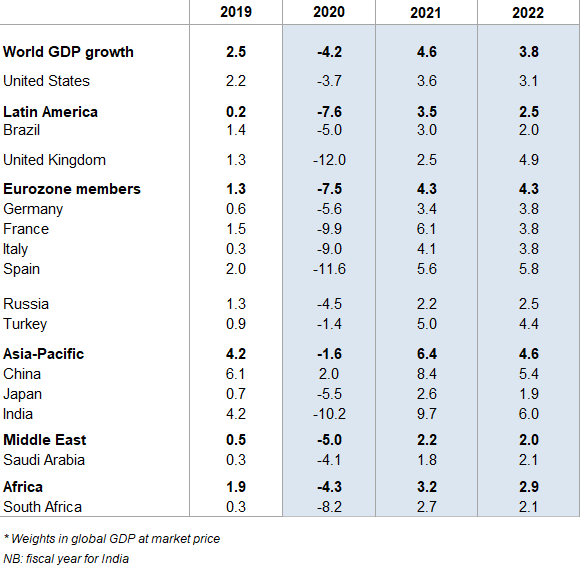

The Chinese recovery has become broad-based, but beware of earlier than expected policy normalization as authorities focus on long-term risks. Public spending is likely to be focused on more long-term themes such as supply chains, innovation and environmental protection. We expect the Chinese economy to grow by +2.0% in 2020 (after +6.1% in 2019), followed by +8.4% in 2021 and +5.4% in 2022. This continued outperformance compared to the rest of the world should allow authorities to start normalizing the policy mix, which in turn implies further renminbi appreciation (USDCNY towards 6.3 at the end of 2021). After a slump in Q1 2020 in the wake of the Covid-19 pandemic, the Chinese economy quickly rebounded, led by policy-driven sectors such as infrastructure and construction. Exports also performed strongly, supported by global demand for medical and electronic goods. It took longer for consumers and services to bounce back, but lower unemployment and rising income growth will extend the recovery in that area into 2021. As economic growth became more broad-based, policy support was dialed back in Q4 2020. This is reflected in our proprietary credit impulse index, which declined for the first time this year in November, in part due to slower corporate bond issuance. Indeed, defaults by state-owned enterprises show that authorities are now turning their focus to long-term risks rather than short-term economic support, in our opinion. Further non-systemic defaults are likely in the coming quarters, as regulators aim for more discipline in the financial system. A rate hike by the PBOC is also likely in Q1 2021, when activity indicators will be particularly strong, thanks to favorable base effects – we expect GDP growth to peak at +17.7% y/y in Q1 and come back to trend levels in the rest of the year (+5.6% y/y on average in the remaining three quarters). Recently, low inflation has been caused by temporary factors and we expect prices to grow by +2.5% in 2020 (after +2.9% in 2019), followed by +2.0% in 2021 and +2.4% in 2022. On the fiscal side, policy support will continue, but is likely to be of smaller amount – we estimate c.5.0% in 2021 compared with 7.2% in 2020. In particular, the special sovereign bonds quota, which represented c.2% of GDP in 2020, is unlikely to be renewed in 2021. Public spending is likely to be focused on more long-term themes such as supply chains, innovation and environmental protection. This is in line with the dual circulation strategy that was introduced in May 2020. Another policy area to watch is related to the real estate sector, which presents downside risks in the context of growing regulatory scrutiny over developers’ debt and housing prices.

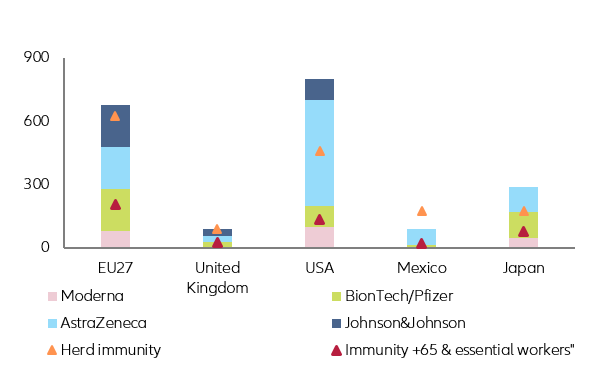

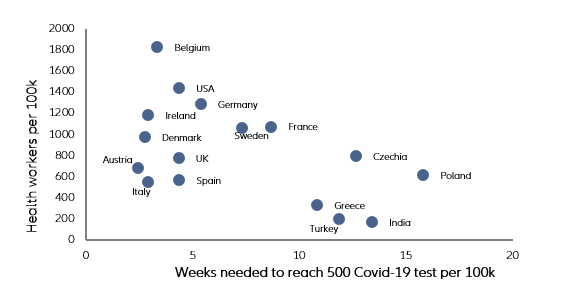

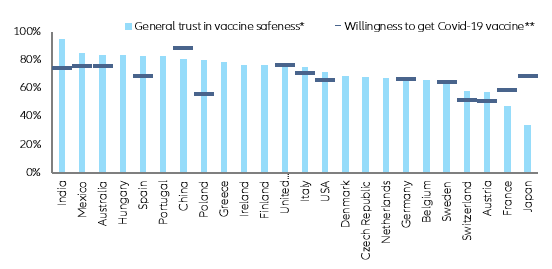

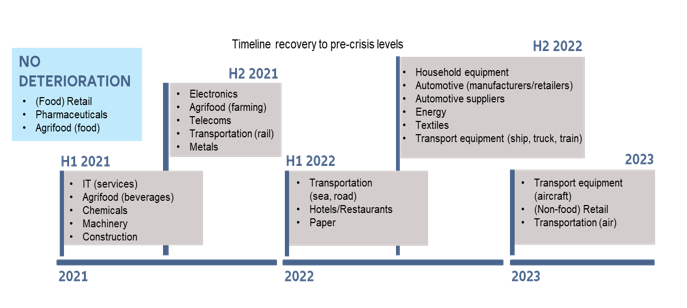

We expect Eurozone GDP to contract by -7.5% in 2020, followed by an expansion of +4.3% in both 2021 and 2022, against the backdrop of prolonged second lockdowns, on the one hand, and a marked services-driven vaccine-enabled rebound unfolding in the second half of 2021 on the other hand. A return to pre-crisis GDP levels is expected by mid-2022. In the final quarter of 2020 the vast majority of European countries retightened lockdown measures to address rising infection numbers. The at least initially pursued “lockdown light” approach together with a resilient manufacturing sector – thanks to tailwind from Chinese export demand – helped contain the negative impact on the economy. As a result, we expect the Eurozone economy to double dip by “only” -3.5% q/q in Q4 2020, around 30% of the contraction registered in Q2 2020. However with infection numbers now stubbornly plateauing at elevated levels in several key Eurozone countries, the tightening and prolongation of lockdown measures into early next year suggests the region’s economy will start 2021 on a week footing with increasing risks of a second consecutive quarter of recession, notably in

Germany,

France,

Italy and

the UK. Meanwhile an economic resurrection is only on the cards from Easter onwards as warmer temperatures together with progress on the vaccination campaign will allow for a gradual loosening of restrictions and in turn the unleashing of demand pent-up over the winter months. A full elimination of containment measures should only be feasible by mid-2021 when the vaccination of at-risk populations reduces the risk of a third lockdown as well as a triple-dip by alleviating pressures on healthcare systems. This milestone will set the stage for a swift and pronounced catch-up growth in H2 2021. In fact, we expect to see some of the strongest quarterly GDP expansions on record in 2021 – above +2% q/q in both Q2 and Q3 – second only to the sharp Q3 2020 growth spurt. Private consumption will lead the vaccine-enabled rebound as households start tapping into their precautionary savings in a context of markedly reduced economic uncertainty. In particular, ‘social spending’ stands to benefit, which will set the stage for a re-convergence between the services and the manufacturing sectors. Meanwhile, investment should pick up as early as Q2 2021, with the EU recovery fund providing additional tailwind in the following quarters. However, momentum will be held back by sizeable excess capacities and squeezed corporate financials. Moreover political risks around Brexit as well as the looming elections in Germany and France could weigh on investment plans. In 2022, we expect GDP growth to remain notably above potential as the achievement of herd immunity would allow for a return to economic normalcy while monetary and fiscal policy (don’t expect the Eurozone budget deficit to fall below -3% before 2023) remain supportive. Labor markets meanwhile will start to recover with the unemployment rate falling to 8% in 2022 after reaching 9% in 2021. All in all, we expect Eurozone GDP to contract by -7.5% in 2020 followed by an expansion of +4.3% in both 2021 and 2022. We expect a return to pre-crisis GDP levels in H1 2022, however, inter-country divergences remain notable, with laggard countries including Spain and Italy requiring at least one additional year to heal.

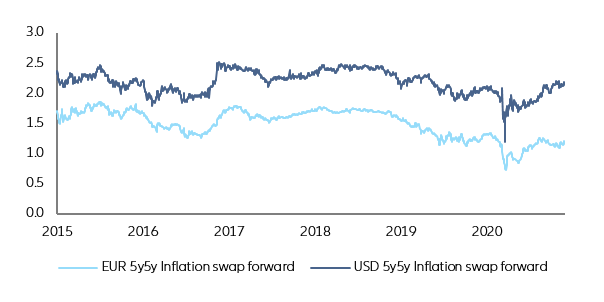

The ECB has made its key policy objective crystal clear: no tightening in financing conditions will be tolerated. To lend credibility to its increasingly explicit ambition to control yield curves – or rather, in the Eurozone context, to cap sovereign spreads – it has boosted its Pandemic Emergency Purchase Program (PEPP) to EUR1,850bn. With the horizon of PEPP purchases pushed out to March 2022, the additional QE-ammunition will allow the ECB to largely maintain in 2021 the average monthly asset purchase pace of EUR110bn it set since March, when added to the EUR20bn in monthly Asset Purchase Program (APP) purchases and the expected unspent PEPP powder of around EUR600bn as of end-2020. In practice, this will mean increasing the ECB balance sheet by another EUR1.6tn in QE purchases until spring 2022, however it could well end up not spending all of the PEPP ammunition. After all, the “threat” of a sizeable QE envelope to be deployed at any time to put out fires in bond markets has, in our view, a greater spread-compressing impact than a set monthly pace of asset purchases. We expect any unspent funds to be reverted to the APP in 2022, which will take the QE-lead as the economic outlook returns to normalcy. In light of the subdued inflation outlook (0.2% in 2020, 0.8% in 2021 and 1.2% in 2022) we expect monetary policy to remain expansive throughout 2022, with rate hikes remaining firmly off the table before 2023. Moreover, we expect to see additional support for the banking sector in 2022 (fresh rounds of TLTROs at even more favorable rates) to mitigate a credit crunch as banks still struggle to digest the expected rise in NPLs. Regarding the euro, which has stubbornly settled above the important USD1.20 line, we think the ECB will not go beyond verbal intervention even though we expect the euro appreciation trend to run further in H1 2021, driven by a weaker dollar in a context of abating global uncertainty.

German GDP will contract by -5.6% in 2020 followed by a strong recovery of +3.4% and +3.8% in 2021 and 2022, respectively. As a consequence, we expect a return to pre-crisis GDP levels in early 2022. With the pre-Christmas return to a “hard lockdown” which is unlikely to be eased notably before February 2021, we expect the Germany economy to slip back into recession at the turn of 2020/21. With the easing of Covid-19 restrictions from Q2 onwards and the vaccination of the population at risk by mid-year, we expect German economic momentum to shift into overdrive. Fiscal policy looks set to remain supportive in 2021 and 2022 –the risk of premature withdrawal is rather low during an election year and our baseline of a conservative-green coalition should see more social spending thereafter – allowing for quarterly GDP growth to register above +2% q/q in Q2 as well as Q3. As uncertainty about the economic outlook recedes, the relatively solid labor market situation (unemployment forecast: 5.4% in 2022 after 6% in 2020) will provide support to the deployment of precautionary savings and in turn private consumption. Exports should continue to recover over the coming quarters, but given ongoing protectionist tendencies, a strong Euro and persistent structural headwinds facing German industry, the GDP growth contribution should slow below the pre-pandemic trend.

After a contraction of -9.9% in 2020, we expect a rebound in French GDP of +6.1% in 2021, followed by above-potential growth in 2022 (+3.8%). Consumer spending will remain the key driver of the recovery, thanks to improved confidence (active government support to labor markets) and the unleashing of EUR19bn of excess savings. The unemployment rate is expected to rise to 9.9% in 2021 and 10.1% in 2022. During the pre-electoral period we expect active labor market policies to focus on keeping the youth (new graduates) and the most vulnerable out of unemployment statistics. Inflation meanwhile looks set to remain muted (0.5% in 2021 and 0.7% in 2022) on the back of a negative output gap as the economy will not return to pre-crisis levels before mid-2022, alongside low energy prices and strong Euro.

With new restrictions put in place in November, Italy in course to fall back into recession in Q4. Economic output is therefore likely to fall by -9% this year before rebounding by +4.1% in 2021. Italy’s contraction is less pronounced compared to other southern European countries, thanks to a lower share of Covid-19-sensitive services in private consumption and a higher importance of the manufacturing sector, combined with a strong rebound in exports. Italian industry currently is benefiting from its position in the global supply chain, with its focus on machinery, chemicals and high-end consumer goods, with production already back at pre-crisis levels. Italy ambitious fiscal stimulus package (additional spending to the tune of 6% GDP & state guarantees worth 35% of GDP) has boosted public spending by only 1% since the beginning of the year vs. 3% for other large Eurozone countries. Nevertheless it has been more successful in supporting corporate confidence: investments rebounded strongly in Q3 (+31% q/q). The rising volume of corporate loans (+5.3% y/y the strongest dynamic since end-2011) suggest the favorable trend looks set to continue. This is remarkable as the Italian banking sector remains vulnerable and even state-guaranteed loans to companies, especially SMEs, are covered only by 80% on average. Against this background we expect real GDP to grow at a rate of +4.1% in 2021 and +3.8% in 2022. Although Italy’s debt-to-GDP ratio is on course to reach 160% this year and will only fall to 153% by 2022. The ECB will ensure that refinancing costs for the Italian sovereign remain favorable. Indeed, with the expansion of the PEPP program, the market supply of Italian government bonds should again decline next year. Only a flare-up of the Italexit topic could actually trigger market stress.

In Spain, restrictions will likely weigh on the short-term outlook and delay the consumer recovery, but the vaccine and ambitious stimulus are good news for the services-oriented economy. Only half the job losses in Spain have been recovered so far, and prolonged restrictions and a cautious reopening will weigh on consumer spending until spring 2021. Vaccination campaigns could be well advanced by summer, hence providing a boost to tourism revenues in H2. The global return to normalcy in 2022 could benefit further Spain’s social spending. Therefore, after falling by -11.6% in 2020, we expect GDP to grow +5.6% in 2021 and +5.8% in 2022. Spain’s ambitious stimulus paves the way for green investment and social redistribution. However, institutional and political hurdles could mean that not all EU grants (EUR72bn) are used in 2021-2023. In addition, we see the unemployment rate remaining high next year as emergency pandemic measures are phased out; it will only start decreasing in H2 2021 (+16% average in 2020, +17.2% in 2021 and +15.5% in 2022). Real economic activity will return to pre-crisis levels early 2023. Downside risks are political risk and stimulus implementation, which would delay the recovery, especially for the labor market; upside risks include a faster than expected vaccination campaign, and a smooth and efficient allocation of EU stimulus funds.

In the UK, Brexit will act as a drag on the post-lockdown recovery, with GDP to remain -5% below pre-crisis levels at end-2022. We expect Q4 GDP to fall between –5% and –6% q/q – with the cost of the second lockdown up to one third of the first one. Social spending, primarily impacted by the lockdown measures, accounts for 48% of GDP. The start of the vaccination campaign is good news, but sanitary restrictions are expected to remain high until at least late spring as the vaccination of the population at-risk is estimated to take around five months. In addition, Brexit is expected to cut -2.5pp from the post-lockdown recovery in Q2 (to +3.5% q/q). Overall, we expect GDP growth to reach +2.5% in 2021 as the expected fiscal stimulus (around 3% - 4% of GDP, mainly focused on infrastructure spending and reducing consumer taxes to reduce the burden of higher import prices post Brexit) is unlikely to fully compensate for the cost of Brexit. The Bank of England is expected maintain its monetary policy stance throughout 2021 after having announced GBP150bn of additional QE in November. Assuming the fiscal stimulus will feed into strong infrastructure spending to reduce the non-tariff barriers post Brexit (estimated at +10%), we expect GDP to accelerate by +6.5% in 2022, but to remain -5% below pre-crisis levels.

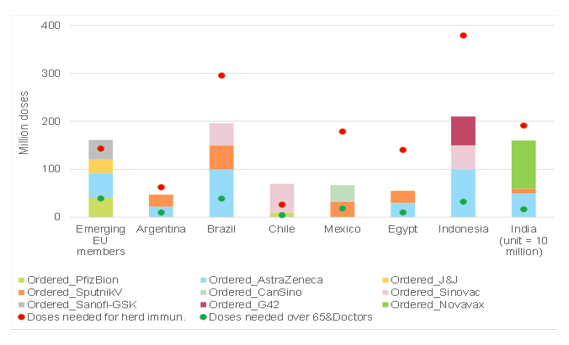

Emerging Markets as a whole (excluding China) are forecast to post a modest recovery, with real GDP expanding by +2.6% in 2021 and +2.2% in 2022. The pre-crisis full-year GDP level of 2019 is expected to be reached in 2022. This pattern is also true for the Central and Eastern Europe region as a whole, which is projected to grow by +3.2% in both 2021 and 2022 (after shrinking by -4.3% in 2020).. Average inflation in the CEE region is expected to tick up slightly from +4.5% in 2020 to +4.7% in 2021 and +4.6% in 2022. Price pressures are mitigated by moderating wage growth, which come along with rising unemployment in the region, forecast at 7.8% in 2021 and 6.8% in 2022, up from the pre-crisis rate of 6.5%.

Asia-Pacific overall is likely to continue outperforming other regions of the world in 2021, but that masks disparities across countries. Aggregate GDP growth for the region is likely to reach -1.7% in 2020 (after +4.3% in 2019), followed by +6.4% in 2021 and +4.5% in 2022. On the one hand, economies that are managing the Covid-19 crisis relatively well and that have strong exposure to global trade in goods are recovering faster – China,

Taiwan, Vietnam (and

South Korea to a lesser extent). Policy easing should turn less aggressive there (with China even gradually tightening). On the other hand, a more protracted epidemic in India, the Philippines and

Indonesia means that their economic recoveries are slower and the loss of GDP compared to pre-crisis trends are very large (especially in the former two). While the pandemic was well-managed domestically in

Thailand, the large exposure to services trade (tourism) is delaying the full recovery of the economy. We expect further policy easing in these economies.

L

atin America: no remedy for pre-pandemic structural weaknesses. The region will only go back to pre-crisis activity levels by end-2023. In the short-term, risks of a second wave (especially in Mexico and Brazil) will keep sanitary restrictions high and inhibit the recovery. Next year, domestic risks and vulnerabilities will also come to the forefront, despite the vaccine deployment which will be good for consumption and tourism in H2. Social risk in the region, anemic growth in Mexico, high unemployment and the debt burden in Brazil or political risk in Chile will be drags on regional activity: we expect +3.5% GDP growth in 2021 after -7.3% in 2020, and +2.5% in 2022. Lastly, there is a higher probability of scarring effects from the crisis in Latin America, namely hysteresis of the labor market and destruction of the capital stock, as few countries still have fiscal leeway (only Chile and Peru) to relaunch their economies. In 2022, the expectation of a US rate hike could put economies under pressure to promote visible fiscal adjustments (e.g., Argentina,

Brazil) or gradually rebuild fiscal buffers used during the pandemic (e.g., Chile, Colombia).

After being through the worst recession in its recent history in 2020 (-4.2%), we expect the African economy to rebound by +3.2% in 2021 and +2.9% in 2022. Covid-19 infection rates remained relatively low on the continent compared with other parts of the world. However, African economies were severely hit by the crisis due to weak demand (internal and external) and commodity price shocks. In 2021 and 2022, we expect the recovery to be essentially driven by stronger world demand, higher commodity prices and resuming tourism activity. We see as the main challenge worsened fiscal imbalances –increasing public spending and loss of government revenues – and public debt pushed up to hardly sustainable levels. In terms of debt sustainability, we cannot exclude the contagion of sovereign defaults over the continent in 2021-2022. Angola, Mozambique, Ghana and Tunisia are most at risk for debt sustainability. African governments now have less fiscal space than after the onset of the Great Financial Crisis to boost economic recovery. Therefore, the continent needs to attract private investment more than ever as an engine of growth. Nevertheless, the lack of basic infrastructure (in energy and connectivity) and long-lasting structural issues (corruption, administrative barriers, rule of law deficit, etc.) may continue to hold back the emergence of private sector-led growth in the medium term. Fragile democracies, upcoming elections, deteriorating labor market conditions, strong inequalities and endemic corruption set the stage for increased social tensions in 2021-2022. Zambia, Tunisia and Kenya are close to having new IMF program agreements in 2021. Yet, the fiscal consolidation requirements that would be associated with these programs might be contested by populations (already suffering significant economic losses because of Covid-19). Ethiopia, Nigeria, Tunisia and South Africa are most at risk for social unrest.

Regional growth in the Middle East is projected to recover only gradually, with real GDP increasing by +2.1% in both 2021 and 2022. As the region contracted by -5.8% in 2020, the pre-crisis full-year GDP level of 2019 will only be reached in 2023 at the earliest. Contained foreign investment and the lack of fiscal leeway – as most economies have already very high public debt burdens and an undifferentiated revenue structure – are the main brakes on the recovery. Regional inflation should remain elevated at around 7% but this average is tainted by very high price increases in a few crisis countries (Lebanon, Iran, Yemen). Most of the other economies in the region will experience deflation or subdued inflation at least until end-2021.