- The conventional wisdom among investors suggests that low interest rates are favorable for equities. The assumption holds true with regards to profits and leverage. However, theory tells a different story, as do the performance of two key metrics: earnings yields (how much a company earns per share) and dividend yields (ratio of annual dividend to share price).

- In the early 20th century, higher earnings yield was accompanied by pessimistic growth expectations and higher risk premiums. Today, constant and low earnings yield and darkening growth expectations affect equity valuations.

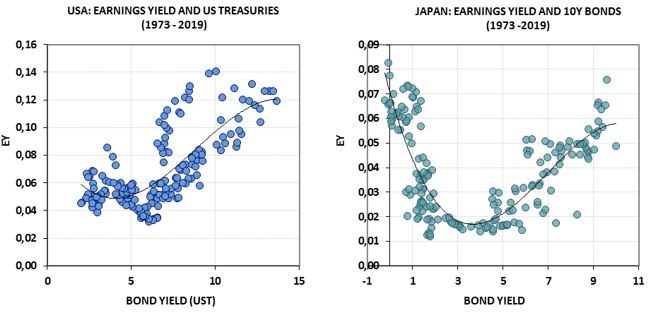

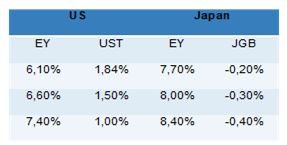

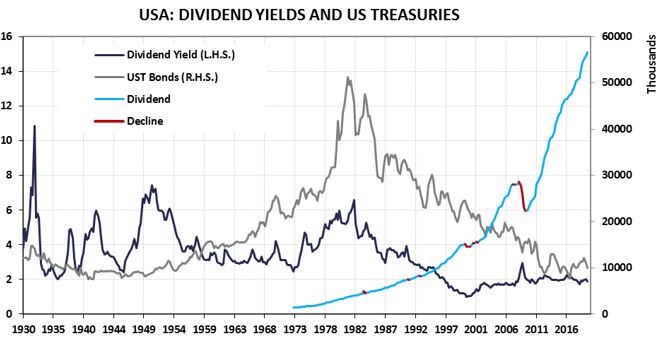

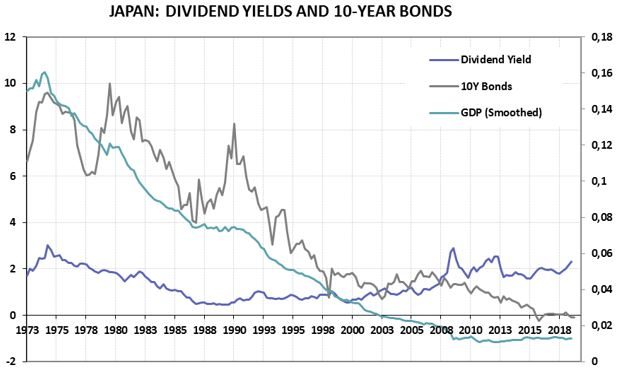

- In the U.S. and Japan, earnings and dividend yields were decreasing simultaneously with interest rates. Nevertheless, they climbed up when interest rates reached a historically low territory. This behavior hints at gloomy growth expectations, suggesting investors need to adapt to the challenging environment.

Following the 2008 Great Recession, central banks around the world have been decreasing interest rates, a sign of concerns about the growth outlook. In the U.S., for instance, long-term nominal rates hit a record low of an average 3%, a level unseen since the end of World War Two. This situation puts investors in a bind as the fixed income asset class increasingly fails to provide their target returns.

However, the conventional wisdom has it that low interest rates can only be good for equities: not only can they increase corporate profits, but they can also decrease the discount rates used to compute the present value of these profits. The fair value of an investment equals the present value of its expected cash flows. So the lower the discount rate the higher the present value of expected cash flows.

However, the theory (see box) tells a different story, and so does the performance of two key metrics used by investors.

First, we look at Earnings Yields - also known as an inverted Price-Earnings (PE) ratio – which show how much a company earns per share. For “return hungry” investors, this is a prominent valuation metric associated with market value gains. In contrast, “income hungry” investors prefer stocks paying high Dividend Yields (ratio of annual dividend to share price) over low-yield bonds.

How have earnings or dividend yields behaved when interest rates have been very low? Two examples from history provide us with interesting field experiments: the U.S. markets during the Great Depression and the Japanese markets in the last thirty years.

What does the theory say?

The Gordon-Shapiro model (GS) helps to sharpen this analysis. In this reference model, a stock is assumed to generate an infinite stream of income (cash flows, earnings or dividends) and its price is a function of three variables:

- The income expected at the end of year 1: Y

- The constant growth rate of income expected g from the end of year 1 to infinity

- The constant discount rate i (which is itself the sum of the risk-free long-term rate of interest and an ex-ante equity risk premium p)

If income is expected to grow at least as fast as it is discounted, i.e. if 1+g > 1+i , then the present value of the successive expected income flows is continuously increasing and the price becomes infinite. For the price of an equity to be finite, the discount rate must, therefore, be strictly greater than the expected growth rate g, i.e. the sum of the risk-free rate and the risk premium must be larger than the expected growth rate.

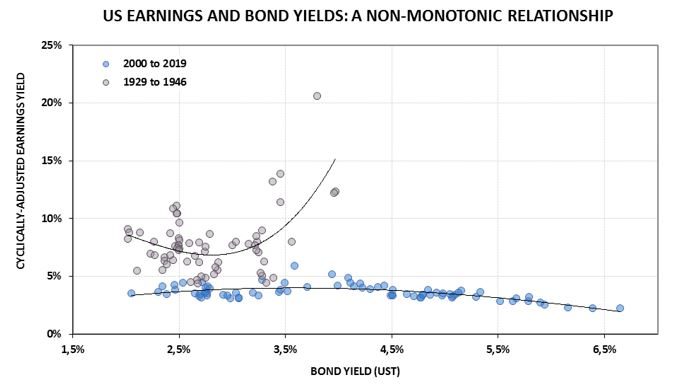

If the discount rate is higher than the growth rate, the discount model can be simplified to yield the Gordon-Shapiro model. After rearranging terms, the earnings yield (i.e., the inverse of the PE) or the dividend yield is shown to be the sum of three variables: the risk-free rate r, the ex-ante equity risk premium p, and the expected rate of growth g. By assumption, this yield can only be greater than zero. The condition r+p > g clearly shows that if the risk-free rate falls, then either the expected growth rate must also fall, or the risk premium must rise. Accordingly, the earnings or dividend yields should not necessarily decrease when interest rates fall. They may as well rise. Yet, conventional wisdom has it that the earnings or dividend yield has only one way to go, namely down when interest rates fall. Having cast some doubt on this assumption from a theoretical point of view, let us now see what historical experience has to say on this topic. Is the relationship between earnings yield and risk-free interest rates really monotonic?

Earnings yield as a gauge of value

The earnings yield is often used to assess whether a stock is cheap or expensive relative to its own history, to other stocks or other financial assets. The more investors expect earnings to grow, the more they are willing to pay for current earnings, and the more they are content with a low earnings yield. Thus, a low earnings yield suggests that the market is optimistic about growth expectations. However, the relationship between earnings yields and interest rates has changed over time, as shown in Figure 1.