- On 5 March 2019, at the key annual session of the National People’s Congress, China’s top legislature lowered the country’s economic growth target for 2019 to 6.0%-6.5%. It also announced a significant fiscal package of RMB4.15tn (5% GDP), including tax and fee cuts (RMB2tn) and infrastructure spending (RMB2.15tn).

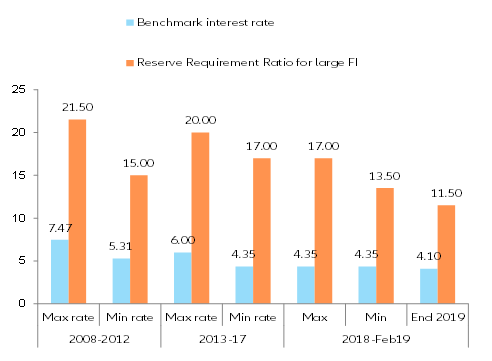

- These developments came as a response to the slowdown in China, and on top of an already generous, targeted and quite innovative monetary stimulus, composed of both cuts in rates, and non-traditional measures to increase lending to small and microbusinesses by 30% in 2019.

- As a result, we expect economic growth in China to accelerate timidly from +6.2% y/y in the first quarter to +6.4% y/y in the second half of the year, as the effects of the private sector-oriented fiscal stimulus could take time to materialize. On the other hand, capital markets are expected to react very positively to the double stimulus, not minding the risks accruing on the horizon.

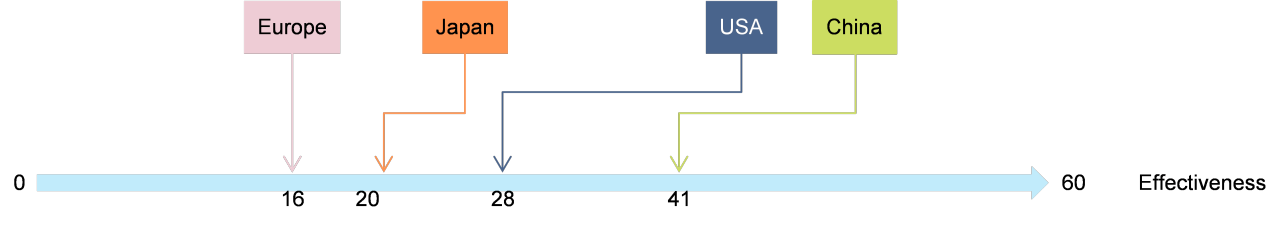

- This stimulus package is unlike previous ones, and transmission channels within China and to the rest of the world will be different. Consumer goods and services exporters from industrialized countries into China could be the main winners, especially as US-China trade tensions de-escalate. On the opposite, industrial commodity exporters and countries with large financing needs in the emerging world may not benefit as much. In any case, as growth in the US and Europe is decelerating, China’s decisive move is more than welcome.

Weaker Chinese growth raised the alarm but it was not that bad after all

On 5 March 2019, at the key annual session of the National People’s Congress, China’s top legislature lowered the country’s economic growth target for 2019 to 6.0%-6.5%. It also announced a significant fiscal package of RMB4.15tn (5% GDP), including tax and fee cuts (RMB2tn) and infrastructure spending (RMB2.15tn).

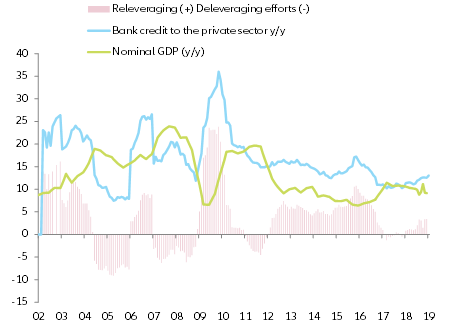

These measures came at a time when worries about a sharp deceleration of activity in China have resurfaced, in spite of past measures to support growth in the second half of 2018. China’s economic growth slowed to +6.4% y/y in Q4 (from +6.5% in Q3 2018) due to moderation in exports and private consumption growth. January-February indicators also point to a weak outlook. While it is true that USD-denominated exports made a remarkable comeback in January (+9.1% y/y after-4.4% in December), imports continued to contract (-1.5% after -7.6%) and auto-sales plunged for a seventh consecutive month (-15.8% y/y). Earlier this year, fears resurfaced about the possibility of a hard landing in China. Past crises such as the Asian financial crisis (1997-98) and the global financial crisis (2008) shaved off more than -0.9pp p.a. of GDP growth. The end-2018 deceleration was not a crisis situation.

Figure 1: China’s GDP growth – a long-term perspective

.png)