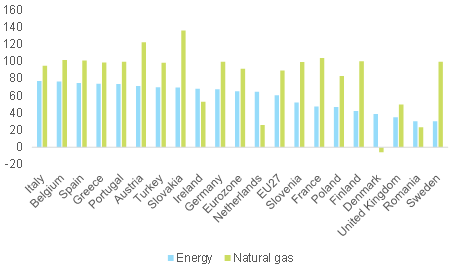

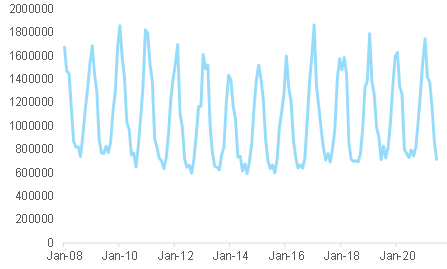

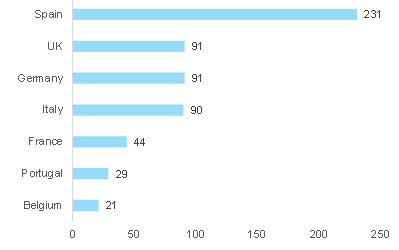

However, small utility companies have already seen financial stress, particularly in the UK. In a very fragmented market (see Figure 10), a number of small UK distribution companies, which buy power on the wholesale market and sell it to final clients but did not hedge their supply while offering guaranteed low prices to customers, have requested government support. As the government has refused to act, some will likely go bust. In a normal year, about seven to eight power distribution companies file for bankruptcy in

the UK; as of October 2021, eight have already done so and the count will likely go higher. However, this situation is not a direct consequence of fragmentation. Other markets are also very fragmented but market participants are managed more responsibly, have the ability to pass on price increases and/or are under a tighter regulatory framework. For example, in Spain, although the market is highly concentrated and there are many small local actors, because most consumers are on dynamic contracts (which allows for daily price revision), they are not in the same situation as small distributors in

the UK.

Germany’s market structure is similar to that of

the UK’s as it chose to liberalize the energy sector in order to create choice for consumers and dismantle monopolies. In addition, there are no utility price caps in Germany and households buy energy in a mostly unsupervised market. As power futures are at very high levels, some distributers and suppliers with fragile cash positions could run into liquidity issues or even become insolvent in the coming months. And as in the case of

UK, firms will not be able to rely on policy support: Recently the Bundesnetzagentur (BNetzA), the German energy regulator, said it was not its role to monitor procurement strategies or pricing mechanisms.

Figure 10 – Power suppliers by countries (2018)