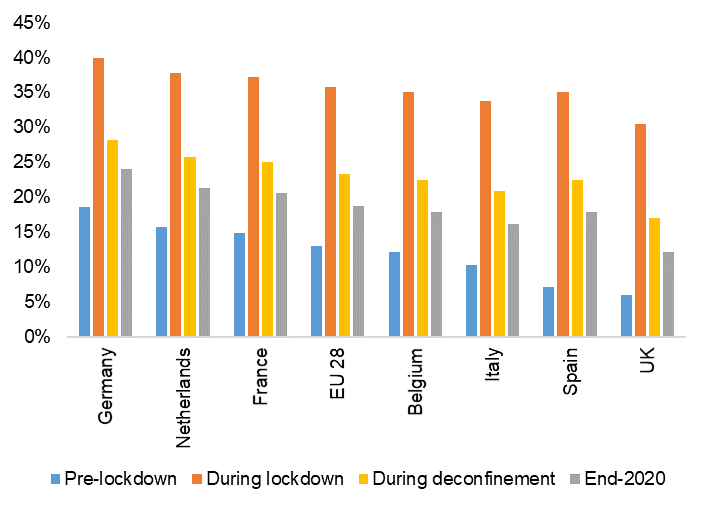

We estimate that in Europe, household saving rates could increase by as much as +20pp to 36% on average in Q2 2020 (see Figure 1). This means EUR1.3tn of additional savings, or 10% of GDP. Total savings could peak at EUR2.3tn. In 2009, savings in the EU28 jumped by EUR100bn, with a total of EUR1.1tn of total savings (annualized) seen at the trough of the crisis.

Covid-19 lockdowns has made consumption in many areas – from eating out to travelling – literally impossible. Private consumption is set to drop like a stone, by an estimated 35% on average during the lockdowns. To add to this, we estimate that 40% of the active population will be placed on partial unemployment, which will in part protect their income, yet lead to a loss of 20% to 40% of their disposable incomes; total household income may thus decline by 8% to 16%. In general, the saving rate would increase by +5pp for a fall of household total income of 5% and a drop in private consumption of 10%.

Figure 1 – Saving rate by country, % of gross disposable income