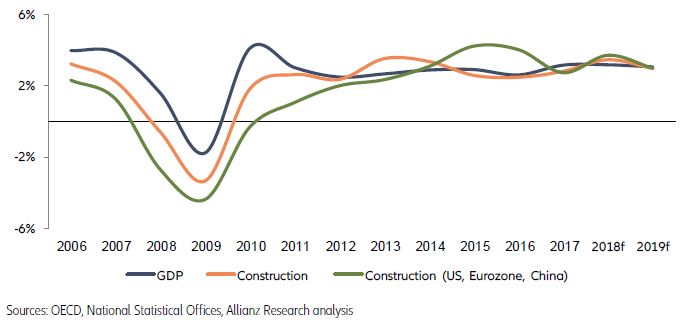

- After ten years of growth (2008-2018), we have reached the peak in the global construction cycle. This year will be the turning point for the global construction industry, beginning to cool down gradually to +3% y/y in 2019, from +3.5% y/y in 2018. Over the past decade, most of the growth came from emerging markets (+57% since 2008), while the developed markets have not even fully regained their pre-crisis volumes. Going forward, slowing GDP growth and tighter financial and monetary conditions will explain the deceleration in the residential sector (+3% y/y in 2019, after +3.5% y/y in 2018, and +4% y/y in 2017). Necessary fiscal discipline and the impetus of e-commerce respectively explain the limited boost to expect from the infrastructure and commercial segments.

- While growing for the past decade, the construction sector did not “repair the roof while the sun [was] shining” to quote J.F. Kennedy. According to Euler Hermes’ proprietary data, on millions of companies across 70 countries, average sector risk ratings for demand, profitability, and liquidity did not improve. As a result, the construction is less prepared for a downturn. That is essential since construction is a crucial part of all economies (advanced and emerging) and plays a role in magnifying or reducing the impact of a cyclical slump. As a first sign of a turnaround, in the first three quarters of 2018, there were 41 large bankruptcies of construction companies (turnover exceeding EUR50m), more than in the retail sector (39).

- Five construction outlooks for 2019:

- The US: Construction to grow by +3% y/y in 2018 and +2.1% y/y in 2019. Residential market shows warning signs. Demand and operating margins below pre-crisis level.

- China: Construction to grow by +4.2% y/y in 2018 and +4% y/y in 2019. Rising leverage and high liquidity risk.

- France: Construction to grow by +1.6% y/y in 2018, and +1.5% in 2019. Weaker demand and operating margins. Liquidity, after a long period of improvement, is starting to show the first signs of stress.

- The UK: Construction to grow by +0.5% y/y in 2018 and +1.5% in 2019. Recovering demand, but crippled profitability and deteriorating liquidity. The uncertainty over Brexit continues to weigh on business and consumer confidence.

- Germany: Construction to grow by +2.9% y/y in 2018 and +2.8% y/y in 2019. Solid demand and profitability. However, liquidity has stopped improving and is showing first signs of deterioration.

The global construction cycle has peaked in 2018

We expect the global construction industry to grow by +3.0% in 2019, after +3.5% in 2018, and +2.7% in 2017. 2018 was the fastest growth rate during the current global construction cycle (2008–now) and quicker than the world economy (+3.2% expected in 2018). However, this year is likely to be the turning point for the worldwide construction industry, meaning that from 2018 onwards growth will begin to cool down gradually, in line with global GDP growth. Indeed, we have reached a peak in the global economic business cycle (global GDP growth of +3.1% in 2019) which means a couple of sectors would need to adapt to an environment of fragile demand prospects and more restrictive monetary and financing conditions.

The cyclical nature of the construction sector has strengthened over the past years, which suggests that the sector growth will be dragged down by the rising interest rates and tighter credit conditions in Western economies (with the Eurozone starting in H2 2019) and the economic growth slowdown in China. They collectively represent close to 55% of the global construction industry. Generally, the duration of a growing cycle in the construction sector averages around eight years, and we are already beyond this length.

Emerging markets (+57% since 2008) have been the main contribu-tors to the growth of the global con-struction industry, as the developed markets have not even fully re-gained their pre-crisis volumes. The volume of goods and services pro-duced by the global construction industry has grown by +23% since 2008, which equals, roughly, a +2% increase per year. That is half the level of growth seen in previous ex-pansionary cycles. This suggests the sector is not in an overbuilding phase, a typical late-cycle feature which could be followed by a strong correction. In addition, such a perfor-mance is worse than that of the global economy, which has been growing at an average annual growth rate of +2.5% during the same period.