EXECUTIVE SUMMARY

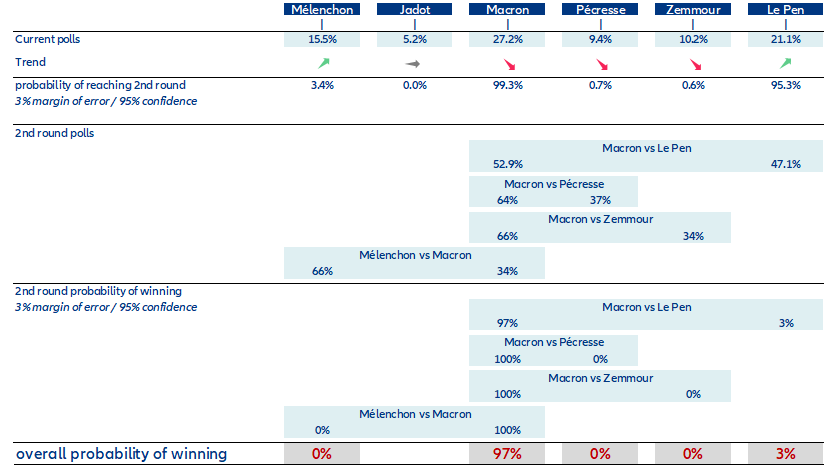

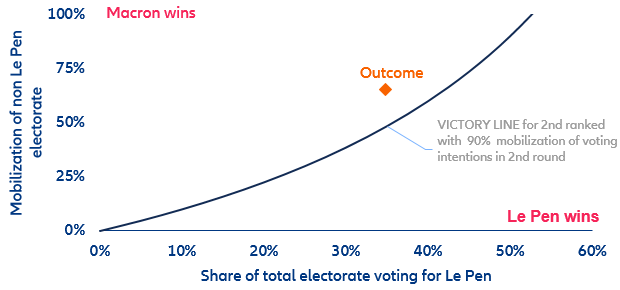

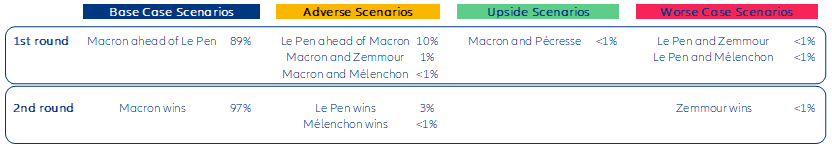

- Is the market underestimating the risk of a surprise outcome in the French elections? Unlike 2017 the delicate phase for investors lies between the first and second round. A significant repricing of the political risk premium could occur in case we see (i) a massive shift in second-round voting intentions against incumbent Emmanuel Macron and/or (ii) a risk of massive abstention.

- Our base-case scenario is a victory of incumbent Emmanuel Macron with a repeat of the 2017 contest against Marine Le Pen in the second round. We expect some temporary spread widening for French government bonds (OAT) between both rounds. However, a victory of an EU-skeptical candidate would carry longer lasting risks for both OAT and peripheral spreads.

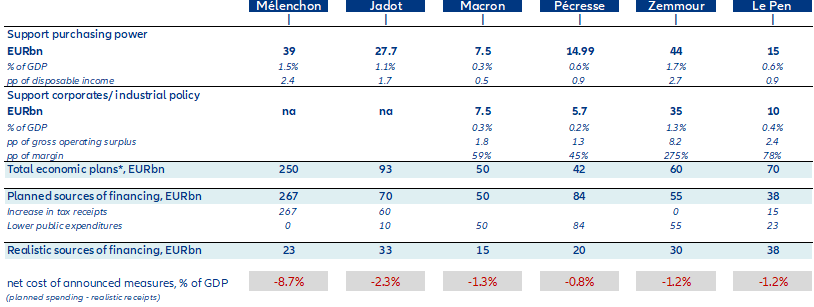

- French government bonds’ semi-core status is not a given and will depend on France’s relative fiscal stance in the Eurozone. While the budget deficit doesn’t show noticeable improvement from the pre-Covid-19 years (-6.5% in 2021, -7% for in 2022) none of the candidates’ programs point to a consolidation course.

Is current market pricing underestimating the risk of a surprise outcome in the French elections?

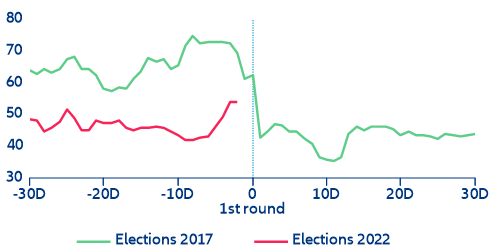

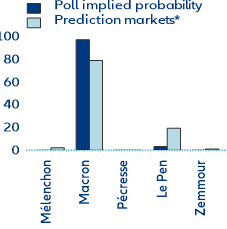

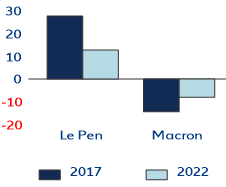

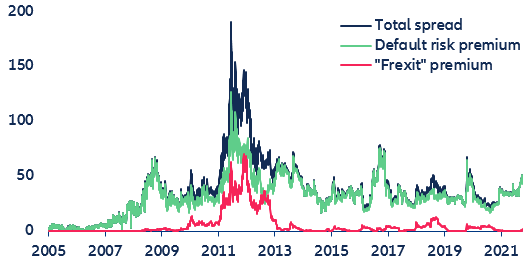

The upcoming Presidential elections in France are taking place in a very different context compared to that seen during the previous elections in 2017. That year marked a peak of political uncertainty in Europe as volatile polls suggested that two EU-skeptic candidates (M. Le Pen and J.L. Mélenchon) had a non-negligible chance of being elected. The possibility of a sovereigntist shift in Europe’s second-largest economy fueled concerns about EU cohesion and even reignited Euro exit fears. The EUR depreciated -5% vs the USD and the risk premia of French government bonds (OAT) increased significantly, reaching the highest value since the Euro crisis in 2012 (Figure 1). Today, despite the recent increase the risk premium of French government bonds remains contained. Europe has become more fiscally integrated with the Covid-19 crisis, and the invasion of Ukraine has reinforced foreign policy, defense, and energy cooperation.

Figure 1: Risk premium of French government bonds (OAT) around elections 10y OAT versus 10y Bund, in bps