Jess Bozzo: I think the topic of risk is a nice segue to our poll.

[Poll presented to audience]

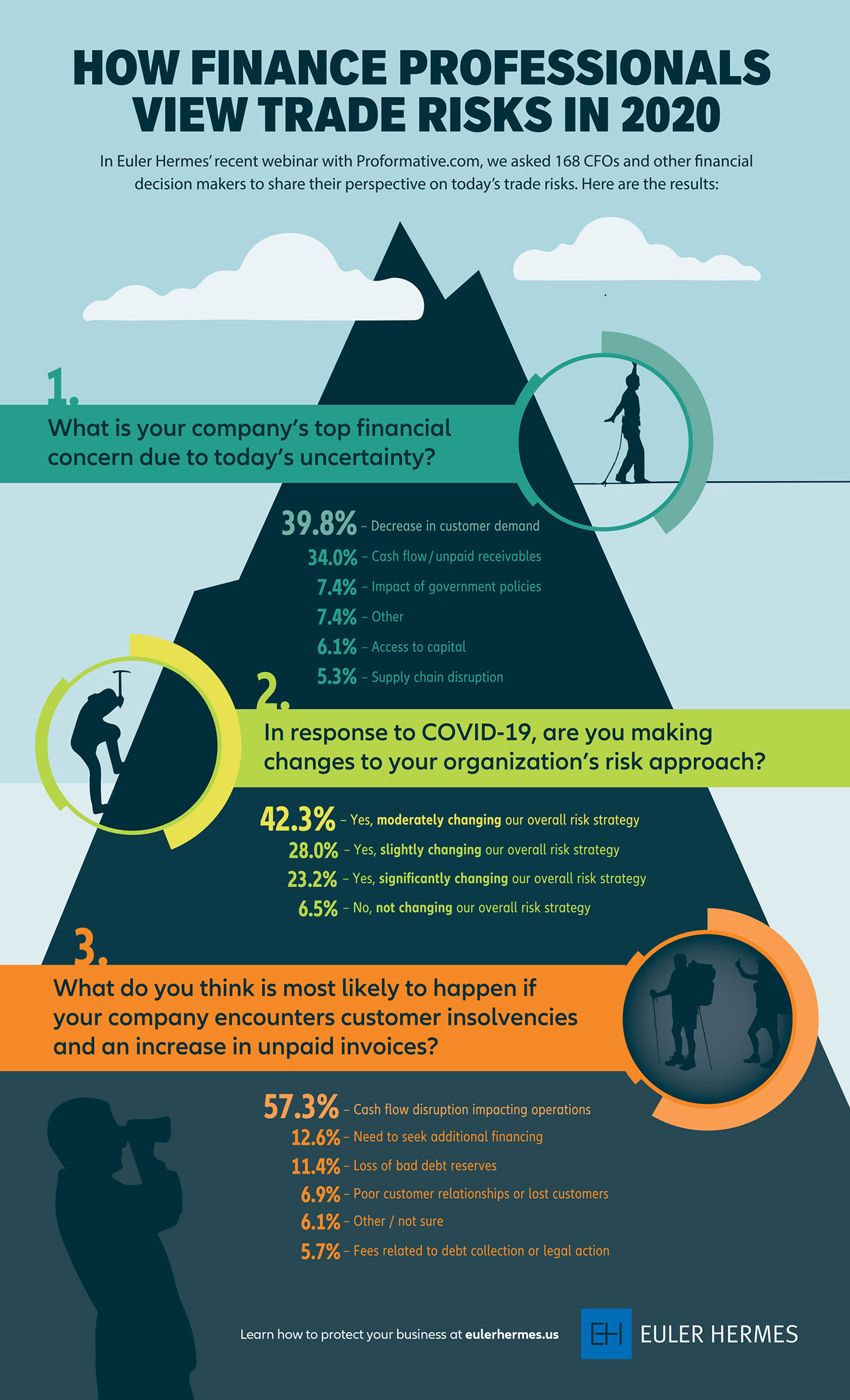

In response to COVID-19, are you making changes to your organization's risk approach?

- Yes, we are significantly changing our overall risk strategy.

- Yes, we are moderately changing.

- Yes, we are slightly changing

- No, my organization is not changing our overall risk strategy

So please go ahead and make your final selection here and then you can scroll until you see the submit button. All right. What we'll do now is go ahead and take a look at the responses here.

[Poll ends]

Let’s see. It looks like the most popular answer, James, here, a little over 43% is “Yes, we are moderately changing our overall risk strategy” Any thoughts here, James?

James Daly: Yeah, I'm a little surprised. I would have thought that we'd have more select the first one – significantly changing their risk strategy – because really and truly, what to me, the biggest challenge we face now is, yeah, we're right now living in the lockdown and we're managing that lockdown, but we've got to come out of this. It's often called “The After.”

And the way that we look at the world in the office is going to be very different.

I mean, in Euler Hermes, it's our business to analyze data information, to calculate risk. And that's completely changing in the short-term. And so if I have to take a risk on, I have to ask “Do I sell to this company now? Do I sell to this company tomorrow coming out of the crisis?”

The models I would have used pre-crisis as a credit manager or a CFO may have no relevancy.

And so therefore, what data, what KPIs am I going to be configuring to make those risk decisions? They're going to be very different.

So, you know, a little bit surprised, but maybe people are feeling that the world will return to normality more confidently than I do. But I do believe that the world that we face post-COVID is going to be very different.

Jess Bozzo: Thank you, James, for weighing in there. Would love to continue on here. So this recession is different than others because it largely stems from government-mandated shutdowns for public safety. We're all hoping that means a fast recovery. How do you think CFOs can best prepare their companies to start growing again when the recovery starts?

James Daly: That's a great question. I think, again, it goes back to asking: Where is the demand? And you know, unfortunately, there's going to be some companies where that demand is gone and will be gone for some time now.

If your sole business was to provide services into the cruise liners or the airliners six months ago, that demand is probably gone for now. So that's one end of the spectrum. Whereas if you were making paper and sundries packaging, that demand is at unprecedented levels.

As the CFO or the CEO of an organization, you need to understand where you're at, where that demand is in your supply chain. And if that demand is diminished to a point where it's impractical to continue, then you need to adjust your business model to accommodate work, to make sure that everyone's safe.

But unfortunately, I think there are going to be a number of businesses out there that just can't make it.

And that's one of the reasons Euler is here: we're trying to help protect those companies that can't make it and help our customers navigate through this new world.

But, you know, it's going to be extremely challenging. Seventy percent of the US economy is driven by consumers buying stuff. And people are buying a lot less of what they were buying previously and they're buying in different patterns now, and those patterns will normalize.

It's really important to understand how that demand will move over the next 6 months, 12 months, and it's really going to be a journey. And it's going to be difficult to navigate, which is why people and companies like ourselves exist – to help people get through these difficult times, Jess.

---

Jess Bozzo: Absolutely. I think that’s a nice place to kind of wrap up and close out. Do you have any closing thoughts or advice for CFO and other business leaders? Anything else you would you would share, James?

James Daly: Yeah, there's the old adage, “Cash is king.” Cash management is going to be a critical. Making decisions that could destroy that cash right now is what should be avoided at all costs.

And you know, as I said before, communicate, communicate, communicate.

Jess Bozzo: Absolutely. Thank you so much, James, for having this great discussion with us today. Really appreciate it.