I need help with commerical debt collection. Do you offer this service and how can I add it?

What would you like to learn about?

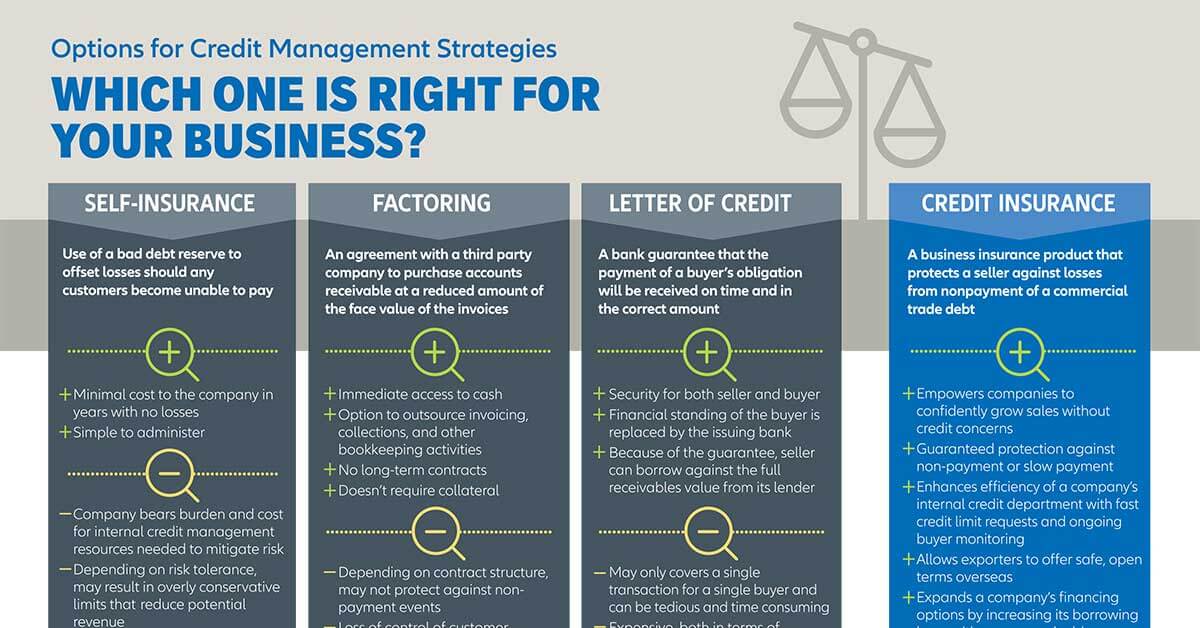

Understanding Trade Credit Insurance

Want to see if trade credit insurance might be worth it for your business?

Customer Credit Management Techniques

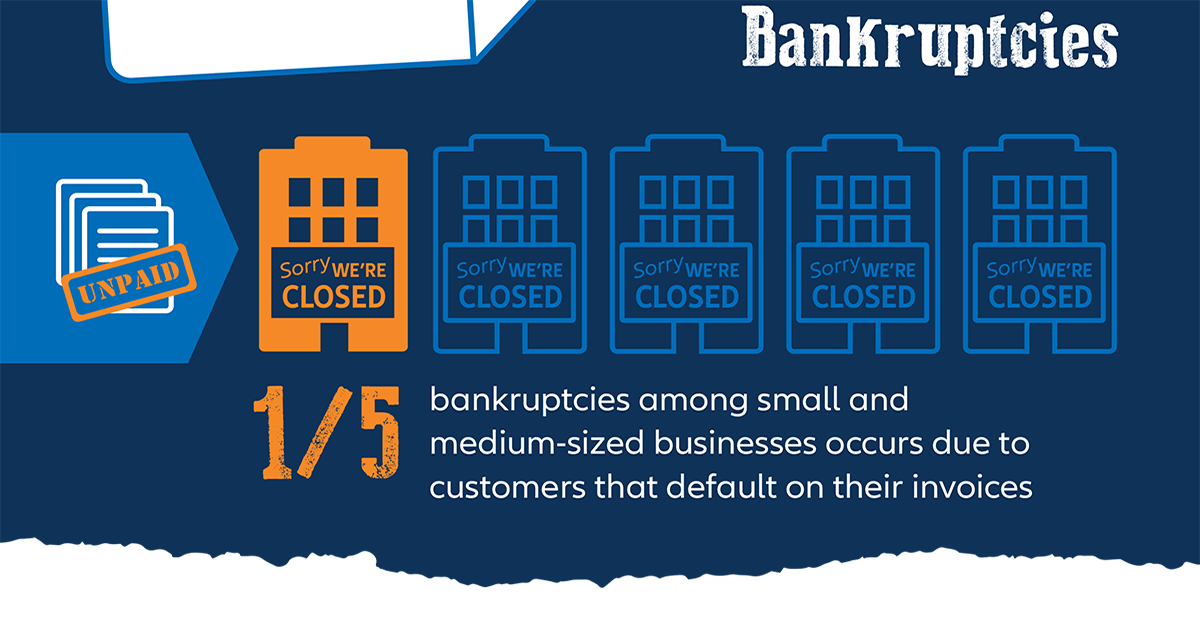

Bad Debts, Late Payments & A/R Protection

Tell us about your customers, and we'll tell you about the trade risks... and opportunities.

International Trade & Export Risk Management

FAQs for Current Customers