Anyone looking at your financial reporting – for example banks, potential investors, customers – will want to know what you’re doing in relation to CSR (Corporate Social Responsibility) and ESG (Environmental, Social, Governance) issues and may downgrade their judgement if they don’t like what they see.

Customers could go elsewhere. New payment risks could come from more difficult access to financing for companies with higher carbon footprints. Assets could be at risk of stranding because of regulatory decisions.

Your own reporting should include an account of your company’s performance in Environmental, Social, and Governance matters that have an impact on your company’s performance.

Social criteria

Governance criteria

But beware when presenting extra-financial information:

- Be sure the statistics you present are accurate and believable.

- Ensure the results linked to ESG matters can be traced back to your KPIs.

- Make sure your own governance in practice matches what your ESG report says in theory.

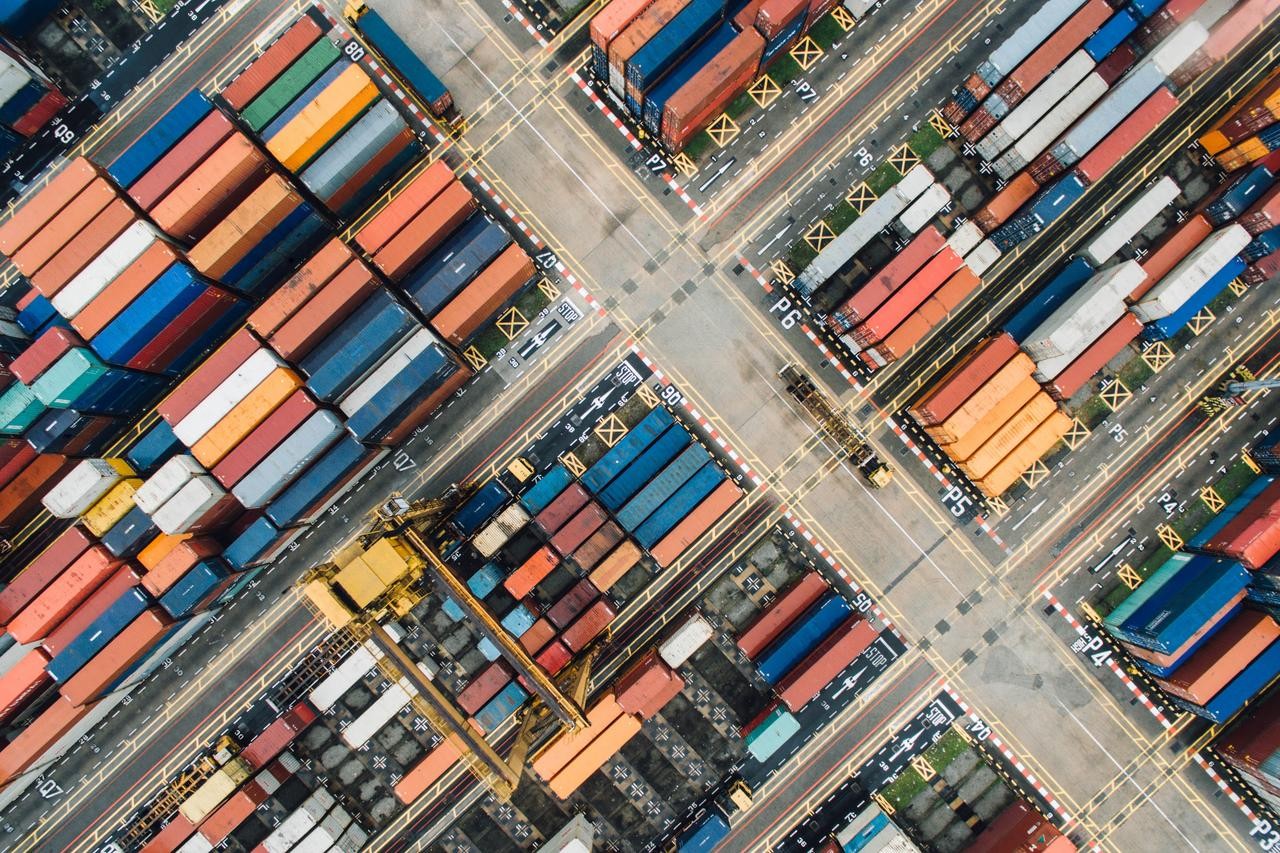

Recently several severe extra-financial events have affected businesses globally. Out-of-control forest fires in Australia and California destroyed millions of acres of property and nature; a deadly cold spell across Texas crippled the world’s energy industry, a massive cargo ship got stuck in the Suez Canal and shuts down world trade for six days at a cost of $9B a day, according to Lloyd’s List.

The economic ripple effect of delay and destruction caused by these extraordinary events are hard to calculate, but the correlation between non-payments and extra-financial events is clear. Severe climate-related events can disrupt supply chains and can lead to non-payments and insolvency.

These are the kinds of issues over which you have no control, but which will impact your company’s growth, market share and profitability. And you need to account for them in your financial analysis. But it’s tough. “There is generally no good formula for this kind of analysis,” says Nicolas Marchenoir, former Head of Risk at Euler Hermes Energy and now Head of Commercial Underwriting at Euler Hermes France. “But it does not mean that you should not take it into account: consider it as a wild card. Climate change is not a black swan event; we know it’s real.”

How to assess this kind of risk is the role of risk analysts. Numbers can be calculated by a computer, faster and maybe more accurately. But as Nicolas says: “The risk analyst’s added value is not just KPIs, but the ability to look at all of the numbers in an ecosystem, including climate change, ESG issues, ownership and strategy of a company. The credit analyst makes sense of the numbers and understands the business of the company.”

In June of 2020, we became the first trade insurance company to include ESG indicators for all ESG-related issues into our rating methodology to help the companies we serve analyse and evaluate the sustainable development and long-term issues deployed in their strategy.

The rating augments our country ratings with a set of indicators related to environmental sustainability coupled with sentiment analysis drawn from social media to ascertain political risk. (Governance issues such as regulatory and legal frameworks are already part of our country ratings since 2003).

“ESG matters were not thought of before,” says Nicolas Marchenoir, Head of Energy Risk at Euler Hermes. “Now they’re key considerations, and any company that doesn’t take these into account is taking the risk to fail in the next ten years or less.”

For more tips and advice on business financial monitoring, download our ebook: Boost your financial performance analysis.