Taking it one step further

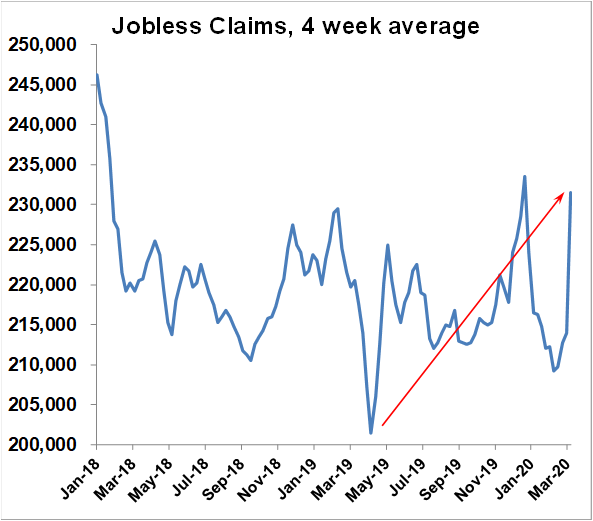

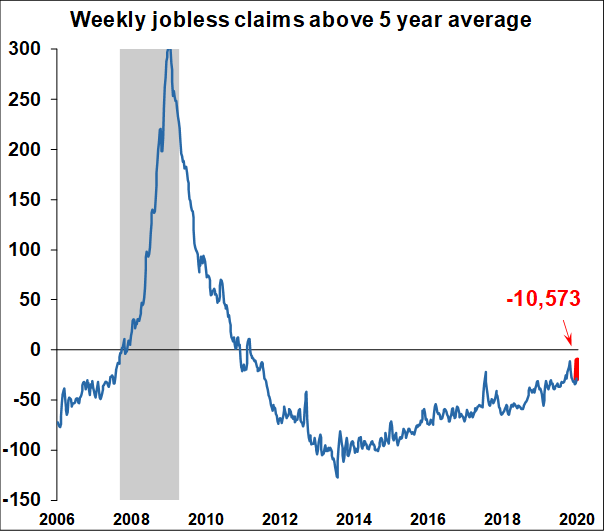

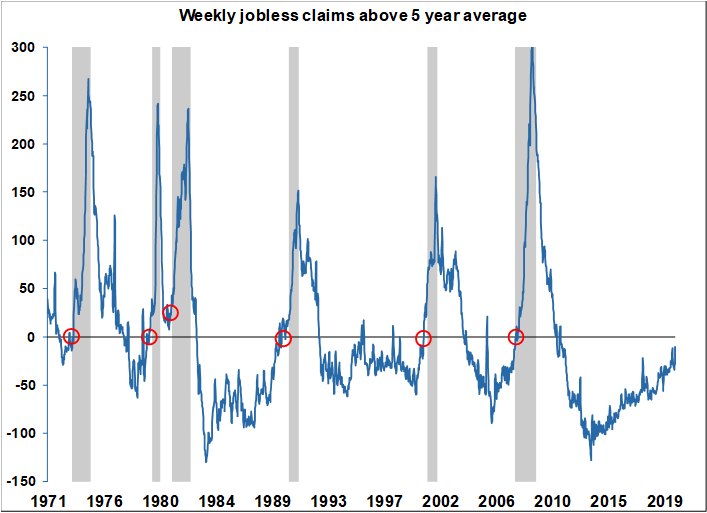

2,000,000 unemployed people would raise the unemployment rate from 3.5% to around 4.8%, an increase off the bottom of 1.3%. And guess what, when the unemployment rate rises 0.5% off of the bottom, that is a perfect recession indicator.

But there is good news here, really. That increase in jobless claims was not because the economy was just winding down at the end of the business cycle, it was because the government made businesses shutdown. And the government can allow businesses to open back up, and it surely will, and most of those unemployed people will go back to work again. If the economy had wound down by itself, it would be much harder to re-start it and put those people back to work. In fact, the last time it took over 6 years for the economy to organically re-create all the jobs it lost in the recession. It will happen much more quickly this time. For example, when the government says “Okay you can open the restaurants now” almost all the employees will immediately return to work. Of course, some restaurants will have permanently closed because of the shutdown, so those employees won’t return to the workforce as rapidly, but in general, the economy will be able to restart relatively quickly. And that’s even more good news because our central scenario is that while H1 will be very difficult, we expect a U-shaped recovery later this year.

Even more good news is that the government is in the process of constructing a nuclear-powered response to this disruption. On the monetary policy side, the Federal Reserve seems to be coming up with a new program almost every day to keep money flowing and the credit markets working:

- March 3rd: cuts interest rates 50 bps

- March 11th: increases repo offerings from $200 billion to $500 billion (a repo is a type of loan to banks and other financial institutions)

- March 12th: offers a new $500 billion three month repo

- March 13th: offers a new $500 billion three month repo

- March 13th: offers another $500 billion one month repo

- (March 13th: Continues to offer at least $175 billion in overnight repos and $45 billion in two-week operations)

- March 13th: Announces it will modify its $60 billion of purchases per month from short term T-bills to include longer-term bills, notes, inflation-protected securities, and other securities

- March 15th: Announces plans to increase Treasury holdings by $500 billion, and mortgage-backed securities by $200 billion.

- March 15th: cuts interest rates 100 bps to a range of 50bps-0bps.

- March 15th: Announces coordinated action with the central banks of Canada, Japan, England, Switzerland, and the European Central Bank, to enhance the standing U.S. dollar liquidity swap line arrangements

- March 16th: Encourages banks to borrow at the Discount Window

- March 17th: Encourages banks to use capital and liquidity buffers, reduces reserve requirements to 0%.

- March 17th: Establishes a $10 billion Commercial Paper Funding Facility (CPFF).

- March 17th: Establishes a Primary Dealer Credit Facility (PDCF)

- March 18th: Establishes a Money Market Mutual Fund Liquidity Facility (MMLF)

- March 19th: Establishes temporary U.S. dollar liquidity swap arrangements with nine other central banks

- March 20th: Coordinates actions with major central banks to enhance liquidity and increases the frequency of swap lines from weekly to daily.

- March 20th: Extends MMLF to include state and municipal money markets

On the fiscal policy side, Congress and the Treasury aren’t moving quite as fast, but the proposals under consideration will surely provide a boost and help keep struggling families and businesses afloat:

- March 5th: $8 billion to fund health agencies

- March 18th: $100 billion for emergency paid leave and free coronavirus testing

- March 20th: IRS moves tax filing and payment deadline from April 15th to July 15th

- As of this writing on March 20th, an approximately $1 trillion package is being negotiated in Congress, including:

- Direct payments of $1,200 to adults, $500 to children (phasing out on a scale to $0 for incomes of $99k individually, $198k household)

- Changes in the tax code to reduce burdens

- Increases in Medicaid support to states

- Deferral of student loan payments for three months

- $300 billion for small businesses

- $150 billion for large businesses

- Loan forgiveness for businesses keeping workers on the payroll

- $200 billion to the Fed and secured lending to airlines and other critical industries

- 50 billion for passenger airlines

- $8 billion for cargo airlines

- Boeing is asking for $60 billion

- Hotel and travel industry asking for $250 billion

- U.S. Conference of Mayors asking $250 billion to help stop the spread in cities

- There are many other provisions possible

So is this $1 trillion dollars package a lot? It’s a massive 21% increase over our current budget outlays of $4.7 trillion dollars a year. And it’s likely to get bigger. That’s good news.

And there’s more good news. According to FasterCures, the Milken Institute’s Center for Accelerating Medical Solutions, there are currently 94 different vaccines for COVID-19 under development, and a handful is even in trials already.

Finally, remember that the U.S. is the world’s largest economy, with the world’s reserve currency, a central bank which appears to be able to print an almost unlimited amount of money, a Treasury which has enormous borrowing and spending capacity, innovative businesses, and as a result, the economy will re-emerge – good news. Now if we could just sing like the Italians….