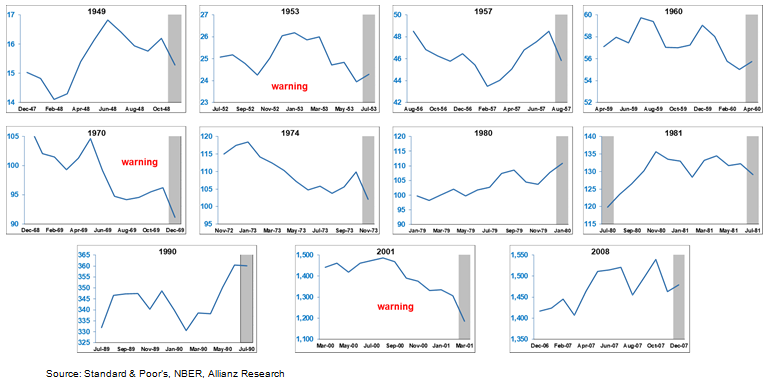

Despite some bumps along the way, 2019 was a solid year all around for the economy, for business, for the consumer, and for the financial markets. For 2020 however, while we expect positive growth, it will be markedly slower. We may even experience a quarter of flat or negative growth, but the odds of a recession are waning.

One of the major supports for the economy for the entire recovery has been somewhat overlooked because it has become the “new normal”, and that is low-interest rates and low inflation. It’s hard to imagine now in a world of stable 2% inflation, but in 1974 inflation was running at 12% y/y and in 1984 it reached 15%. Mortgage rates which are now less than 4% reached an unthinkable 19% in 1981. It’s also hard to overstate the beneficial effects to consumers and to businesses of low and stable inflation and interest rates, even if savers and lenders are somewhat less well off. And the best news is that low inflation and interest are likely to continue on and support the 2020 economy.

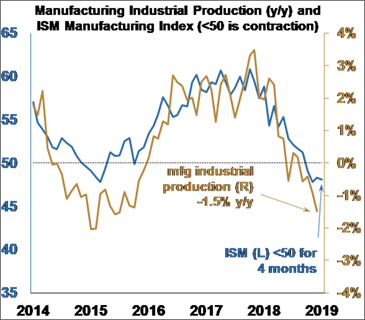

It’s also hard to overstate the importance of the services sector which comprises about 80% of the economy. Historically services have not only grown faster but have also been more stable than the goods sector, offering a solid foundation for growth. That was certainly the case in 2019, and again, given its stability, we expect that to be the case in 2020 as well.

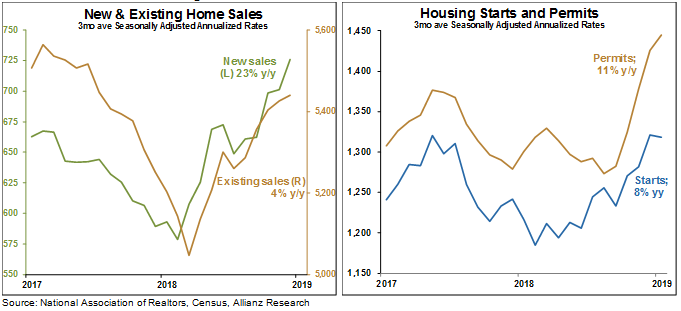

The housing market, which was a drag for part of 2019, has seen a sharp rebound over the past few months. Sales, starts, and permits have all taken a leg up, largely due to lower mortgage rates which declined throughout 2019.