It’s a big news day.

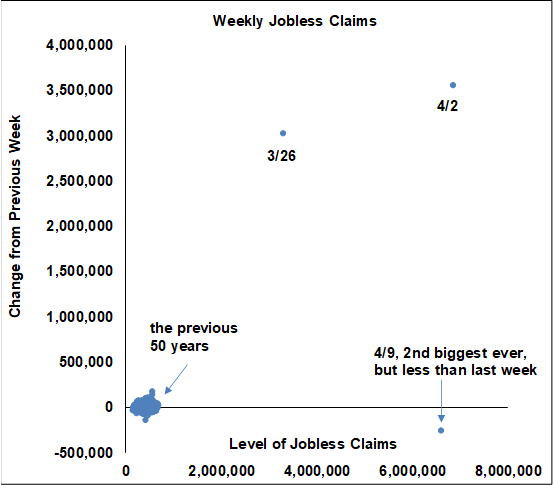

Weekly jobless claims in the US hit 6,606,000, just a bit less than last week’s 6,867,000, which again was almost 10 times as much as the previous record (before the last 3 weeks).

Weekly jobless claims in the US hit 6,606,000, just a bit less than last week’s 6,867,000, which again was almost 10 times as much as the previous record (before the last 3 weeks).

The moment after the jobless claims data was released, the Federal Reserve unexpectedly announced details of the Main Street Lending Program and a whole new set of loan facilities, with a total value of $2.3T. That’s a massive 10.6% of GDP and is a bit more than the CARES act just implemented by Congress. We thought the Fed had already gone “all in” but it continues to signal that it will create all kinds of unprecedented programs and essentially provide almost unlimited support to the economy.

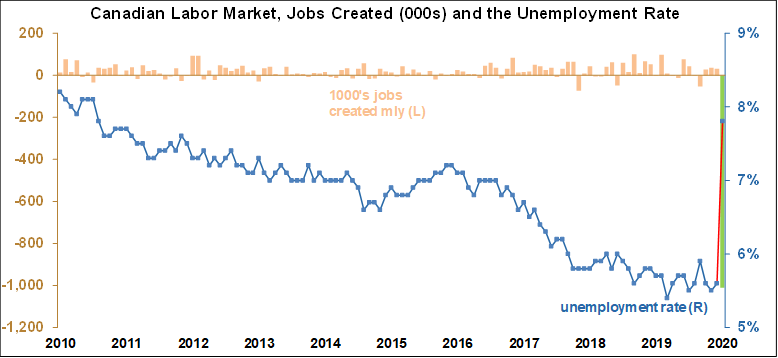

The Canadian government released its March employment showing worse than expected results.

In summary, we have US employment news about as bad as expected, Canadian employment news somewhat worse than expected and the Fed announcing even more lending support including directly to businesses and states. Therefore we maintain our U-shaped recovery scenario, with Q2 GDP loss of as much as -30% q/q annualized in both the US and Canada. However massive fiscal and monetary policy support, plus perhaps progress on COVID-19, suggests a strong recovery in Q3 and Q4.

In the meantime, an excellent new study from our colleagues in Paris concludes that insolvencies in the US are expected to rise by 25% this year. That’s a lot but it’s not as much as the 47% in the Great Recession.

Once again, we know the economic data will be ugly, so don’t be shocked when you see it, and you already know we will be going through a tough time in the economy, and now you know insolvencies will rise sharply. But we will recover.