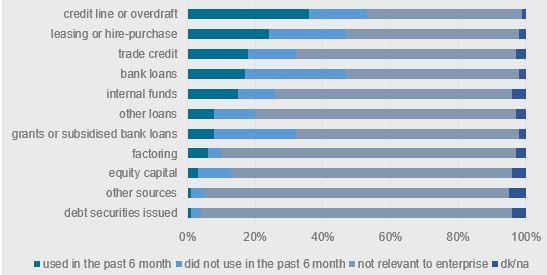

Source: ECB. June 2018. Survey on the Access to Finance of Enterprises in the euro area - October 2017 to March 2018.

As a result, the bank loan financing gap in the Eurozone reduced from 6% of GDP in 2015 to 3% of GDP in 2019, according to a joint study of Euler Hermes Economic Research and TRIBRating. This is closer to though still higher than the 2% of GDP seen in the US.

However, being dependent on bank financing in particular makes SMEs vulnerable to restrictions on lending, which could arise due to regulatory changes. This could widen the bank loan financing gap in the future.

Regulatory changes reduce banks’ willingness to lend to SMEs and increase funding costs

Bank lending policies are significantly affected by capital adequacy regulations. This regulatory framework was significantly strengthened and fortified in Europe following the financial crisis in order to sustainably improve financial stability. Its key components include the Capital Requirements Regulation (CRR) and the Capital Requirements Directive (CRD IV).

The new regulatory framework will raise barriers to bank lending to SMEs through the finalization of Basel III and the implementation of Basel IV. For example, Basel III will increase the minimum capital requirement from 8% to 10.5%. We believe this could also impose higher financing costs and/or stricter collateral requirements, particularly among SMEs with below-average creditworthiness. We estimate that funding costs may increase by more than 100 basis points by 2022 for companies with low credit quality.

However, banks can still benefit from rules that reduce capital charges for loans to SMEs. The “SME Supporting Factor” (SME SF), for example, reduces capital requirements for SME loans by nearly one quarter, or approx. 23.81% (factor: 0.7619) (exposure to SMEs pursuant to Art. 501 CRR). This is a valuable tool for protecting and increasing the flow of bank credit to SMEs.

We believe the SME SF has the potential to counteract the possible negative repercussions of increasing minimum capital requirements. However, it currently only applies to loans worth EUR 1.5 million or less. This concerns 30% of total new loans to corporates in the Eurozone but 47% in Italy and 53% in Spain (against 30% in France and 18% in Germany). This suggests that the impact could be higher in Southern European countries.

The amendment to the CRR (CRR II) from the end of 2016 aims to provide even more regulatory relief for SME lending. For example, it reduces the SME SF and thus the capital requirements even more (factor: 0.7612) and extends it to larger loans (> EUR 1.5 million), meaning even more SME loans could qualify for lower capital requirements. However, larger loans receive less relief since capital charges are reduced by only 15% (factor: 0.85).

Alternatively, it may be possible in certain circumstances to classify SME loans of EUR 1 million or less as retail exposures. These SME loans will benefit from a lower risk weight of 75% in the standardized approach or a less strict correlation calculation in the IRB approach, which has a positive impact on risk weights. Finally, exposures that qualify as being exposures to corporates can be subjected to a lower risk weight depending on the company’s size (annual turnover up to € 50 million).

In a context of regulatory tightening on bank lending requirements, it’s clear that SMEs need a greater variety of financing options so they can become less dependent on bank financing. The planned EU Capital Markets Union would do just that by making it easier for SMEs to tap alternative sources of funding.

Easier access to alternative sources of funding with EU Capital Markets Union

The EU Capital Markets Union is a European Commission initiative designed to spark growth and increase employment in Europe. One of its main goals is to improve the access to finance for European SMEs, particularly with respect to equity and venture capital, by removing barriers in capital markets. The action plan, which was published on 30 September 2015, addresses not only improving access to finance through public bond and equity markets but also a wide variety of funding options for companies. By June 2017, about two thirds of the 33 measures announced in the CMU Action Plan had been implemented. The framework for the implementing the objectives of the CMU implementation is planned to be completed by the end of October 2019. However, its finalization could take longer than expected, given that the topic is not a priority for all the mainstream European parties which are expected to form a coalition following the May 2019 elections (See: European elections: What a fragmented parliament means for the EU’s priorities.)

The CMU aims to create a true single market for capital. To achieve this aim, the Commission has defined six primary objectives:

- Remove barriers

- Improve access to financing

- Diversify funding

- Help SMEs raise finance more easily

- Help the EU attract investments from all over the world

- Support economic growth and job creation in the EU

Some progress has already been made with regard to securitisation, which can unleash important funding potential for SMEs, and the modernisation of the Prospectus Directive, which requires the initiation of special consultations involving the European public.

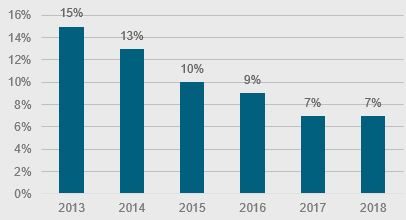

Another declared goal is to enable SMEs to tap more funding sources and thus diversify their financing. The European Commission wishes to reduce reliance on national banks and encourage cross-border finance, in large part because banks reject around 13% of the loan applications filed by SMEs because their credit risk does not meet the banks’ desired risk profile.

Fundamental requirement for the CMU: public availability of SMEs’ financial information

Approximately 20 million SMEs do business in Europe, but only around 3000 are listed on a stock exchange. Typically, listed companies make their financial information available on a regular basis. We believe SMEs’ access to capital markets can only be improved, or the investor base broadened, if credit and financial information is made publicly available. Banks, institutional investors and retail investors have to be able to properly assess the credit risk. A generally valid set of standard, readily comparable information used to assess credit risk could help mobilise more funding for SMEs.

This does not mean, however, that SMEs should be burdened with excessive reporting and information obligations. It is important to reduce regulatory barriers and the costs of issuing equity and debt instruments. At the same time, investors should be able to rely on efficient market conditions and transparent products. The latest revision to prospectus law (EU Prospectus Regulation as of July 21 2019) aims to achieve these goals by making it easier for SMEs to raise funds in capital markets. For example, offers of securities to the public worth EUR 10 million or less will be exempt from the obligation to publish a prospectus if the securities are not admitted to trading on a regulated market. In addition, simplified EU growth prospectuses can be published by SMEs and MidCaps with an average market capitalisation of EUR 500 million or less.

While progress has been made in various areas in implementing the CMU in recent years, the original goals of the Capital Markets Union have not yet been attained. As a result, European SMEs reliant on bank financing need to look at other sources, particularly direct lending.

Importance of direct lending grows as a funding alternative for SMEs in recent years

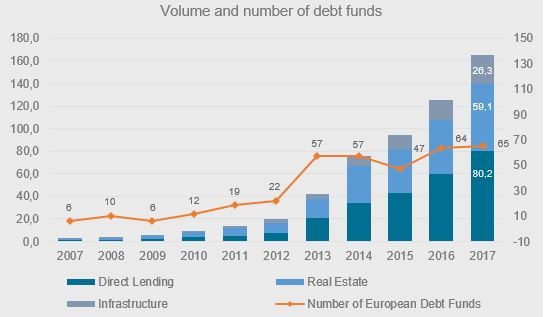

Direct lending to companies by private and institutional investors from outside the banking sector has grown in importance in recent years as an alternative to bank financing. Debt funds are still less constrained by current laws than banks. Direct lending funds in Europe are experiencing rapid growth as they catch up to their counterparts in the US, where debt funds have played a significant role for some time.

Fig. 3: Development of volume and number of debt funds in Europe