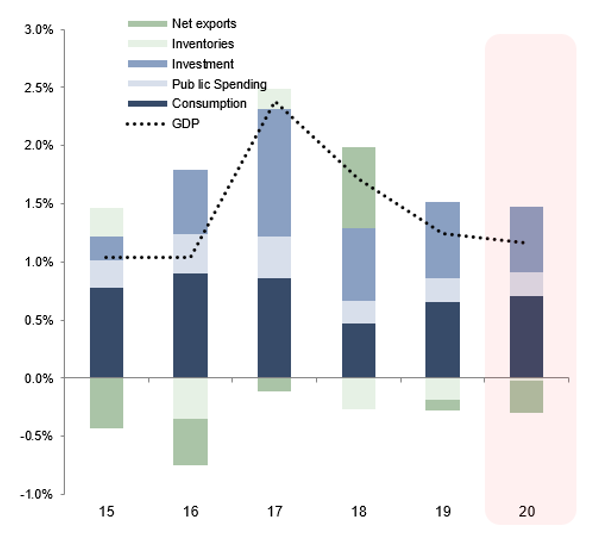

French GDP declined by -0.1% q/q in Q4 2019, below expectations. Household consumption decelerated at 0.2% q/q in Q4 2019 compared with 0.4% q/q in Q3. Data released by large retailers and anecdotal evidence from trade associations suggest that retail sales could have declined by as much as -5% for food specialists and -10% for specialty retailers because of December strikes. The industry has made clear that e-commerce sales did not compensate for the decline in physical stores footfall. The adverse impact on December sales is all the more impressive than December 2018, already marked by the Yellow Vests movement. We estimate the impact of those strikes around -0.1pp in Q4 2019.

All in all, social tensions throughout 2019 could have cost -0.2pp of real GDP growth in 2019. Change in inventories significantly contributed on the dowside to growth in Q4 2019 mirroring the ongoing impact of both external and domestic uncertainties. Political uncertainty[1] in 2018 and 2019 may have cost as much as -0.2 percentage points of growth throughout 2019; it could cost another -0.1 percentage point in 2020, should social climate remain the same in the coming months. In 2019, economic growth was resilient, and in-line with the Eurozone average at +1.2% in 2019. Despite a tense social climate, consumer spending has been the main driver of growth throughout the year (+1.2% compared with 0.9% in 2018) supported by ad hoc purchasing power measures (EUR17bn of emergency social spending).

French corporates took advantage of low interest rates, fruitful structural reforms and increasing attractiveness as mirrored by strong FDI, which continued increasing at healthy pace in 2019 despite challenging external conditions. The French corporate sector financed more investments, with a focus on digital, as non-residential investment grew by a strong +4.2% in 2019 (compared with 3.9% in 2018), the highest pace of growth since 2017. However, French corporates were not immune to global uncertainties, which pushed inventories to unusually high levels. Their ongoing adjustment shaved -0.4pp to Q4 GDP growth. In terms of external performance, France showed resilience too as exports grew by +1.8%, driven by good performance of the aircraft and chemicals sectors. Overall, net exports shaved -0.2pp to 2019 real GDP growth on the back of solid domestic demand, which supported imports (+2.3% in 2019).

We expect GDP to grow again by 1.2% in 2020. French real GDP growth is likely to remain above Eurozone average in 2020 at +1.2%, and be twice as high as German growth. Firstly, households are likely to spend at a slightly higher pace in 2020 (+1.4% versus +1.2% in 2019) mainly thanks to higher real purchasing power in a context of muted inflation (1.5% in 2020), lower unemployment rate (8%, the lowest level since 2008) and benefits from the transmission of a still positive fiscal impulse. The low interest rate environment, coupled with improving labor market conditions, will support residential investment, expecting to be stable at +2.1% in 2020, after +2.2% in 2019.

Companies: profitability, exports, and financing at risk. The end of the CICE (replaced by reduced social contributions) will have a corrective effect on corporate margins (-0.8pp). Combined with upwards wage pressures (labor costs increased by 2.3% y/y in October 2019 in the manufacturing sector) and muted growth, we expect margins to decrease to 31.4% in 2020 (-1.3pp compared to 2019). In addition, weak trade will affect more extensively French exporters. We expect only EUR8bn of new export gains in 2020, half that of 2019. Last, lower self-financing capacity coupled with very low interest rates should continue to stimulate corporate debt growth in 2020 (+2pp to 76% of GDP). As a result, we foresee a deceleration of corporate investment at +2.3%, slightly below its long-term average.

[1] In order to stimate the overall cost of political uncertainty, we estimate the reaction of the French GDP growth to a shock of one standard deviation based on the French Political Uncertainty Index (EPU). The EPU mirrored a climax of uncertainty in Q4 18 and no signifant improvement thereafter.