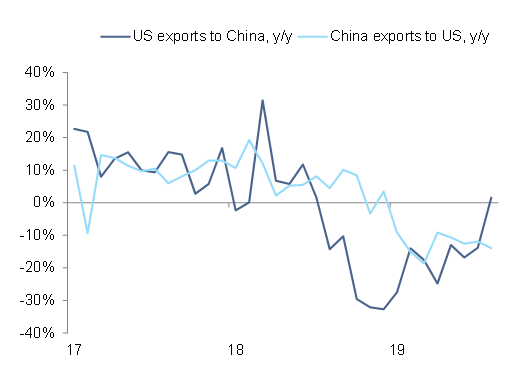

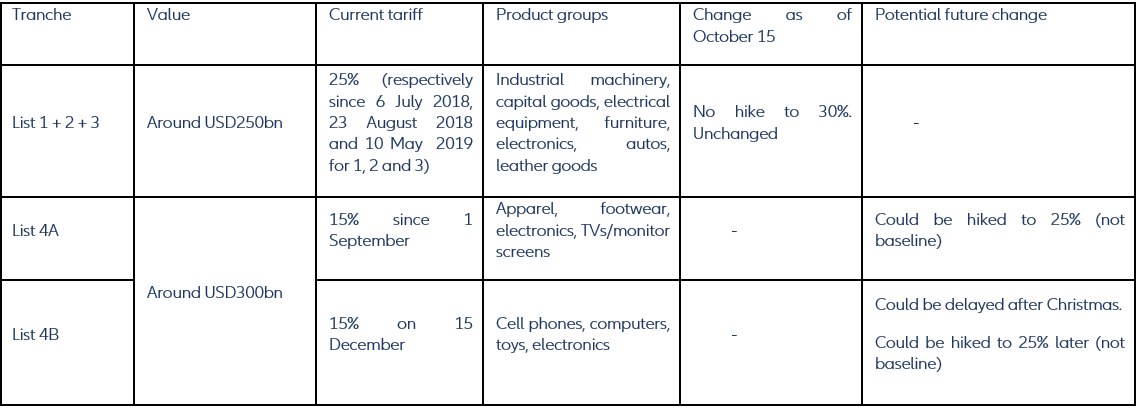

- The so-called “mini-deal” between the U.S. and China is not a game-changer for the global economy. The U.S. average tariff could reach around 8.5% by year-end (taking into account a 10% tariff on EU car imports and the 15 December round of tariffs on Chinese goods). We remain in our intermediate “Trade Feud” scenario; policy volatility is the new norm in trade negotiations, and it goes beyond tariffs (ban lists of companies).

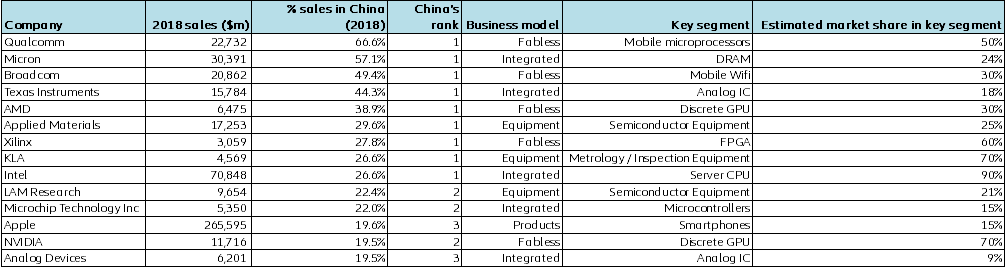

- We are far from a comprehensive agreement. The hardest part of negotiations still lies ahead: the two parties are switching to “Phase two”, which should deal with market access, IP protection, China’s industrial subsidies, U.S. sanctions on Huawei and Chinese surveillance firms. We are unlikely to see a comprehensive deal before the 2020 U.S. election.

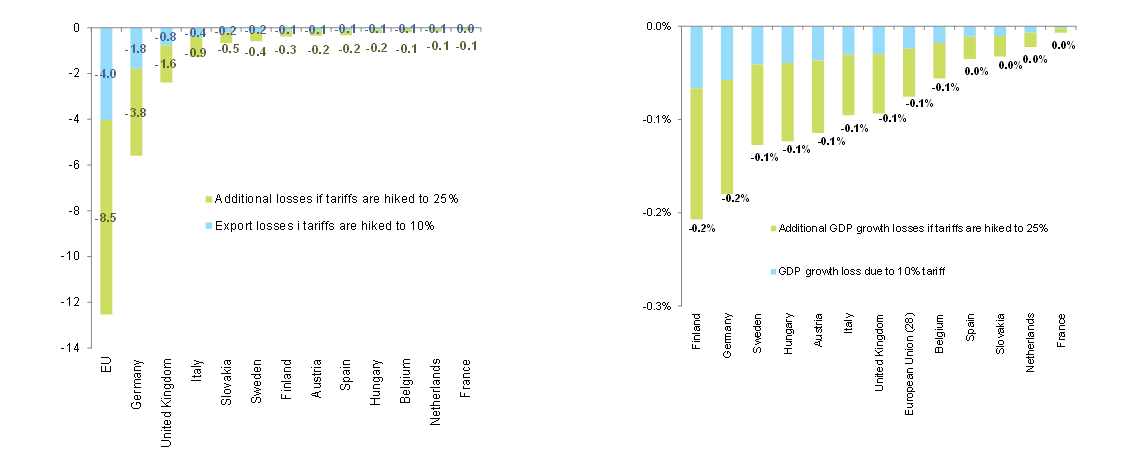

- We give 55% probability to the scenario of the U.S. turning its trade policy focus to Europe on 17 November. In the case of a 10% tariff on car imports, aggregate export losses for the EU would be EUR4bn per year, and GDP growth would be hit by an annual -0.1pp.

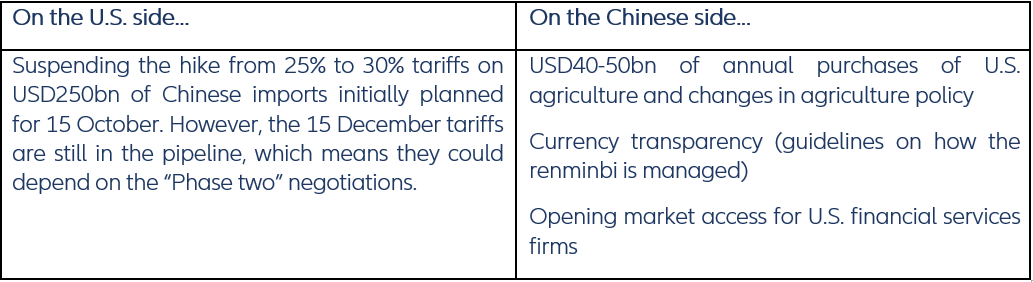

On October 11, the White house announced a “deal” with China, although the Chinese official press did not used the words “deal” or “agreement”. The details will be finalized over the next month and ideally Presidents Trump and Xi would sign the agreement in Chile mid-November at the APEC Summit. However, this agreement is only “Phase one” of the negotiations: During a White House meeting with Liu He, China’s Vice Premier, President Trump said “It’s such a big deal that doing it in sections, in phases, is really better. . So you’ll either have two phases or three phases.”