- After a successful first year of long-awaited reforms, French corporates remain indebted and households lack purchasing power. The Government just published their 2019 budget proposal and economic policy objectives are clear: (i) a further reduction of government spending to deliver tax cuts; and (ii) the strengthening of incentives and financing for the private sector. Significant cyclical tailwinds will help keep the reform momentum.

- President Macron's economic policy can be summarized by five building blocks: (i) Trim public spending; (ii) Make social protection more efficient; (iii) Lower the fiscal burden; (iv) Improve the business climate; and (v) Incentivize households to save less and channel more savings to corporate financing. The growth impact of the whole reform agenda is positive (+0.2pp in real GDP growth per year), thanks to increased competitiveness and in spite of lower public spending.

France's economic pulse one year on

One year on after President Macron's first reform package, the country's scorecard still shows some weaknesses:

(i) a supersized government (fiscal spending reached 55.1% of GDP in 2017);

(ii) an indebted corporate sector (72.7% of GDP in 2018Q1);

(iii) high household savings (about 14% of disposable income per year) and sluggish consumption; and

(iv) a sizeable trade deficit (EUR63bn in 2017). For a private sector-friendly government, more can be done for corporates and households still faced with significant headwinds.

French corporates: High debt, low margins, and more defaults

2017 was a good year for the corporate sector; manufacturing production grew by +2.9%, hitting its best level in October of that year since October 2008. Moreover, a rising capacity utilization rate (85% in July 2018) meant that corporates had to keep on investing (+3.7% in 2018).

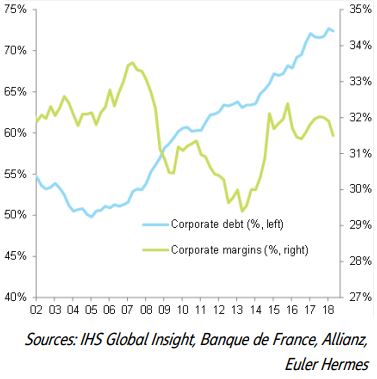

While corporate debt stabilized at 64% of GDP in the Eurozone, in France, debt increased from 60% of GDP in 2010 to 72.7% in Q1 2018 (Figure 1). This helped cope with lower margins than anywhere else in the Eurozone: 29.5% at its lowest level in 2013 and 31.5% in 2018Q2 (pre-crisis average level was 32.5%) in France (the current level is 40.8% in the Eurozone).

French households: Lacking purchasing power

Private consumption grew by +1.1% compared to +2.3% for overall GDP in 2017. The high household savings rate (14.3% in 2018Q2) coupled with unemployment fears have been capping consumer spending. In 2018, purchasing power eroded (-0.5% in Q1) as a result of a higher energy prices (+25% y/y in Q1). This contributed to households’ perception that their financial situation deteriorated. Overall, their income growth did not translate into purchasing power growth (Figure 2).

We expect consumption to grow by +0.8% in 2018, which is significantly lower than GDP growth for the second year in a row, because of limited purchasing power growth.

Figure 1 : Corporate debt in % of GDP and Corporate margins