Agrifood

Even though food and agricultural production account for 20% of all global emissions, the bulk of which come from the livestock sector (source: FAO), there is very little regulation as yet or up and coming. However, we expect the sector to come under scrutiny by policymakers in the near future. There are already some calls for a policy framework for CO2 emissions for agricultural food production to be put into place. The sector is also behind on voluntary action, with only six out of 16 of most global food companies having set targets to reduce supply chain emissions, according to the FAIRR investor network. We can see more stringent policies on deforestation but also feedstock production and other issues coming forward. There could be opportunity in conjunction with energy related technologies, particularly in relation to biomass, methane and other biotech related pathways that can be deployed for sustainable heating, electricity generation and petrochemicals substitute products.

Chemicals

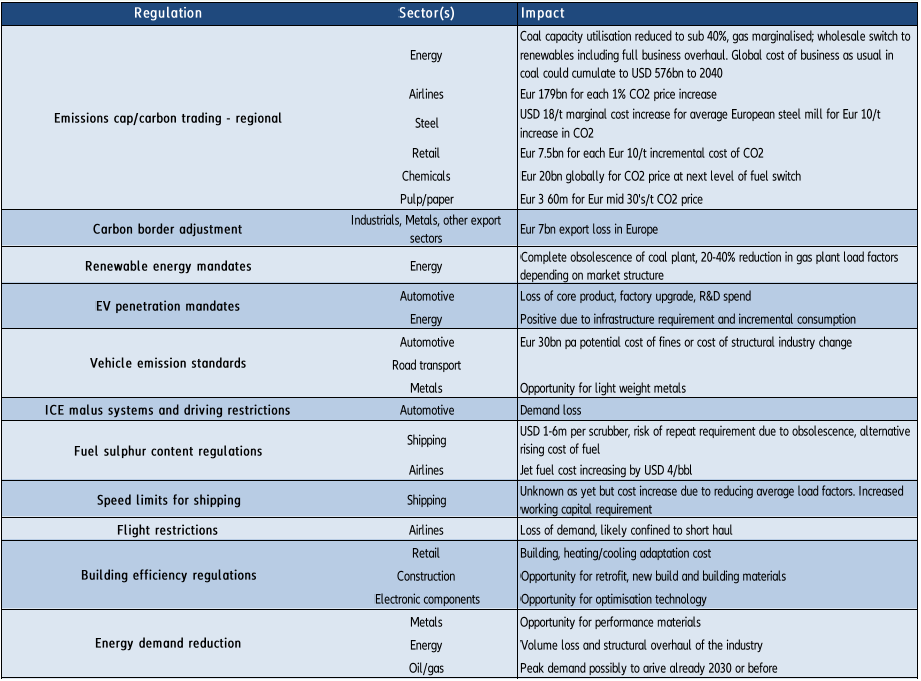

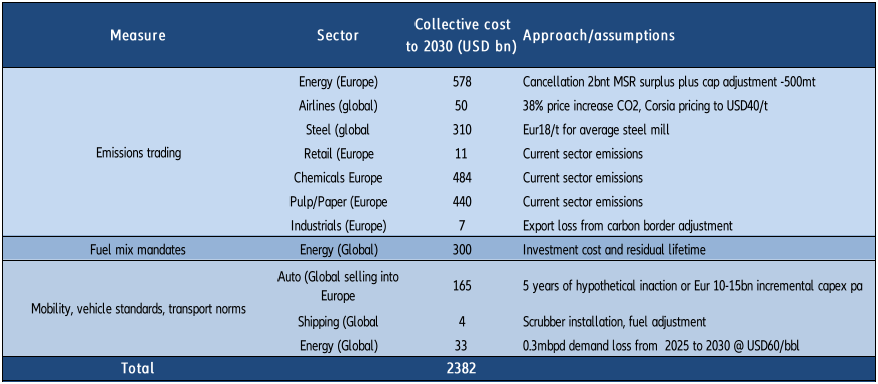

The chemicals sector is a large emitter that accounts for 7% of global greenhouse gas emissions, in its own right and through indirect emissions, and growing. Before accounting for technological improvement, direct emissions could increase by 36% by 2050, according to the EU Science Hub. Globally, the sector accounts for 1.2bn of CO2 (source: IEA), of which close to 1gt comes from China and 126mt from Europe. This suggests that emissions trading alone could cost the industry USD 484bn for an increase in CO2 prices still below the Eur 40/t mark. Note, though, that there are other markets with much higher CO2 allowance pricing, for example California, where a ton of CO2 costs USD 190.

Beyond that, the industry is subject to regularly tightening pollution control and industrial emissions standards at plant level. The overarching legislation is the EU industrial emissions directive of 2010. The American Chemicals Institute estimates a total of USD 40bn emissions mitigation investment requirement by 2030 in the U.S. and Europe alone. Yet, the ACC estimates that being a carbon neutral sector requires total investments for chemicals worldwide to amount to net USD13bn per year (from 2010 to 2030) for the U.S. industry, while CEFIC estimates them a little higher at USD19bn per year. We point out, however, that such investment would likely lead to positive operating cost savings.

Furthermore, the sector in Europe is subject to the EU energy efficiency directive. Because there might be an increasing penetration of the broader economy by the chemicals sector as a result of demand growth, particularly for speciality applications, it is likely that the sector will see more rounds of regulation. Chemicals are also one of the most important oil-consuming sectors. In this context, there is potential for mitigation through carbon capture and usage (CCU), particularly in the hydrogen and ethylene industries, but that of course comes at its own very high cost point. Lastly, the chemicals sector may see indirect repercussions from regulations affecting the transport industry because of the petroleum products and refining connection.

Pulp & paper

Pulp and paper is a major emitter, accounting for c 2% of global direct industrials emissions, and highly energy intensive. As a result, it is exposed to climate change regulation in two major ways: Energy consumption and deforestation. In Europe, the sector would see a negative impact to the tune of USD400m if CO2 prices increased to the mid Eur 30s, an amount that could be doubled for each USD 10/t if ever a U.S. emissions price were to be introduced in a similar way. The sector needs to reduce emissions by 75% by 2050 according to the CEPI industry association framework. We can also anticipate an increasing cost of certification and raw materials if and when forestry regulations tighten. Moreove,r there could be tightening in paper recycling regulations. CHP and biomass usage would mitigate, but still mandatory use would not be inconceivable.

Retail

Retail is principally exposed to energy efficiency regulation, i.e. demand reduction in relation to heating and cooling, but also lighting and broader building efficiency. The sector is impacted by the net zero energy target for new commercial buildings from 2020. Beyond that, we can see indirect exposure to transport regulations in relation to supply chains and logistics, albeit that will be already reflected in the transport sector. That being said, the transport and logistics sector will most likely attempt to pass through its own regulation-induced cost increase. Who will be the final receiver of the corresponding pressure on margins will be a question of relative strength and the broader competitive and demand environment. Based on current emissions by the industry globally, we estimate that each Eur 10/t increase in the price of emission would lead to an incremental cost of USD8.2bn as a bottom end value. The reality is likely to be higher as our underlying sample is dominated by large developed market retailers who, on average, achieve lower levels of emissions than their emerging market peers.

ITC

While the IT, technology and communications sectors are traditionally seen as low carbon intensive, energy consumption is growing with digitalisation. Data centers alone consume in the order of 200TWh of electricity annually. We estimate that each Eur 1/t of CO2 prices feeds into electricity prices in the order of Eur 0.6-0.8/kWh. Thus, assuming the sector only triples in size, it could face incremental costs exceeding the USD 500tn mark each year.

Telecommunications will, in the short run, increase energy consumption due to the shift to 5G. As it is, it takes ten times more energy to transport the same quantity of data over 5G infrastructure vs 4G infrastructure but the technology will become more energy efficient over time, much like 4G and 3G in the past. 5G will account for 15-20% of all mobile subscriptions by 2025 (source: Ericsson). Over time, though, efficiency from phasing out of 2G and 2.5G technologies will compensate. We therefore see little regulatory pressure. Besides that, the next step up will also lead to greater computing, storage and data centre requirement which leads back to the large increase in IT related energy consumption as outlined above.

Semiconductors might be one segment that benefits for various reasons, namely as an enabler for compliance with new regulations –new energy technologies - but also because we expect a rising intensity in electronic components for energy-efficient products. For instance, the shift to hybrid/electric and connected/intelligent vehicles is already translating into fast-growing computing, memory, telecom and power chip sales to the automotive industry.

Other sectors

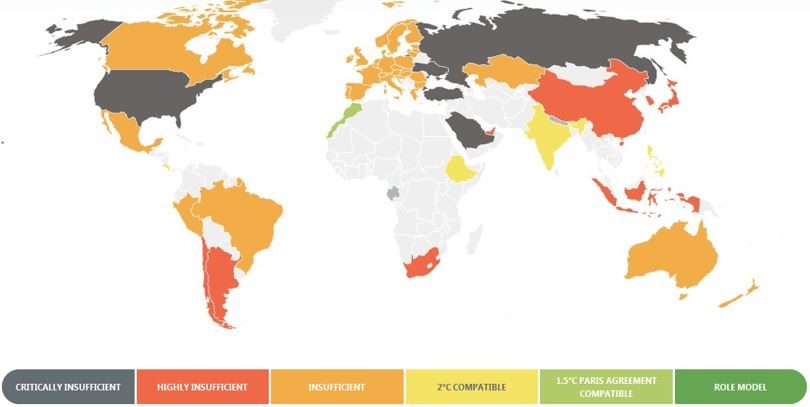

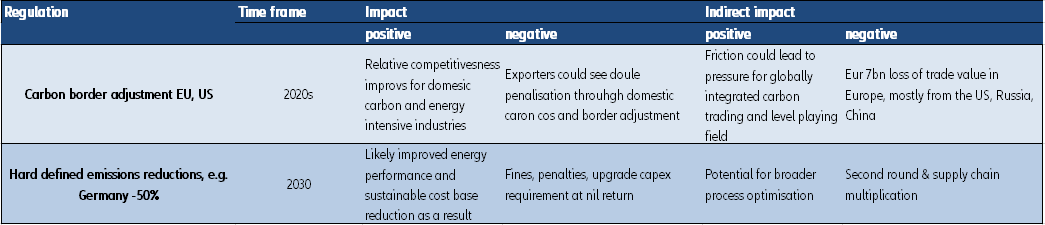

The energy and carbon intensity of industrial machinery and manufacturing varies widely. It is primarily affected by global greenhouse gas emissions and energy efficiency policies, as well as regulations covering specific end markets. As a whole, we calculate that the global machinery sector could face cost increases in the order of USD15bn for CO2 alone and prior to mitigation, if we were to see a carbon price in the mid Eur 30s/t. Much more importantly, though, the industrials, capital goods and machinery sectors are heavily exposed to global trade. As a consequence, there is already an impact on relative competitiveness as a result of regional carbon trading schemes, to put it in very crude terms. Unless there is global integration, which may be the ultimate and only logical structure but in our view remains a very long way away, those differentials will widen. The consequences are indirect cost increases through lower capacity utilization, loss of economies of scale and the like. To make matters worse, the intermediate step of carbon border adjustments – under debate in many regions currently – could lead to a negative fallout for all export industries together in the order of USD10bn for Europe, the U.S., China and Russia alone for each 1% adjustment, according to our calculations.